Thursday, February 26, 2009

Getting Closer to My Usability Ratings

But it turns out that those posts served a purpose beyond procrastination. In particular, they helped me to clarify the distinction between small campaigns focused on a specific treatment (e.g. offering a white paper or promoting a Webinar) and the larger process of managing the flow of treatments.

I’d already noticed that the simplicity-focused vendors (Marketo, Infusionsoft, OfficeAutoPilot and, as of yesterday, Genius.com) build their campaigns as a list of steps with no branching flows. (To be wholly accurate, some of them do permit limited branching within each step. But they hide it well.) As a result, I had flagged that as a key item on my usability-for-simple-programs checklist. (As a reminder, I'm planning to build two usability scores, one for simple marketing programs and one for complex marketing programs.) (Yes, there are far too many parenthetical comments in this post. Sorry.)

But I also knew that some of the vendors focused on complex programs (Market2Lead, Marketbright and arguably Silverpop/Vtrenz) embed similar-looking list-style campaigns within a larger flow logic. The question was why those systems should not also be rated as easy for simple projects—because, at least in my opinion, they are not.

What I realized while writing my posts on Marketo and Genius.com is that you can’t view the individual campaigns in isolation. You must also consider how a system moves leads from one campaign to another.

The complexity-oriented vendors do this with flow logic that explicitly routes leads among campaigns. Marketbright and the new Market2Lead interface use an actual flow chart; Silverpop/Vtrenz uses non-visual rules. This makes sense, since marketers with sophisticated programs will want precise control over this routing. (In case you're wondering about other vendors I track, Eloqua, Neolane and Manticore Technology all set up flow charts without embedding the small list-style campaigns. So the distinction between campaign design and lead routing doesn't really apply.) (Sorry about the parentheses.)

The simplicty-oriented vendors don’t have explicit campaign-to-campaign routing. Instead, independent qualification rules for each campaign determine where the leads go next. This is obviously less work for marketers to set up, although it can be harder to understand lead flows when more than a few campaigns are in place.

I had documented the mechanics of this process during my research, but not thought of it as a lead routing mechanism. Yet even though there is no explicit lead routing involved, leads are still moving from one campaign to another. As Kurt Vonnegut never said, no matter what you do, lead routing happens.

So that's my grand epiphany: every system has a lead routing approach. Simplicity-focused products route leads by default, via independent campaign selection rules. Complexity-focused products route leads explicitly. As epiphanies go, it may not match Saul on the road to Damascus, but it will have to do.

Now that we’ve cleared that up, it’s evident that the proper checklist item is not linear campaign design, but implicit lead routing. It’s equally clear that the checklist for complex program usability will include explicit routing. I think that’s enough wisdom for one blog post, so I’ll end this one right here.

Wednesday, February 25, 2009

First Look: Genius.com Adds Nurturing Campaigns to MarketingGenius

Genius.com itself has been around since 2006, when it launched SalesGenius. This gave salespeople a desktop “Tracker” that instantly alerted them when prospects responded to their emails, and showed which pages the prospects visited on their company Web site. What made SalesGenius special was doing this without installing tracking scripts on the company Web pages. Instead, links embedded in a Genius-generated email point to a proxy server that relays the visitor to company Web pages but keeps a record of the interactions as they pass through. This allows instant deployment without any involvement of the company’s Web or IT team.

(Note: in addition to the original proxy server technology, Genius also now offers a tracking solution based on inserting conventional tags into Web pages. This allows it to track all site visits, not only those routed to the proxy server by a Genius-generated link.)

The product was soon extended to integrate with Salesforce.com and to let the proxy server add Genius-generated popups that display personalized messages or offer an online chat. Later, the company added MarketingGenius, which lets marketers send email on behalf of salespeople and can react to Salesforce.com workflow rules. The two products are now offered in combination as Genius Pro.

Genius Enterprise expands the company’s beachhead in marketing by adding automated lead nurturing and lead scoring. This makes it more of a competitor to traditional demand generation systems, although Genius Enterprise still lacks landing pages and surveys. Genius.com plans to add those fairly soon, but in the meantime feels its easy deployment and real-time sales alerts are already reason enough for marketing and sales users to buy its product.

