Oracle announced today that it has agreed to purchase B2B marketing automation leader Eloqua for $23.50 per share, which comes to $871 million. This was a bit of a surprise, given that Eloqua just went public in August. The stock had been hovering around $17.50 recently, so $23.50 is a 34% premium: reasonable but not exciting. It suggests that neither Oracle nor Eloqua management felt the company was substantially undervalued.

The deal makes obvious sense, in that it gives Oracle a much stronger position in the fast-growing B2B marketing automation industry*. Oracle does have an existing B2B marketing automation product, based on the technology it acquired from Market2Lead in 2010. Market2Lead was very good system, but it lacked the huge market presence that Oracle gains from Eloqua. Oracle may also be gaining a more sophisticated “cloud native” platform, since other Oracle products grew largely from on-premise roots.**

So that’s all fine, but what industry observers really want to know is how Salesforce.com will react. Before addressing that, let’s acknowledge that it’s an "inside the Beltway" concern. Working marketers care more about how this affects the products and services they’ll get as current or potential Eloqua customers.

The jury on that is very much still out. Eloqua’s press release promises that Oracle will “significantly increase engineering investments in Eloqua products” and “make Eloqua the centerpiece of its Oracle Marketing Cloud”. But that’s what they all say, eh? It seems more likely that Oracle will slow down Eloqua enhancements as it evaluates the product’s direction and decides how to best integrate existing Oracle technologies. Indeed, the company says as much in its FAQ on the deal: “Oracle plans to integrate several of its key technology assets, such as Big Data and Business Intelligence, to deliver enhanced value to Eloqua’s products.” That may be the best for Eloqua’s customers in the long run, but the changes will take time to deliver and necessarily distract from near-term product enhancements.

The impact on customer service is likely to be even more negative. Eloqua’s culture is very focused on customer success, and it has been a clear leader in areas like marketer training. Oracle is less customer-focused and generally less nimble (I'm being polite here). It will be Oracle’s culture that dominates the combined organization.

Small businesses in particular can expect little love from an Oracle-ized Eloqua. The company had already been pulling away from that market and now will almost surely give it even less attention. One very specific reason is that B2B marketing automation vendors have always touted client counts as a competitive success metric, which encouraged them to sell to a lot of small clients to inflate that number. Oracle doesn’t report client counts, so that motivation will be gone.

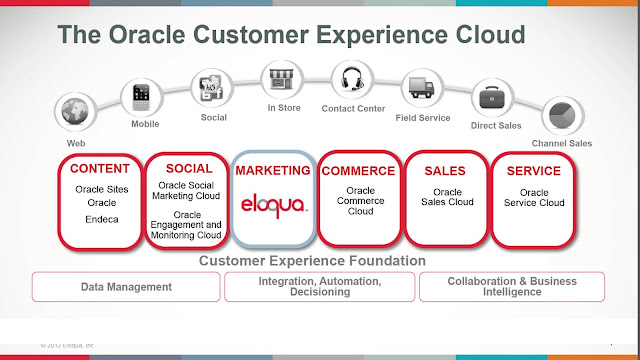

What if you're an enterprise marketer? In that case, this might well be a good thing. If you look back at my earlier post this week on the industry future, I argued that the major marketing automation systems will become platforms that support a range of independently developed applications, similar to the Apple and Android app stores or the Salesforce.com AppExchange. As part of the Oracle “Customer Experience Cloud”, Eloqua itself will plug into a larger platform: so it’s pretty much the same model but on a larger scale.

The advantage is that this platform (shown in Oracle’s diagram as the “Customer Experience Foundation”) is unequivocally designed to span all customer-facing activities in the company. A marketing automation platform can't do this because it bumps up against the competing platform of CRM. A platform that truly includes all customer-facing activities can be more powerful than one limited to marketing automation. This applies especially to the data structures, which are limited for different reasons in both marketing automation and cloud-based CRM systems. (The reasons: marketing automation databases are constrained by the need to synchronize the CRM data structures; CRM databases are limited by the challenges of delivering adequate performance at reasonable cost for operational processing.)

Of course, a platform that serves all customer life stages also by definition contains all information about each customer. This is another Good Thing, since it provides a truly complete customer view and thus enables the best possible coordination of customer treatments across systems and throughout the relationship.

I’m not saying Oracle is guaranteed to fulfill this potential (see my earlier comments under "nimbleness, lack of"). But at least it’s possible. And, just maybe, Oracle managers will see the value of Eloqua’s “appcloud” marketplace and expand rather than kill it. Wouldn’t that be nice?

Okay, now we can talk about Salesforce.com. There’s a case to be made that this whole purchase is just a way for Oracle’s Larry Ellison to annoy Salesforce’s Marc Benioff: after all, Eloqua isn’t costing that much more than the Hawaiian island that Ellison bought himself not long ago and it might give Ellison greater pleasure. It’s certainly worth a chuckle at Oracle headquarters that Eloqua was recently selected as Salesforce’s own marketing automation tool.

More significantly, the Eloqua purchase poses an awkward dilemma for Salesforce, which wouldn’t let Market2Lead continue to integrate with Salesforce after Oracle bought it. Taking the same line with an Oracle-owned Elqoua isn’t quite as easy, and in fact is probably impossible. So now Salesforce finds itself forced to give Oracle access to prime customers, which cannot be a pleasant prospect. We’ll see how they handle it.

The Eloqua purchase certainly exposes the downside of relying on AppExchange partners to provide significant functionality needed by Salesforce clients. Yes, Salesforce.com gets to leverage those partners’ efforts, saving its own funds for other, more strategic investments. But if a big partner like Eloqua goes away, there’s some danger it could take Salesforce clients with it. This doesn’t matter when there are plenty of alternative partners to provide Salesforce clients with similar capabilities, which has been the case with marketing automation. The calculus changes when a few large vendors start to dominate the marketing automation space – especially among enterprise clients, who have special needs that only a few vendors can meet. More concretely, Salesforce now has to think long and hard about Marketo’s future. The expectation has always been that Marketo would remain independent, eventually as a public company. But what if they get bought by potentially serious competitor like SAP or IBM, either before or after a public offering? Salesforce might well decide to buy them itself just as a defensive measure.

As I say, this is really just inside gossip that's not terribly relevant to most working marketers. But who doesn’t like a good soap opera? Stay tuned…

_____________________________________________________________________

* Raab Associates estimates the industry grew about 50% this year, to $525 million. I haven’t come up with a

considered estimate for next year, but suspect the rate will fall a bit

on a percentage basis, even though absolute dollar growth will be about

the same or higher.

** In fact, Oracle has two B2B marketing automation products, the other being Oracle Fusion Marketing.

Thursday, December 20, 2012

Tuesday, December 18, 2012

Future of Marketing Automation: Grow or Die

‘Tis the season for industry predictions. I’ve already fielded a couple of requests for my thoughts, which usually requires some pondering before I reply. But this time I was able to answer right away because I’ve just finished a white paper on the future of B2B marketing automation, sponsored by Leadformix and available here for free download.

The question answered by the paper is “What will marketing automation vendors do next?” This is different from the perhaps-more-important question of “What will marketers do next?” I don’t claim any particularly deep insights into the latter: they'll continue to adapt to new media and buying habits, I guess. Like everyone else, I’m seeing greater use of social, mobile, and video; more cross-channel campaigns; closer cooperation between marketing and sales; and expanded use of analytics. If I had to predict one thing that isn’t utterly obvious, it's that B2B marketers will be more involved with managing customer relationships after the initial sale. The reason is that post-sales interactions are increasingly automated and marketers have the best tools to manage automated interactions effectively. The task is really the same as a sophisticated lead nurturing campaign: to monitor customer behavior and respond appropriately.

