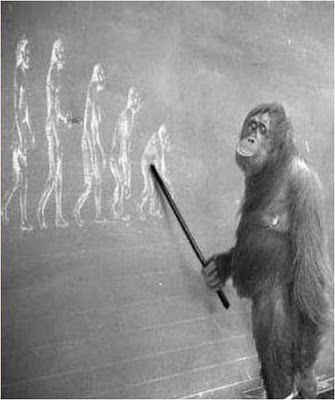

There’s still time to sign up for my October 7 Webinar on stage-based marketing measurement (sponsored by Marketo and hosted by the American Marketing Association). During my extensive, um, research, I was very pleased to find the following picture to illustrate the concept of stages:

I like this picture both because it's amusing (a major priority) and also because it illustrates that stage definitions are constructed, not discovered. (I suppose the proper science is that evolutionary stages are objective facts, in which case our monkey friend in the photo simply has it wrong. But the deeper point still stands: whether it’s evolutionary stages or purchasing stages, someone imposes conceptual order on the jumble of reality.)*

If the picture isn't enough reason to attend, the Webinar will also present four essential metrics of stage-based marketing measurement. (Quick review: stage-based measurement tracks the ability of marketing programs to move leads through stages in the purchase process. This is more meaningful than attributing some fraction of the final revenue directly to each program. I’ll cover this in the Webinar and also discuss it in a recent whitepaper Winning the Marketing Measurement Marathon).

In case you can’t attend the Webinar, I thought I’d share the four metrics here.

1. Marketing ROI.

Purpose: to show the company’s return on its marketing investment.

Inputs: marketing costs and marketing-related revenue.

Metric: return on investment (= revenue / cost)

Comment: As with any ROI calculation, the trick here is to determine which costs are associated with which revenues. It’s always hard for marketers to know which revenues they helped to generate, but I’ll assume a database or digital environment that identifies the treatments applied to individuals and their actual purchases. In this situation, marketing ROI is calculated by summing all marketing costs for a cohort of customers sharing some common feature such as original source, acquisition date range or first purchase date. Note that a meaningful calculation must also include spending on people who never purchase, so a cohort based on purchase dates must somehow include non-buyers.

2. Program ROI

Purpose: measure the relative performance of individual marketing programs.

Inputs: incremental marketing cost, incremental revenue

Metric: incremental ROI

Comment: Obviously the key word here is “incremental”. Marketing programs exist in the context of other activities that influence buyer behavior. The only thing you can really measure is the incremental change that occurs when a particular program is added or removed from the mix. Combined with incremental costs, this gives an incremental ROI for the program. Spending more on high ROI programs and less on low ROI programs is how marketers optimize their results. Remember, though, that ROI is just one part of the equation. In practice, marketers must balance it against considerations such as revenue goals and marketing budgets.

Incremental measurement requires formal tests that compare performance of two similar groups which differ only in whether they received a particular program. These tests can cover any type of program, including nurture programs that don’t acquire new names. Proper measurement must track through the end of the buying cycle, since a program’s impact on early stages might vanish or even be reversed at later stages. One common example: a free introductory offer that yields higher initial response but doesn't add to the final number of paying customers.

3. Stage Results

Purpose: understand movement of leads through the buying stages

Inputs: marketing costs per stage, conversions (= number of leads that move to the next stage), conversion time (= time in stage before conversion to next stage; a.k.a. velocity), lead inventory (=number of leads in each stage)

Metrics: conversion rate, cost per conversion, average conversion time

Comment: These statistics describe how leads are moving from one stage to the next. The information is used to project future behaviors, to identify problem stages, to track changes in stage performance, and to compare the effects of marketing programs. Where leads in different cohorts (based on original source, acquisition date, marketing treatments, etc.) behave differently, statistics should be gathered separately for each cohort.

One statistic you can't calculate is the ROI for stage investments. This is counter-intuitive: stage ROI should be possible because you're making investments at each stage and the investments produce leads with higher values. But in fact the aggregate value of a cohort of leads remains the same as they move through the stages; all that happens is that unproductive (i.e., valueless) leads drop out. That is, even though the value per lead increases, there is no increase in the value of all leads combined. Without a value change, you can’t calculate a return on investment.

(Actually, there is a bit of value change as leads move through the stages because leads in later stages will need less additional investment to reach the final sale. But the expected revenue for the cohort stays constant. Of course, to the extent that a particular marketing program creates an incremental change in total value, this can be measured like any other program ROI.)

4. Revenue Forecast

Purpose: estimate future period revenues (by week, month, quarter, etc.) from the current lead inventory.

Inputs: lead inventory per stage, conversion rate per stage, conversion time per stage

Metric: revenue forecast by period

Comment: Revenue projections are among the most critical of corporate statistics. The stage-based approach allows more accurate projections of revenue over time, starting with the current lead inventory and known stage statistics. If the projections can distinguish marketing-generated leads from other leads, they can also give a concrete measure of the value that marketing has provided to the organization. If leads from different cohorts behave differently, the projections need to use separate assumptions for each group.

_____________________________________________________

* Platonists and creationists, with their respective theories of absolute Forms and divinely-created immutable species, might argue that species actually do have an independent existence. They're wrong.