As to the landing pages and forms themselves, companies can build their own, have Genius.com professional services staff build them, or use Web to Lead pages created in Salesforce.com. The pages would need to be added to the company’s own Web site, since Genius.com will not host them. Data captured by the forms will be loaded first into Salesforce.com and then copied into Genius.com during the regular synchronization process. Setting up the synchronization is fully automated and updates are shared between the systems in real time. Although real-time synchronization is not unique to Genius.com, the company sees it as essential to frictionless coordination between sales and marketing, ensuring immediate reactions to prospect behaviors. Genius.com’s term for this is “dynamic engagement”.

So much for the theory. In practice, Genius Enterprise delivers a cleanly designed lead nurturing and scoring tool that meets basic needs quite nicely.

The system is organized around campaigns, called workflows, which are laid out as a sequence of steps. Each step has three components: a trigger with rules to select leads; actions to apply to those leads; and directions for what to do next.

The triggers can be based on profile data from Salesforce.com, the end of a waiting period, or activities including opening an email, leaving a message, visiting a specific Web page, and starting or ending a Web site visit or chat session. Leads enter a campaign when a data change qualifies them for its initial trigger, so there is no explicit campaign schedule. This is part of the system’s real-time approach. Users can build a static list and attach it to a campaign, to send a conventional outbound mass email.

The list of available actions is small but captures the essentials: send an alert to sales, where it will appear on the salesperson’s real-time “tracker”; change a lead score; send the lead an email; or set a data value. Changing the data value is a key ability, since it could trigger another campaign or system action. Possible directions include moving to the next step in the sequence, removing the lead from the campaign, or watching for the same trigger again. Again, that’s a minimal set of choices but does what’s necessary.

The simplest possible step contains one rule, one action, and one next direction. But users can also build multiple rule sets, and then assign multiple actions and different directions to each set. This gives the system considerable power. The interface seemed quite intuitive to me: users drag triggers onto the screen to add a step to the sequence (there is no branching, but a new step could be inserted between existing ones). They then open up the step to specify the rules, actions and directions. Rules and directions are defined by filling in blanks and picking from lists; actions are dragged in from a box on the side.

Genius Enterprise does not send leads directly from one campaign to another. Rather, leads are added to independently to each campaign whenever they qualify for its selection rules. This is a somewhat unusual approach but avoids complicated flow charts. Lead scoring can be handled by a dedicated campaign that operates separately from the other campaigns. Most vendors take a similar approach. Users do have the option of modifying scores within individual campaigns.

The system’s approach to sending leads to sales is more distinctive. In addition to the primary workflow, each campaign has a “conversion event” with its own trigger rules and actions. Outcomes can either convert the lead to sales and remove it from the campaign, or to keep it in place. This technique has two advantages: no need to build a separate conversion rule into each step, and no delay while waiting for any pauses built into the main workflow. It’s a pretty good solution, although I’m not sure whether leads are removed from all campaigns or only the one the conversion event is attached to.

Genius Enterprise includes the email builder from earlier Genius systems, which seems perfectly serviceable. It provides the usual features: Word-style editing, personalization, send emails on behalf of the assigned sales rep, previews, list definition and immediate or deferred delivery. In addition, users can set up the popup messages I mentioned earlier and specify whether the email should be included in the “Tracker”. There’s also plug-in to send Genius-trackable emails from Microsoft Outlook.

I didn’t explore whether Genius includes more sophisticated demand generation features, such as split testing, rule-driven content selection, and profitability analysis. Probably not. But if all you need are basic email nurturing and lead scoring, and can live for the moment without landing pages, it’s a solid, easy-to-use package at a reasonable price (starting around $1,500 per month).

Yet evaluating Genius Enterprise like conventional demand generation system is largely missing the point. What sets Genius apart is its proxy-based technology, Web site popups, real-time alerts to sales, and tight integration with Salesforce.com. Companies attracted by those features—which probably means companies where sales and marketing are working closely, or plan to—are the ones who should consider it most carefully.

Tuesday, February 24, 2009

First Look at New Marketo Release

The changes that Fernandez described seemed good but subtle. Major themes were greater access to detailed information, more precise targeting, and tighter integration with Salesforce.com. The company also reworked the user interface--of more than 200 total changes in this upgrade, about 75 were tied to usability--although it still takes the same basic approach of building campaigns as lists of steps, rather than branching flow charts. In Fernandez’ view, this reflects a fundamental philosophical difference from his competitors: Marketo sees marketing as reacting to prospect-initiated behaviors, not executing company-driven interaction paths. Although I actually think that quite a few demand generation vendors share the Marketo philosophy, it’s still helpful to hear the distinction made clearly.