While my vision of future marketing may be rather broad, I think I see the future of marketing automation in clearer detail. This is what’s covered in the white paper. To summarize the argument:

The question answered by the paper is “What will marketing automation vendors do next?” This is different from the perhaps-more-important question of “What will marketers do next?” I don’t claim any particularly deep insights into the latter: they'll continue to adapt to new media and buying habits, I guess. Like everyone else, I’m seeing greater use of social, mobile, and video; more cross-channel campaigns; closer cooperation between marketing and sales; and expanded use of analytics. If I had to predict one thing that isn’t utterly obvious, it's that B2B marketers will be more involved with managing customer relationships after the initial sale. The reason is that post-sales interactions are increasingly automated and marketers have the best tools to manage automated interactions effectively. The task is really the same as a sophisticated lead nurturing campaign: to monitor customer behavior and respond appropriately.

While my vision of future marketing may be rather broad, I think I see the future of marketing automation in clearer detail. This is what’s covered in the white paper. To summarize the argument:

- marketing automation vendors must grow or die. Today’s B2B marketing automation systems are used primarily for lead nurturing. This means they don’t help other marketers who do lead acquisition and marketing administration (planning, budgeting, project management, etc.). They also have limited interactions with sales and service departments, who own the post-sales customer relationship. Marketing automation vendors who want to expand their business need to service these other groups or risk some other system becoming the central platform for marketing management. If that happens, the other systems will slowly encroach on marketing automation functionality and eventually replace it.

- marketing automation can expand in either direction along the customer path: backward to acquisition or forward to sales and service. Most expansion to date has been towards sales, in the form of add-ons that give salespeople access to information about behavior of their leads. But CRM systems are deeply embedded in sales departments, so they block growth in that direction. I therefore expect marketing automation vendors to instead shift toward features for acquisition marketers. These would include not just “inbound marketing” through social media and search engine optimization, but also purchasing media such as online and offline advertising.

- marketing automation can also be divided into layers of delivery systems, campaign management, and platform functions. Delivery systems manage touchpoints such as Web sites, email, and social media publishing. Campaign management is the rules and models to select names for promotions. Platform functions are supporting technologies such as the marketing database, planning and budgeting, content management, analytics, and security. Current marketing automation systems do all three to the degree needed for lead nurture campaigns. Extending to other users will require more powerful platform functions in particular. Whoever controls the platform can best expand throughout the marketing department.

- marketing automation vendors will increasingly fall into two groups: a handful of big platform vendors and larger number of small specialists. The platform vendors will offer a broad range of functions internally and further extend their range by exposing their platforms to third party developers through “app markets”. The specialists will have narrower scope but be very good at serving companies with specific needs such as low cost, marketing services, or industry editions (for sports, investments, franchises, etc.) Both types of companies can succeed although the platform vendors will tend to dominate over time.

- new competition will come from outside the industry, especially from delivery systems. This seems counter-intuitive: delivery systems are by definition channel-specific and function-generic (a term I just invented to mean they serve all functions within marketing, sales and service). This means they are in the strategically weak position of selling commodity products without strong ties to any particular set of users. But the delivery vendors recognize this weakness and can afford to overcome it by investing in campaign engines and platform features. This is exactly what's happening when email vendor ExactTarget purchases Pardot or Web content management vendor SiteCore adds email campaigns and a database. It (almost) goes without saying that CRM vendors are also potential competitors: they already have the platform features; what they mostly lack are campaign engines.

Thursday, December 13, 2012

Sitecore Migrates from Web Content Management to Cross-Channel Customer Engagement

It’s more than three years since my original post about Sitecore’s plans to transform itself from a Web content management system to a platform for cross-channel customer experience management. It seems to be working out – since that time, revenue has grown 40% per year and the number of clients has nearly doubled from 1,600 to 3,000. The company has attracted additional funding, added support for producing dynamic print content, launched an “App Center” for pre-integrated third party products, built a cloud deployment on the Microsoft Azure platform, and extended to new channels via partnerships covering community management (Telligent), online video publishing (Brightcove), and social marketing campaigns (Komfo).

In other words, Sitecore has been steadily executing on the strategy they described in 2009. If there has been a change, it’s recognition that the company can’t build everything itself: hence the partnerships and app center, which use other developers’ products to extend Sitecore to other channels. Sitecore says this makes sense because giving customers a consistent experience across all channels requires only central data and central content management. Letting external systems deliver the actual interactions causes no particular harm.

This vision should sound familiar: it’s the idea behind the real time decision management systems I’ve been reviewing recently. The difference is architecture: the decision managers place decision logic at the center and see customer data and content as peripheral.

More specifically, the decision managers assemble a consolidated customer profile by pulling data on demand from external systems rather than storing it internally. This is actually a pretty minor difference, since in practice most companies will both maintain a central customer database with key profile information and make direct connections to other systems for details such as transactions. The Sitecore model is pretty much the same: it creates its own customer database and supports real time connections to other systems via Web services or database queries.

The approach to content is a more significant distinction. Most decision managers assume content is best stored with the touchpoint systems, while Sitecore wants to store most content itself. I chalk this up to their heritage as a content management vendor. Both approaches have their merits: central storage makes coordination easier but requires continued extension of system features to handle new formats; touchpoint storage makes it harder to know what content is actually available and appropriate. So far, Sitecore has been making the investments to manage new formats centrally, at least to the extent of making the contents visible to functions like message selection, access control, and approval workflows. It doesn’t necessarily extend to actually creating or modifying the contents themselves. Maybe that’s a good compromise.

The other important difference is decision rules. These are obviously the main focus of decision management products. Sitecore doesn’t talk about them much, although does deliver them in the form of campaigns flows and dynamic content rules. The campaigns can manage activities across multiple channels – such as sending an email response to a Web visit – although they are not as sophisticated as the multi-branch, looping logic, advanced decision arbitration, and integrated predictive modeling available in the best decision management systems.

On the other hand, Sitecore makes very powerful use of its close control over content. Each item can be assigned scores on several attributes, such as how much it relates to technology, product, or industry topics. The system then tracks the content consumed by each individual and compares their behavior to “profile cards” of personas such as frequent site visitors with high interest in business. Each person is assigned to the profile card they match most closely; people can be switched to a different card if their behaviors change. This nearest-fit approach is more flexible than the rigid inclusion criteria of traditional segments or lists. Cards are used in decision rules to select contents and treatments for each person.

Although I just compared Sitecore with decision management systems, its more immediate competitors are marketing automation vendors. Like Sitecore, they aim to be a company’s core marketing platform. Sitecore’s campaign flow, email and decisioning features are roughly comparable to the same features in mid-tier marketing automation products, while its Web site management and content creation are generally stronger. Marketing automation systems still probably have advantages in analytics and other areas, although it’s hard to generalize. Sitecore does offer the key B2B marketing automation capability to synchronize with CRM products including Salesforce.com and Microsoft Dynamics CRM.

One clear difference is that most marketing automation systems today are software-as-a-service products, while Sitecore is sold as licensed software, running either on-premise software or on the Microsoft Azure cloud. Pricing starts around $125,000 for an enterprise deployment. Smaller companies would pay less, but Sitecore will never be a system you can get for $1,000 per month.