What's ultimately more important than the uniqueness of Marketo's philosophy is how they have built it into their software. In Marketo, each campaign is a relatively small, self-contained sequence of steps that is triggered by a particular prospect need. Fernandez used the analogy of a cocktail party: you might have a few stories you expect to tell, but don’t know exactly when you’ll tell them or in what order. The simplicity of these individual campaigns is what lets Marketo use a simple interface to build them. There is certainly more to it than that—the company has a fanatical devotion to usability—but I’d argue that being structured around simple campaigns is the key to Marketo’s well-deserved reputation as a system that’s easy to use.

The challenge with all these simple campaigns is the same as the challenge of telling stories at a cocktail party: you have to be sure to tell the right story to the right person at the right time. Marketo’s approach is to trigger campaigns based on specified events or list criteria. But since this by itself won’t coordinate the separate campaigns, Marketo also lets users set up other campaigns (which sound suspiciously like flow charts, although they are not displayed that way) whose rules send prospects to one campaign or another. This is a perfectly straightforward approach, although I suspect that marketers may find it hard to keep track of the selection rules as they get increasingly complicated.

Here is where it’s worth considering the approaches of other vendors. Products including Silverpop Engage B2B (formerly Vtrenz), Market2Lead and Marketbright also let marketers set up small, sequential campaigns and embed them in selection framework. Each vendor takes a different approach to building this framework, and, like Marketo, they can all be difficult to grasp once you pass a certain threshold of complexity.

Still, I think its fair to say that the general approach of simple campaigns linked in a decision matrix is a more effective way to implement non-linear, prospect-driven interactions than conventional flow charts. My own experience over the years has been that flow charts quickly become too complicated for most marketers to deal with.

Hmm, I seem to have fallen back into a discussion of usability without planning to. You can just imagine how much fun I am at a cocktail party. Fernandez and I did in fact discuss other things, including Marketo’s phenomenal growth (he hopes to sign his 150th customer any day now), its success in selling to non-technology companies (healthcare, manufacturing and business services have been strong), and the growing importance of demand generation systems as buyers take control of the purchasing process.

That last point morphed into a discussion of the increased integration between marketing and sales. Today's prospects repeatedly bounce between the two during hyper-extended sales cycles that begin earlier and are far less linear. That resonated with me because I’ve noticed several other demand generation vendors offering features that cross into traditional sales department territories, such as prospect portals and reseller management.

In Marketo’s case, though, it’s less a matter of adding sales-type functions than tightening its integration with Salesforce.com. Changes to support this include faster response times, more extensive data sharing, and more precise control over synchronization rules. Still, the general point is the same: marketing and sales must cooperate more closely than ever. It's always interesting to see how a thoughtful company like Marketo looks at a trend like this and decides to react.

Monday, February 23, 2009

Three Options for Measuring Software Ease of Use

In preparation, I wanted to share a general look at the options I have available for building usability rankings. This should help clarify why I’ve chosen the path I’m following.

First, let’s set some criteria. A suitable scoring method has to be economically feasible, reasonably objective, easily explained, and not subject to vendor manipulation. Economics is probably the most critical stumbling block: although I’d be delighted to run each product through formal testing in a usability lab or do a massive industry-wide survey, these would be impossibly expensive. Being objective and explicable are less restrictive goals; mostly, they rule out me just arbitrarily assigning the scores without explanation. But I wouldn’t want to do that anyway. Avoiding vendor manipulation mostly applies to surveys: if I just took an open poll on a Website, there is a danger of vendors trying to “stuff the ballot box” in different ways. So I won’t go there.

As best I can figure, those constraints leave me with three primary options:

1. Controlled user surveys. I could ask the vendors to let me survey their client base or selected segments within that base. But it would be really hard to ensure that the vendors were not somehow influencing the results. Even if that weren’t a concern, it would still be difficult to design a reliable survey that puts the different vendors on the same footing. Just asking users to rate the systems for “ease of use” surely would not work, because people with different skill levels would give inconsistent answers. Asking how long it took to learn the system or build their first campaigns, or how long it takes to build an average campaign or to perform a specific task would face similar problems plus the additional unreliability of informal time estimates. In short, I just can’t see a way to build and execute a reliable survey to address the issue.

2. Time all vendors against a standard scenario. This would require defining all the components that go into a simple campaign, and then asking each vendor to build the campaign while I watch. Mostly I’d be timing how long it took to complete the process, although I suppose I’d also be taking notes about what looks hard or easy. You might object that the vendors would provide expert users for their systems, but that’s okay because clients also become expert users over time. There are some other issues having to do with set-up time vs. completion time—that is, how much should vendors be allowed to set up in advance? But I think those issues could be addressed. My main concern is whether the vendors would be willing to invest the hour or two it would take to complete a test like this (not to mention whether I can find the dozen or two hours needed to watch them all and prepare the results). I actually do like this approach, so if the vendors reading this tell me that they’re willing, I’ll probably give it a go.

3. Build a checklist of ease-of-use functions. This involves defining specific features that make a system easy to use for simple programs, and then determining which vendors provide those features. The challenge here is selecting the features, since people will disagree about what is hard or easy. But I’m actually pretty comfortable with the list I’ve developed, because there do seem to be some pretty clear trade-offs between making it easy to do simple things or complicated things. The advantage of this method is that once you’ve settled on the checklist, the actual vendor ratings are quite objective and easily explained. Plus it’s no small bonus that I’ve gathered most of the information already as part of my other vendor research. This means I can deliver the rankings fairly quickly and with minimal additional effort by the vendors or myself.

So those are my options. I'm not trying to convince you that approach number 3 is the “right” choice, but simply to show that I’ve considered several possibilities and number 3 seems to be the most practical solution available. Let me stress right here that I intend to produce two ease of use measures, one for simple programs and another for complex programs. This is very important because of the trade-offs I just mentioned. Having two measures will force marketers to ask themselves which one applies to them, and therefore to recognize that there is no single right answer for everyone. I wish I could say this point is so obvious that I needn't make it, but it's ignored more often than anyone would care to admit.

Of course, even two measures can’t capture the actual match between different vendors’ capabilities and each company’s particular requirements. There is truly no substitute for identifying your own needs and assessing the vendors directly against them. All I can hope to do with the generic ratings is to help buyers select the few products that are most likely to fit their needs. Narrowing the field early in the process will give marketers more time to look at the remaining contenders in more depth.

Monday, February 16, 2009

How to Compare Demand Generation Vendors: Choosing Summary Measures

This raises the issue of exactly what should be in the summary listings. It seems that what people really want is an easy way to identify the best candidates for their particular situation. (Duh.) This suggests the summary should contain two components: a self-evaluation where people describe their situation, and a scoring mechanism to compare their needs with vendor strengths and weaknesses.

Categories for the self-evaluation seem pretty obvious: they would be the standard demand generation functions (outbound email, landing pages and forms, nurturing campaigns, lead scoring, and Salesforce.com integration), maybe a menu for less standard functions (e.g. events like Webinars, paid and organic search, online chat, direct mail, telemarketing, partner management, etc.), price range, and willingness to consider less established vendors. Once you’ve settled on these, you have the vendor ratings categories too, since they have to align with each other. That lets you easily find the vendors with the highest scores in your highest priority areas. Simple enough.

Except...some marketers only need simple versions of these functions while other marketers need sophisticated versions. But every system in the Guide can meet the simple needs, so there’s no point to setting up a separate scores for those: everyone would be close to a perfect 10. On the other hand, the vendors do differ in how easily they perform those basic tasks, and it’s important to capture that in the scoring.

The literal-minded solution is to score vendors on their ease-of-use for each of the functions. Sounds good, and as soon as someone offers me a couple hundred thousand dollars to sit with a stopwatch and time users working with different systems, I’ll get right on it. Until that happens, I need a simpler but still reasonably objective approach. Ideally, this would allow me to create the scores based on the information I’ve already assembled in the Guide.

My current thinking is to come up with a list of specific list of system attributes that make it easy to do basic functions, and then create a single “ease of use for basic tasks” score for each vendor. As a practical matter, this makes sense because I don’t have enough detail to create separate scores for each function. Plus, I’m pretty sure that each vendor’s scores would be similar across the different functions. I also think most buyers would need similar levels of sophistication across the functions as well. So I think one score will work, and be much simpler for readers to deal with.