In other words, Sitecore has been steadily executing on the strategy they described in 2009. If there has been a change, it’s recognition that the company can’t build everything itself: hence the partnerships and app center, which use other developers’ products to extend Sitecore to other channels. Sitecore says this makes sense because giving customers a consistent experience across all channels requires only central data and central content management. Letting external systems deliver the actual interactions causes no particular harm.

This vision should sound familiar: it’s the idea behind the real time decision management systems I’ve been reviewing recently. The difference is architecture: the decision managers place decision logic at the center and see customer data and content as peripheral.

More specifically, the decision managers assemble a consolidated customer profile by pulling data on demand from external systems rather than storing it internally. This is actually a pretty minor difference, since in practice most companies will both maintain a central customer database with key profile information and make direct connections to other systems for details such as transactions. The Sitecore model is pretty much the same: it creates its own customer database and supports real time connections to other systems via Web services or database queries.

The approach to content is a more significant distinction. Most decision managers assume content is best stored with the touchpoint systems, while Sitecore wants to store most content itself. I chalk this up to their heritage as a content management vendor. Both approaches have their merits: central storage makes coordination easier but requires continued extension of system features to handle new formats; touchpoint storage makes it harder to know what content is actually available and appropriate. So far, Sitecore has been making the investments to manage new formats centrally, at least to the extent of making the contents visible to functions like message selection, access control, and approval workflows. It doesn’t necessarily extend to actually creating or modifying the contents themselves. Maybe that’s a good compromise.

The other important difference is decision rules. These are obviously the main focus of decision management products. Sitecore doesn’t talk about them much, although does deliver them in the form of campaigns flows and dynamic content rules. The campaigns can manage activities across multiple channels – such as sending an email response to a Web visit – although they are not as sophisticated as the multi-branch, looping logic, advanced decision arbitration, and integrated predictive modeling available in the best decision management systems.

On the other hand, Sitecore makes very powerful use of its close control over content. Each item can be assigned scores on several attributes, such as how much it relates to technology, product, or industry topics. The system then tracks the content consumed by each individual and compares their behavior to “profile cards” of personas such as frequent site visitors with high interest in business. Each person is assigned to the profile card they match most closely; people can be switched to a different card if their behaviors change. This nearest-fit approach is more flexible than the rigid inclusion criteria of traditional segments or lists. Cards are used in decision rules to select contents and treatments for each person.

Although I just compared Sitecore with decision management systems, its more immediate competitors are marketing automation vendors. Like Sitecore, they aim to be a company’s core marketing platform. Sitecore’s campaign flow, email and decisioning features are roughly comparable to the same features in mid-tier marketing automation products, while its Web site management and content creation are generally stronger. Marketing automation systems still probably have advantages in analytics and other areas, although it’s hard to generalize. Sitecore does offer the key B2B marketing automation capability to synchronize with CRM products including Salesforce.com and Microsoft Dynamics CRM.

One clear difference is that most marketing automation systems today are software-as-a-service products, while Sitecore is sold as licensed software, running either on-premise software or on the Microsoft Azure cloud. Pricing starts around $125,000 for an enterprise deployment. Smaller companies would pay less, but Sitecore will never be a system you can get for $1,000 per month.

Tuesday, December 04, 2012

MindMatrix Adds Sales Support to Marketing Automation

One easily predictable trend in B2B marketing automation is that vendors will tailor their systems to specific industries. This is happening to some extent, but not as quickly as I had expected. The reason may be that B2B marketing automation products have a narrower scope than B2C systems, meaning there’s less advantage in creating vertical editions. For example, the data model of B2B systems is largely fixed, so industry-specific data models (a major component of vertical systems) are largely irrelevant.

But while I see just a few general systems trying to become vertical specialists, I do keep finding specialist products trying to serve additional markets. I wrote in February about one set of these vendors: Balihoo and others that specialize in helping central marketing organizations work with channel partners such as dealers and franchisees. In May I wrote about Demandforce, which specializes in local service businesses such as dentists and auto repair shops and had just been purchased by Intuit. I'm sure plenty of other specialists exist as well.

MindMatrix is one of them. Founded 14 years ago, the company has built its business serving the real estate industry, where individual agents and local agencies work in conjunction with large national franchises. The company has nearly 250 clients and about 34,000 end-users, making it larger than most B2B marketing automation vendors. MindMatrix already has 30% of its business outside the real estate market and has recently begun to promote itself as a general purpose marketing automation system – or, more precisely, as the “next generation” of such systems.

The company’s justification for this claim is that it adds sales-marketing alignment to standard marketing automation features. Concretely, this refers to centrally-created marketing materials that are automatically personalized for individual sales people; desktop and smartphone alerts for Web activity by sales targets; and creation of personal Web sites, landing pages, and social media accounts. As the table accompanying my Balihoo post indicates, these are pretty much standard features for channel partner systems. But MindMatrix is correct in saying that they’re not part of mainstream B2B marketing automation.

Mindmatrix does a good job with these features. Content personalization is especially sophisticated, supporting dynamic content (i.e., conditional logic) within templates; drawing personalization variables from user, partner, contact, and other tables; and providing precise control over which content attributes can be edited by a salesperson or other end-user. Personalized output formats include not just email, but also Web pages, Powerpoint, and online or pritned PDFs. The content can be sent from the smartphone app as well as the desktop. Emails can be sent through Microsoft Outlook and tracked in the MindMatrix contact history.

The system also provides a full set of standard marketing automation features. These include landing pages and forms for lead capture; email and postal mail; lead scoring on attributes and behaviors; branching multi-step campaigns; and bi-directional synchronization with Salesforce.com, Microsoft Dynamics, Outlook, and SugarCRM. Integrations with ACT! And Saleslogix are under development.

Lead scoring rules can consider response to system-generated documents, such as proposals and presentations, arguably allowing more accurate scoring than other systems. Another unusual feature, due for release in January 2013, can add personalized Web messages, polls and chat requests as pop-ups within an external Web page.

The system’s campaign flow builder is reasonably powerful, with support for test splits, filters on based on time and on complex behaviors such as number of Web page visits, updates of contact data, and sending contacts to a different campaign. The interface lays out steps in the flow like a deck of cards, making it unusually straightforward. Flows can be shared with sales users, with some or all features locked down to prevent unauthorized changes.

Does all this really make MindMatrix the next generation of B2B marketing automation? I don’t quite think so: although sales integration is indeed important, I believe the next generation will be focused on serving other groups within the marketing department, including acquisition (advertising and social media) and administration (budgets, planning, content creation, workflow, etc.). Integration with sales will be important but there’s only so far marketing automation systems can go before they compete with CRM – a contest that marketing automation will inevitably lose, since CRM will remain the primary system for sales.

Although MindMatrix has been sold primarily as system to coordinate central marketing with channel partners, it is also used with internal sales groups. The company is actively targeting small companies, with a starting price of $499 per month for the marketing features and another $25 per sales person per month. This is competitive with conventional marketing automation products for small-to-mid-size businesses. It's a pretty good deal considering the additional sales alignment features that MindMatrix provides.

But while I see just a few general systems trying to become vertical specialists, I do keep finding specialist products trying to serve additional markets. I wrote in February about one set of these vendors: Balihoo and others that specialize in helping central marketing organizations work with channel partners such as dealers and franchisees. In May I wrote about Demandforce, which specializes in local service businesses such as dentists and auto repair shops and had just been purchased by Intuit. I'm sure plenty of other specialists exist as well.

MindMatrix is one of them. Founded 14 years ago, the company has built its business serving the real estate industry, where individual agents and local agencies work in conjunction with large national franchises. The company has nearly 250 clients and about 34,000 end-users, making it larger than most B2B marketing automation vendors. MindMatrix already has 30% of its business outside the real estate market and has recently begun to promote itself as a general purpose marketing automation system – or, more precisely, as the “next generation” of such systems.

The company’s justification for this claim is that it adds sales-marketing alignment to standard marketing automation features. Concretely, this refers to centrally-created marketing materials that are automatically personalized for individual sales people; desktop and smartphone alerts for Web activity by sales targets; and creation of personal Web sites, landing pages, and social media accounts. As the table accompanying my Balihoo post indicates, these are pretty much standard features for channel partner systems. But MindMatrix is correct in saying that they’re not part of mainstream B2B marketing automation.

Mindmatrix does a good job with these features. Content personalization is especially sophisticated, supporting dynamic content (i.e., conditional logic) within templates; drawing personalization variables from user, partner, contact, and other tables; and providing precise control over which content attributes can be edited by a salesperson or other end-user. Personalized output formats include not just email, but also Web pages, Powerpoint, and online or pritned PDFs. The content can be sent from the smartphone app as well as the desktop. Emails can be sent through Microsoft Outlook and tracked in the MindMatrix contact history.

The system also provides a full set of standard marketing automation features. These include landing pages and forms for lead capture; email and postal mail; lead scoring on attributes and behaviors; branching multi-step campaigns; and bi-directional synchronization with Salesforce.com, Microsoft Dynamics, Outlook, and SugarCRM. Integrations with ACT! And Saleslogix are under development.

Lead scoring rules can consider response to system-generated documents, such as proposals and presentations, arguably allowing more accurate scoring than other systems. Another unusual feature, due for release in January 2013, can add personalized Web messages, polls and chat requests as pop-ups within an external Web page.

The system’s campaign flow builder is reasonably powerful, with support for test splits, filters on based on time and on complex behaviors such as number of Web page visits, updates of contact data, and sending contacts to a different campaign. The interface lays out steps in the flow like a deck of cards, making it unusually straightforward. Flows can be shared with sales users, with some or all features locked down to prevent unauthorized changes.

Does all this really make MindMatrix the next generation of B2B marketing automation? I don’t quite think so: although sales integration is indeed important, I believe the next generation will be focused on serving other groups within the marketing department, including acquisition (advertising and social media) and administration (budgets, planning, content creation, workflow, etc.). Integration with sales will be important but there’s only so far marketing automation systems can go before they compete with CRM – a contest that marketing automation will inevitably lose, since CRM will remain the primary system for sales.

Although MindMatrix has been sold primarily as system to coordinate central marketing with channel partners, it is also used with internal sales groups. The company is actively targeting small companies, with a starting price of $499 per month for the marketing features and another $25 per sales person per month. This is competitive with conventional marketing automation products for small-to-mid-size businesses. It's a pretty good deal considering the additional sales alignment features that MindMatrix provides.

Wednesday, November 28, 2012

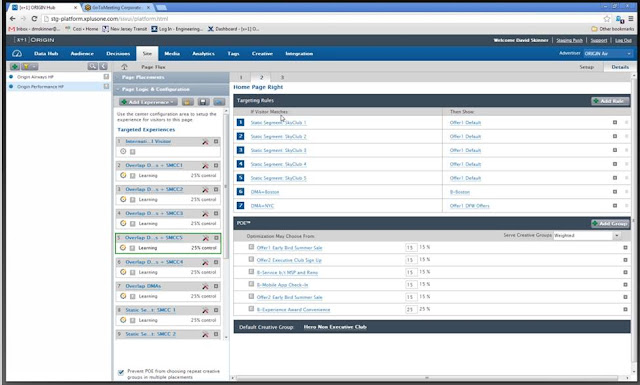

[x+1] Origin Digital Marketing Hub Offers Cross-Channel Decision Management

My recent posts on real time decision systems have all described products from vendors of batch-oriented, outbound campaign management systems. Expansion to real time decisions helps those vendors cement their strategic position as a complete solution for marketing departments. But technically the two sets of systems have little in common: outbound systems create lists for direct mail and email, while real time systems generate recommendations for Web sites and call centers. Knowing this, you might suspect there are other real time decision management vendors with roots in Web marketing. You would be correct.

[x+1] Origin Digital Marketing Hub is one example. [x+1] originally began as Poindexter Systems, which offered real-time Web ad optimization based in predictive models and anonymous user profiles. This was an early form of what now called a Data Management Platform (DMP), which one articulate blogger defined as “a very smart, very fast cookie warehouse with analytical firepower to crunch, de-duplicate, and integrate your data with any technology platform you desire.”

You could also see DMPs as a type of marketing database because they have the key characteristic of being organized around individual prospects and customers. It’s true that DMPs identify individuals with cookies, not a conventional name and address. But both types of systems can still perform the basic marketing database functions of sending messages to individuals and tracking their responses.

That original DMP is still the foundation of the [x+1] suite. But the company has also extended into Web ad buying (Origin Media DSP), Web site recommendations (Origin Site), attribution (Origin Analytics), and cross channel marketing (Origin Digital Marketing Hub). Supporting multiple channels and potentially storing names and addresses puts [x+1] Hub into direct competition with other real-time decision management products.

I’ll assess the Hub against my real time decision management framework in a minute. But first let's look at [x+1]’s features that are not found in a typical real time decision manager. These include:

- Web tag management: the system provides Javascript code to tag Web pages and advertisements, drop cookies on visitors’ computers, and then use those cookies to track visitor behaviors. The system also supports server-to-server connections that capture user behavior without relying on cookies. Most real time decision systems rely on external systems to capture this data.

-Web audience management: [x+1] Hub can integrate Web audience data from external compilers such as BlueKai and eXelate, enabling marketers to use that information for decisions and targeting. In theory, any decision manager could access the APIs of those providers, but [x+1] is designed specifically to integrate their data and manage the associated charges. [x+1] can also help sell the client’s own data to external syndicators.

- Web media buying: [x+1] can manage real-time bids and other Web advertising purchases. Users set up campaigns with budgets, cost targets, date ranges and other parameters for the system to execute automatically. The system can also track media purchases made outside of [x+1]. Reports provide detailed information on reach, frequency, pacing, inventory, and other advertising-specific metrics.

- attribution: the system tracks visitors through user-defined funnel stages, as defined by visits to specified Web pages or media exposures. It then uses regression analysis to estimate the influence of each promotion and promotion attributes, such as ad size and format, on stage movement . This is much more sophisticated than the first touch, last touch, or fractional attribution methods available in standard marketing systems.

These features make clear that [x+1] Hub isn’t directly comparable to conventional real time decision systems. But [x+1] does offer itself for real time decision applications, and the whole point of decision management is to centralize decisions within a single system. This means that [x+1] Hub is inevitably competing with the other products to be the one thing that rules them all.

So, how does [x+1] Hub stack up against my decision management criteria?

- connecting to external systems. Like other real time decision managers, [x+1] Hub can connect to external systems via Web services and batch file imports. It can also capture Web traffic via the Javascript tags and server-to-server connections. However, displaying the returned messages on a Web site requires code created outside of the system. [x+1] Hub has existing integrations into call center, search, mobile, SMS, social, and email products.

Visitor profiles are stored permanently within the system and can contain whatever attributes the user chooses. The base set includes visitor behaviors, http header attributes (browser, operating system, location derived from IP address, etc.), information imported from external data vendors, and a history of messages presented to each individual. The system can link cookies from [x+1], the client, and third party vendors once these are identified as the same person. Partners including LiveRamp, i-Behavior and Datalogix can link online and offline identities.

Web behaviors and imported data can trigger actions including as assigning a visitor to a segment, adjusting a counter, exporting data, and sending a message through an external system. The results of these actions are stored in the [x+1] database where they can be inputs to other decision rules.

- making decisions based on rules and predictive models. Decision rules in [x+1] Hub are organized into two layers: the system first tests a visitor against one or more “targeted experience” definitions until it finds a match; then, it tests the visitor against a sequence of “targeting rules” associated with the winning experience. Each rule returns a specified offer or creative treatment. Offers and creatives can also have their own eligibility rules, which apply across all campaigns.

Rules can include if/then logic or predictive models. If the models are used, [x+1] can generate scores for multiple responses and pick the best option based on response probability, expected value, or other formulas. This lets the [x+1] select the best option for each individual even though the system always selects the first rule the visitor matches. There are also default choices in case the visitor fails to meet any other rule.

The models are set up by [x+1] technicians. Scoring formulas can incorporate external data, such as inventory levels or sales goals, so long as these are accessible to [x+1] via data import or API connections. Users can also specify the percentage of responses that will receive each option, allowing the system to deliver a fixed mix of results even if the models would favor some choices less or more often.

The system can return multiple offers in response to a single request. Users can block these from containing duplicate offers. Users can also set up “creative groups” of incompatible offers and have the system return only one offer from each group.

- integration with campaign and content systems. [x+1] Hub is not part of a suite with its own outbound campaign manager, although it can be integrated with other vendors’ campaign management products. Similarly, the system also doesn’t store or render content but can connect with third party content management systems. [x+1] does maintain a registry of content IDs that are sent back to execution systems, which look up and render the related messages.

- deployment model. The entire [x+1] suite is sold as a subscription. This can include the software only or software plus supplemental services. On-premise deployment is technically possible but no client has yet selected it. Pricing is based on system functions and volumes. It starts around $12,500 per month but can be lower if the client is also buying media through [x+1].

All told, [x+1] Hub seems functionally competitive with stand-alone decision managers. Still, the system’s main appeal will be to marketers who want the DMP, media buying and attribution features. Those marketers should find that [x+1] Hub lets them coordinate real-time customer treatments across all channels without purchasing a separate decision management system.

Tuesday, November 20, 2012

Pitney Bowes Interaction Optimizer and Dialogue Offer Unified Inbound/Outbound Marketing Campaigns

In his classic Harvard Business Review article Marketing Myopia, Theodore Levitt argued that railroad companies could have survived the rise of the automobile had they considered their business to be providing transportation, not running trains. Someone at Pitney Bowes clearly got the message. The postal equipment giant has aggressively moved to become a provider of “customer communication technologies”, making 83 acquisitions costing $2.5 billion since 2000. Purchases have included Group 1 Software (2004), MapInfo (2007) and Portrait Software (2010), which are now part of a customer analytics and interaction group within the company’s software division.

Portrait itself brought an agglomeration of previous acquisitions, having expanded its original customer relationship management system by purchasing Quadstone analytics in 2005 and Million Handshakes marketing automation in 2008. Their descendants are now modules within integrated Portrait suite, including Portrait Explorer (visualization), Miner (predictive modeling), Uplift (model-based treatment selection), Foundation (data access and integration), Dialogue (multi-step outbound campaigns), and Interaction Optimizer (real-time decisions).

Dialogue and Interaction Optimizer are closely linked, sharing a user interface for campaign definition and both using Foundation to connect with external systems. The interface, called HQ, lets marketers define a hierarchy of campaigns linked to multiple marketing activities, which in turn contain multiple channels and offers. Offers are linked to products, which have customer-level eligibility criteria.

Marketing activities have budgets and response forecasts, which can be set for the activity as a whole or for each channel / message combination (called a treatment). An activity can be assigned an activity type, priority, and scoring rule, which are used to prioritize recommendations during inbound interactions. Activities can also be associated with tasks assigned to the user or others.

HQ provides dashboards showing a campaign calendar, personal and delegated tasks, and results by campaign, offer, and channel. The dashboard can be extended to include external data.

IO connects with touchpoints and other data sources through Foundation, which can accept via Web service calls or SQL queries. Foundation integrates the information it gathers and passes it to IO through a Web services interface. The system usually refreshes the data with each new request, but can be configured to retain data in memory during a multi-step interaction. IO is also integrated with GX Software BlueConic to track and segment Web site visitors. BlueConic-generated events can trigger IO messages and BlueConic-captured behaviors can be loaded to the IO database.

Recommendations in IO are based on marketing activities. Each recommendation has audience and message definitions. The audience can be defined by any combination of static lists, dynamic selections, and scoring rules. Messages belong to a single channel and provide content in a channel-specific format. The content may be an actual message or a pointer interpreted by the touchpoint. IO provides a HTML generator to create messages. These can be personalized with data from the customer record. Messages can be linked to offers, although this is optional.

When IO receives a recommendation request, it checks against the audience and offer definitions of all active recommendations to identify those that are available to the current customer in the current situation. It sorts the options based on activity type, priority, and scoring results, which can be applied in whatever sequence the user defined during campaign setup. More advanced prioritization could be built into the scoring rules but requires a modeling specialist. After the recommendation is selected, it is sent back to the touchpoint for delivery.

Scoring models can be created and automatically updated within IO or imported from external systems. The self-updating models are less accurate than batch built models but make sense where conditions change quickly or very large numbers of models are needed. External models can be created in Portrait’s own modeling tools or with third party software. Scores are calculated within IO using current data.

IO recommendations are generally called by an external touchpoint but can also be embedded within a Dialogue campaign flow, used to generate outbound campaigns. Dialogue provides a drag-and-drop flow builder with a broad range of capabilities to manage data, direct data flows, send messages, and access social media. Campaigns can execute as batch processes or events triggered by database stored procedures. Other Pitney Bowes product offer additional features for database management, data quality, and message creation.

Both IO and Dialogue are available as on-premise software or hosted by Pitney Bowes. Pricing of IO is based on the database size and number of channels supported. It starts around $75,000 for a 100,000 row database for one channel for a perpetual on-premise license. The system has fewer than 50 installations.

Portrait itself brought an agglomeration of previous acquisitions, having expanded its original customer relationship management system by purchasing Quadstone analytics in 2005 and Million Handshakes marketing automation in 2008. Their descendants are now modules within integrated Portrait suite, including Portrait Explorer (visualization), Miner (predictive modeling), Uplift (model-based treatment selection), Foundation (data access and integration), Dialogue (multi-step outbound campaigns), and Interaction Optimizer (real-time decisions).

Dialogue and Interaction Optimizer are closely linked, sharing a user interface for campaign definition and both using Foundation to connect with external systems. The interface, called HQ, lets marketers define a hierarchy of campaigns linked to multiple marketing activities, which in turn contain multiple channels and offers. Offers are linked to products, which have customer-level eligibility criteria.

Marketing activities have budgets and response forecasts, which can be set for the activity as a whole or for each channel / message combination (called a treatment). An activity can be assigned an activity type, priority, and scoring rule, which are used to prioritize recommendations during inbound interactions. Activities can also be associated with tasks assigned to the user or others.

HQ provides dashboards showing a campaign calendar, personal and delegated tasks, and results by campaign, offer, and channel. The dashboard can be extended to include external data.

Recommendations in IO are based on marketing activities. Each recommendation has audience and message definitions. The audience can be defined by any combination of static lists, dynamic selections, and scoring rules. Messages belong to a single channel and provide content in a channel-specific format. The content may be an actual message or a pointer interpreted by the touchpoint. IO provides a HTML generator to create messages. These can be personalized with data from the customer record. Messages can be linked to offers, although this is optional.

When IO receives a recommendation request, it checks against the audience and offer definitions of all active recommendations to identify those that are available to the current customer in the current situation. It sorts the options based on activity type, priority, and scoring results, which can be applied in whatever sequence the user defined during campaign setup. More advanced prioritization could be built into the scoring rules but requires a modeling specialist. After the recommendation is selected, it is sent back to the touchpoint for delivery.

Scoring models can be created and automatically updated within IO or imported from external systems. The self-updating models are less accurate than batch built models but make sense where conditions change quickly or very large numbers of models are needed. External models can be created in Portrait’s own modeling tools or with third party software. Scores are calculated within IO using current data.

IO recommendations are generally called by an external touchpoint but can also be embedded within a Dialogue campaign flow, used to generate outbound campaigns. Dialogue provides a drag-and-drop flow builder with a broad range of capabilities to manage data, direct data flows, send messages, and access social media. Campaigns can execute as batch processes or events triggered by database stored procedures. Other Pitney Bowes product offer additional features for database management, data quality, and message creation.

Both IO and Dialogue are available as on-premise software or hosted by Pitney Bowes. Pricing of IO is based on the database size and number of channels supported. It starts around $75,000 for a 100,000 row database for one channel for a perpetual on-premise license. The system has fewer than 50 installations.

Thursday, November 15, 2012

A Framework for Real Time Decision Management: How SAS RTDM Fits In

I’ve had a couple of consulting projects recently that involve real-time decision systems (a.k.a. real time interaction managers), which are used to select the best treatment during a Web visit, telephone call, or other interaction. This type of software has been around for two decades or more and repeatedly proven its value, but still has relatively few implementations.

There are many possible reasons for the slow adoption. Maybe marketers don’t realize how much improvement they get from driving recommendation with predictive models rather than simple rules. Perhaps the decision capabilities built into delivery systems are already adequate. The delivery systems are controlled by Web and call center managers who are not incented to generate revenue and may not be interested in a shared decision engine to coordinate customer treatments. Maybe each of these plays a role.

Still, the interest among my own clients has been enough to spur a fresh look at the vendors in this field. To gather this information systematically, I need a framework that lists standard features and options within those features. This makes it easy to isolate critical differences among the products.

For real-time decision managers, the framework includes:

With that framework in mind, let’s take a look at another product in this group: SAS Real Time Decision Manager (RTDM).

RTDM meets all the framework requirements: it receives a Web Services request from an external system for a decision, runs the request through rules and models, and returns one or more choices. The results are usually displayed in a slot on a Web page or call center screen, although they could also be presented in an email, mobile device, or other channel.

RTDM leans toward the simpler end of most framework options. Each request loads fresh data from the touchpoint and other source systems, even within a multi-step interaction. At best, users can create continuity by storing a session token at the end of one interaction and retrieving it at the start of the next interaction. The systems returns tags, IDs or URLs but not actual content.

Decisions are based primarily on rules. These can incorporate predictive models, but the models themselves are built outside of the system, using SAS or other products, and do not self-adjust based on results. The system can select among multiple results by sorting on one or more user-specified variables, although any more complex arbitration requires custom coding in the SAS language. Such formulas could be registered in the system and reused across campaigns. Users can define a group of treatments, called a “campaign set”, that share a single set of eligibility rules. Individual treatments can also have their own eligibility rules that are applied whenever the treatment is used.

RTDM is tightly integrated with SAS’s campaign management system, SAS Marketing Automation. It shares the same campaign flow interface, treatment library, and database of contacts and responses. Predictive models built with SAS tools are also available to both. Both use other SAS platform components including data structures, reporting tools, and other general functions. RTDM can be installed on-premise or hosted by SAS.

RTDM has been around in some form since 2008, although integration with the Marketing Automation treatment library is more recent. The system has sold more than 50 licenses, although fewer than half have been deployed. SAS says most deployments have been single-channel, single-purpose projects. Deployment has come slower where RTDM is part of a larger multi-channel deployment involving other SAS marketing products. The other components must be put in place before the client is ready for RTDM.

Pricing of the system is based on the number of decisions processed or call center seats. Cost starts around $150,000.

There are many possible reasons for the slow adoption. Maybe marketers don’t realize how much improvement they get from driving recommendation with predictive models rather than simple rules. Perhaps the decision capabilities built into delivery systems are already adequate. The delivery systems are controlled by Web and call center managers who are not incented to generate revenue and may not be interested in a shared decision engine to coordinate customer treatments. Maybe each of these plays a role.

Still, the interest among my own clients has been enough to spur a fresh look at the vendors in this field. To gather this information systematically, I need a framework that lists standard features and options within those features. This makes it easy to isolate critical differences among the products.

For real-time decision managers, the framework includes:

- connecting to external systems. This includes the touchpoints (customer-facing execution systems), such as Web sites and call centers, and other systems with relevant data, such as order processing and marketing databases. Connections to touchpoints are typically through Web Services calls; connections to other sources are usually made through API calls and SQL queries. The connections are set up during system implementation and then used in real time to look up information about a specific individual during an interaction. One important difference among real time decision systems is whether they look up information each time they are asked for a decision, or whether they look it up once at the start of an interaction and then retain it in a session until the interaction is complete. The session reducing workload and helps to run multi-step dialogues. Another difference is whether the system maintains its own permanent database of individual profiles and contact history or must query external systems for all data.

- making decisions based on rules and predictive models. Rules are always available; systems differ greatly in how hard they are to build and maintain. Predictive models are optional. They be built outside of the system, built within the system in periodic (batch) processes, or built and updated automatically. Systems also differ considerably in how they choose among competing treatments, a process called “arbitration”. The ranking may be as simple as picking the offer most likely to be accepted, or it may involve complex user-specified considerations such as offer value, sales targets, and business priorities. Some systems let users apply weights to multiple factors.

- integration with campaign and content systems. Early decision systems were not connected to outbound campaign managers or to content stores. But today they are often part of a larger marketing suite that includes an outbound campaign manager. The decision system may share campaign flows, offer definitions, customer data, analytics, and other features with the campaign manager. This simplifies training and facilitates integrated, cross-channel customer treatments. But even the unified systems typically run the outbound campaigns and real-time decisions on separate engines, each optimized for its particular type of processing. Regarding content: the decision systems traditionally returned a content ID that the execution system converted to actual content internally. When the decision manager is part of a marketing suite that includes a content repository, it can return the content itself.

- deployment model. Most real-time decision managers are deployed the old-fashioned way, as on-premise software. This gives clients the greatest control over security and performance. Some are cloud-based or vendor hosted (not precisely the same thing, but close enough), which simplifies deployment. Several vendors offer both options.

With that framework in mind, let’s take a look at another product in this group: SAS Real Time Decision Manager (RTDM).

RTDM meets all the framework requirements: it receives a Web Services request from an external system for a decision, runs the request through rules and models, and returns one or more choices. The results are usually displayed in a slot on a Web page or call center screen, although they could also be presented in an email, mobile device, or other channel.

RTDM leans toward the simpler end of most framework options. Each request loads fresh data from the touchpoint and other source systems, even within a multi-step interaction. At best, users can create continuity by storing a session token at the end of one interaction and retrieving it at the start of the next interaction. The systems returns tags, IDs or URLs but not actual content.

Decisions are based primarily on rules. These can incorporate predictive models, but the models themselves are built outside of the system, using SAS or other products, and do not self-adjust based on results. The system can select among multiple results by sorting on one or more user-specified variables, although any more complex arbitration requires custom coding in the SAS language. Such formulas could be registered in the system and reused across campaigns. Users can define a group of treatments, called a “campaign set”, that share a single set of eligibility rules. Individual treatments can also have their own eligibility rules that are applied whenever the treatment is used.

RTDM is tightly integrated with SAS’s campaign management system, SAS Marketing Automation. It shares the same campaign flow interface, treatment library, and database of contacts and responses. Predictive models built with SAS tools are also available to both. Both use other SAS platform components including data structures, reporting tools, and other general functions. RTDM can be installed on-premise or hosted by SAS.

RTDM has been around in some form since 2008, although integration with the Marketing Automation treatment library is more recent. The system has sold more than 50 licenses, although fewer than half have been deployed. SAS says most deployments have been single-channel, single-purpose projects. Deployment has come slower where RTDM is part of a larger multi-channel deployment involving other SAS marketing products. The other components must be put in place before the client is ready for RTDM.

Pricing of the system is based on the number of decisions processed or call center seats. Cost starts around $150,000.

Monday, October 22, 2012

Marketing Lessons from Chernobyl

I’ll be speaking about optimization this Wednesday at the Online Marketing Summit conference in Santa Clara, CA. Since I’m very comfortable with the actual topic, most of my prep time has been spent looking for pictures for my slides.

One discovery was the image above, which shows is how I think most people imagine optimization: a team of dead-serious revenue engineers carefully tweaking dials and watching gauges until they find the perfect balance among alternative marketing investments. That the real world isn’t quite so rigorous is a sad truth I’ll cover during the conference.

But this picture isn’t just any power plant. It’s the control room at the Chernobyl nuclear reactor which disastrously exploded in 1986. Look closely, and what do you notice?

Yes, those hats. Apparently the Chernobyl plant was being run by pastry chefs. That explains so much.

My theory is this: the Soviets had a little-known tradition that translates roughly as “switch jobs with your friends day”. The year of the accident, a team of bakers decided to change places with their buddies in the Chernobyl control room. The nuclear engineers spent the day calculating the volume of pie tins and optimizing heat convection in the baking ovens. Meanwhile, the pastry chefs were decorating fuel rods with icing and asking, “What if we replace the reactor coolant with meringue?”

This did not end well.

Well, maybe that didn’t happen. But my imaginary pastry chefs sound a lot like stereotypical marketers: experts in a subjective field where decisions are based on taste, feel, and appearance, and progress comes through intuitive experimentation. Those methods work well in the kitchen, but can’t be safely transferred to a nuclear reactor. Nor do they work for marketing optimization.

Like reactor management, marketing optimization programs need to be based on deep knowledge of the underlying process. They rely on precise tracking mechanisms that support long-term monitoring of detailed results. They need to be run by marketing equivalent of nuclear engineers, not pastry chefs.

This doesn’t mean that data geeks should take over marketing. Chances are, things weren’t going very well in the Chernobyl bakery that day, either. The city needed both bakers and scientists. But having them wasn’t enough: they needed each in the right place. Marketing departments are the same.

Friday, October 19, 2012

Infor Epiphany Marketing and Interaction Advisor: Good Examples of B2C Marketing Automation

Epiphany was one of the high-fliers of an earlier marketing automation boom: launched in 1997 with an initial public offering in 1999, it traded stock for a full suite of marketing and CRM systems before its price collapsed. The remains were scooped up in 2005 by SSA Global, which was itself purchased in 2006 by enterprise software vendor Infor. Through all this, the company’s products continued to sell with little change. The crown jewel turned out to be RightPoint, a pioneering real-time interaction manager now called Interaction Advisor.

Infor has recently renewed its commitment to the Epiphany line, increasing investment in the product and its marketing. Recent improvements include a unified interface for inbound and outbound campaigns, tighter integration among its components, greater scalability, support for more channels, and pre-packaged solutions for specific applications. The vendor has integrated with Orbis Global for marketing resource management and has an AppExchange integration with Salesforce.com. A new user interface is planned for next year.

As I noted in yesterday’s post, B2C marketing systems like Epiphany have actually been more popular acquisition targets than B2B products. Since many readers of this blog are unfamiliar with the B2C products, it’s worth taking a detailed look at Epiphany’s components.

Let’s start with the marketing automation product, Infor Epiphany Marketing. This sits on a marketing database built outside of the system; part of the set-up is mapping that to Epiphany. This is already a contrast to B2B marketing automation, where the database is part of the system and structures are largely limited to contacts, accounts, and marketing interactions.

In addition to the external data, Epiphany does maintain its own database of operational components. These are arranged in a standard model including programs, which can contain multiple campaigns, which in turn can have multiple communications (messages) and cells (contact groups). Communications can be shared by multiple cells, and one cell can use multiple communications. Each communication may contain one or more creatives, which are specific bits of marketing content. Campaigns, communications, and cells can all be assigned to output channels.

The model also contains segments (sets of customers or prospects), events (campaign triggers, which can be based on time, channel, behavior, queries, or feeds from external Web services), and packages (sets of campaigns used for Interaction Advisor). Campaigns can be divided into waves, each with its own schedule. The schedules can have a fixed date, recur at fixed intervals (from minutes to weeks), or be triggered by events.

Events can be captured as they happen, but the system still pushes the responses to a queue to batch the replies. The queue might be cleared as often as each minute for near-real-time messaging such as a purchase confirmation email. It might wait longer for media such as direct mail, where there are significant economies of scale. Bear in mind that this limit applies only to outbound campaigns: Interaction Advisor provides true real-time response to inbound interactions.

Users can also create global marketing rules that apply across campaigns. These help to enforce regulatory constraints, such as age restrictions or opt-out compliance, or company policies such as limits on the number of messages within a time period.

The structure I've just described is substantially more complicated than most B2B marketing automation systems. That complexity adds some cost, but it also lets users can more easily manage shared components and analyze results by communication, channel, program, segment, and other groupings. This is hugely important in managing marketing programs with hundreds or thousands of components, a typical B2C requirement.

Epiphany campaigns are set up by assembling segments in a hierarchical tree, splitting them into cells if desired, and assigning a communication to each cell. Rules and segmentations are built with a powerful query builder that can read any data in the system, including transaction details, and supports relative dates, value ranges, events, ranking (e.g. 100 highest-revenue customers), and negatives (e.g., has not bought a specific product). Again, this is typical of B2C systems, while B2B query builders are sometimes more limited.

Beyond campaign management, Epiphany Marketing provides integrated data mining and predictive models; advanced reporting and visualization, including use of report cells as campaign segments; an executive dashboard; global permissions and security management; and the Orbis Global integration for marketing calendars, workflow, digital asset management, and financials. These are rarely available in B2B marketing automation systems, although exceptions exist.

Epiphany Marketing has its own email engine. It actually supports two kinds of dynamic content. One is your everyday dynamic content, where rules within the email determine what’s shown to each recipient. The other, which Infor calls “true” dynamic content, can change the contents after a message is delivered. It does this by calling back to Interaction Advisor for a selection based on current information. Neat trick.

On the other hand, Epiphany Marketing currently lacks an end-user tool to build emails or landing pages. This is one feature found in even the mostly lowly B2B systems. But gap exists because Epiphany and other B2C systems were designed primarily for large organizations where content is created by full-time designers or external agencies. Infor plans to add a content builder next year, and other B2C vendors will probably do the same if they haven't already.

So much for Epiphany Marketing. It’s neither the best nor the worst B2C marketing system. But it’s a good example of what those products provide and how they differ from B2B marketing automation products.

Interaction Advisor, on the other can at least make a plausible claim to leading its industry. With nearly 200 installations, it may well have more clients than any competitor – systems including Oracle Real Time Decisions, IBM Unica Interact, Pega Next-Best-Action Marketing, SAP Real-Time Offer Management, and a host of others.

These systems all work roughly the same way. They connect with external customer-facing platforms, usually Web sites or call centers, which alert them when a customer or prospect starts an interaction. The systems pull information about the customer from the external system and other sources, apply rules and predictive models to recommend a treatment, and send the recommendation back to the customer-facing system for delivery.

The connections with external systems are made through Application Program Interfaces (APIs) provided by those systems, so the interaction managers handle those pretty similarly – although there are some differences in the types of connections they support. The more important variations are in their internal decision-making process. Specific considerations include the complexity, scope and difficulty of creating rules; the predictive modeling methods and user requirements; and how the system reconciles conflicting priorities in making its final recommendation.

Interaction Advisor handles all these quite nicely. The vendor divides the process into four steps: dynamic profiling (gathering the data); business rules (selecting options to consider); real-time analytics (self-managing predictive models); and arbitration (selecting the best option based on user objectives).

In practice, the process starts with a call from an external system. This could be triggered by a tag embedded in Web page or call center screen. The call contains information about the current customer and the context. It carries the identity of an Interaction Advisor event, which tells the system what campaigns to apply and how many recommendations to return. The system might need several responses to display multiple ads on a Web page or to give a call center agent some choices.

When the call is received, Interaction Advisor creates a session that will remain open until the interaction is complete. It stores the data it received in memory and then queries other systems, such as the company’s marketing database, customer files, and inventory systems, to assemble whatever other data it needs. This is also stored in memory: there is no persistent customer profile within Interaction Advisor although some information generated during the interaction will be stored permanently.

The system then executes the rules, which first activate the specified marketing campaigns and then determine which offers within those campaigns are available to this customer in this situation. (For example, the system might exclude offers within the campaign for products the customer has already purchased or recently rejected.) There might be additional constraints such as ensuring that offers relate to the contents of the originating Web page or don’t include conflicting products.

Once the eligible offers are identified, the system activates its predictive models. Interaction Advisor supports two types of predictions: Bayesian models that estimate the likelihood of the customer responding to one specific offer, and collaborative filtering that identifies offers most commonly selected together. Both are self-generating and self-tuning, so human model-builders are not needed. The Bayesian models do provide reports on which attributes have the most influence on the likelihood score. These provide useful business insight and let users check that the models are reasonable. The system keeps a record of offers made and accepted, which is essential for the Bayesian modeling technique.

The final step is arbitration. This looks at the likelihood scores for the eligible offers, the value (revenue or profit) from each offer, and perhaps other considerations such as inventory levels or sales quotas. Users set up arbitration rules depending on their priorities: they might want to make the offer most likely to be accepted, the offer with the highest value, or the offer with the highest expected value (i.e., likelihood x value). One arbitration scheme can apply across multiple events, even if they involve different campaigns and offers.

Once the offers are chosen, the system passes the customer-facing system a content ID that tells it what to display. Interaction Advisor could also store the content internally and send it instead of an ID. But most users prefer to let the customer-facing system to manage its own content.

The call-and-response cycle just described applies to a single interaction. Interaction Advisor doesn’t execute multi-step dialogs like a call center script or sequence of Web pages. Users could accomplish that indirectly by creating different events that call different rules, or by creating eligibility rules that take into account previous activities. Since sessions remain active for a user-specified period of time, previous events within the sequence are all immediately available. However, sessions are channel-specific, so a customer simultaneously looking at a Web page and talking to a call center agent would have two independent sessions active. At best, the data in those sessions could be shared by posting it to an underlying database. Posting also makes the interaction history available to in the future.

Products like Interaction Advisor often generate substantially more revenue than manual recommendations. They are priced accordingly: a single-channel Interaction Advisor installation starts around $150,000 and could run much higher. Fees are usually based on the number of users in a call center or sales agent environment, or the number of recommendations or visitors in an automated environment like a Web site. Most clients install InteractionAdvisor on-premise, although hosted options are available.

Infor has recently renewed its commitment to the Epiphany line, increasing investment in the product and its marketing. Recent improvements include a unified interface for inbound and outbound campaigns, tighter integration among its components, greater scalability, support for more channels, and pre-packaged solutions for specific applications. The vendor has integrated with Orbis Global for marketing resource management and has an AppExchange integration with Salesforce.com. A new user interface is planned for next year.

As I noted in yesterday’s post, B2C marketing systems like Epiphany have actually been more popular acquisition targets than B2B products. Since many readers of this blog are unfamiliar with the B2C products, it’s worth taking a detailed look at Epiphany’s components.

Let’s start with the marketing automation product, Infor Epiphany Marketing. This sits on a marketing database built outside of the system; part of the set-up is mapping that to Epiphany. This is already a contrast to B2B marketing automation, where the database is part of the system and structures are largely limited to contacts, accounts, and marketing interactions.

In addition to the external data, Epiphany does maintain its own database of operational components. These are arranged in a standard model including programs, which can contain multiple campaigns, which in turn can have multiple communications (messages) and cells (contact groups). Communications can be shared by multiple cells, and one cell can use multiple communications. Each communication may contain one or more creatives, which are specific bits of marketing content. Campaigns, communications, and cells can all be assigned to output channels.

The model also contains segments (sets of customers or prospects), events (campaign triggers, which can be based on time, channel, behavior, queries, or feeds from external Web services), and packages (sets of campaigns used for Interaction Advisor). Campaigns can be divided into waves, each with its own schedule. The schedules can have a fixed date, recur at fixed intervals (from minutes to weeks), or be triggered by events.

Events can be captured as they happen, but the system still pushes the responses to a queue to batch the replies. The queue might be cleared as often as each minute for near-real-time messaging such as a purchase confirmation email. It might wait longer for media such as direct mail, where there are significant economies of scale. Bear in mind that this limit applies only to outbound campaigns: Interaction Advisor provides true real-time response to inbound interactions.

Users can also create global marketing rules that apply across campaigns. These help to enforce regulatory constraints, such as age restrictions or opt-out compliance, or company policies such as limits on the number of messages within a time period.