The result would be a matrix that looks something like the one below. It would presumably be accompanied by a paragraph or two thumbnail description of each vendor:

| Ease of Basic | Sophistication of Tasks | Other Tasks (list) | Ease of Purchase (Cost) | Vendor Strength | ||||

email campaigns | Web forms/ | nurture campaigns | lead scoring | Salesforce integration | |||||

Vendor A | 5 | 8 | 4 | 8 | 4 | 9 | 4 | 7 | 5 |

Vendor B | 8 | 4 | 8 | 4 | 7 | 4 | 7 | 5 | 8 |

Vendor C | 4 | 8 | 4 | 9 | 4 | 7 | 5 | 8 | 6 |

... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

So the first question is: would people find this useful? Remember that the detail behind the numbers would be available in the full Raab Guide but not as part of the free version.

The second question is: what attributes could support the “ease of basic tasks” score? Here is the set I’m considering at the moment. (Explanations are below; I’m listing them here to make this post a little easier to read):

- build a campaign as a list of steps.

- explicitly direct leads from one campaign to another.

- define campaign schedules and entry conditions at the campaign level, not for individual steps.

- select marketing contents from shared libraries.

- build decision rules from prebuilt functions for specific situations, such as ‘X web page visits in past Y days’.

- build split tests into content, not decision flows.

- explicitly define lead scoring as a campaign step, but have it point to a central lead scoring function.

- explicitly define lead transfer to sales as a campaign step, but have it point to a central lead transfer function.

These items are all fairly easy to judge: either a system works that way or it doesn’t. So in that sense they’re objective. But they’re subjective in that some people may not agree that they actually make a system easier to use for basic tasks. Again, I’d much prefer direct measures like the number of keystrokes or time required the complete a task. But I just don’t see a cost-effective way to gather that information.

Other measures I’d use in my scoring would be the amount of training provided during implementation, typical implementation time, and typical time for users to become proficient. These should be good indications of the difficulty of basic tasks. I do have some of this data, although it’s only what they vendors have told me. Answers will also be affected by differences in vendor deployment practices and in how sophisticated their users are. So I can’t give these too much weight.

Let me know what you think. Do these measures make sense? Are there others I can gather? Is there a better way to do this?

++++++++++

Explanations of the “ease of basic tasks” attributes:

- build a campaign as a list of steps. Each step can be an outbound message (email), an inbound message (landing page or form), or an action such as sending the lead for scoring or to another campaign. Campaigns can be saved as templates and reused, but the initial construction starts with a blank list. (This seems counterintuitive; surely it would be simpler to start with a prebuilt template? Yes for experienced marketers, but not for people who are just starting, who would have to explore the templates to figure out what they contain. For those people, it’s actually easier to start with something they’ve created for themselves and therefore fully understand.) Another aspect to this is that many marketers prefer a list of steps rather than a flow chart, even though they are logically the same. The reason is that simple campaigns tend to be very linear, so a flow chart adds more complexity than necessary. (Of all the items on this list, this is the one I’m probably least committed to. But the really simple systems I’ve seen do use lists more than flow charts, so I think there’s something to it.)

- explicitly direct leads from one campaign to another. Even basic marketing programs need to move leads from one treatment sequence to another, based on changes in lead status or behaviors. But building many different paths into a single campaign flow quickly becomes overwhelming. The easiest solution for basic marketing programs is to create separate, relatively simple campaigns and explicitly direct leads from one campaign to another at steps within the campaign designs. This approach works well only when there are relatively few campaigns in the program. More complex programs require other solutions, such as using rules to send different treatments to different people within the same campaign, having each campaign independently scan the database for leads that meet its acceptance criteria, or embedding small sequences (such as an email, landing page, thank you page and confirmation email) as a single step in a larger campaign. Systems built to handle sophisticated campaign requirements sometimes provide an alternative, simpler interface to handle simple campaign designs.

- define campaign schedules and entry conditions at the campaign level, not for individual steps. Basic marketing campaigns will have a single, campaign-level schedule and set of entry conditions. Even campaigns fed by other campaigns often impose additional entry criteria, for example to screen out leads who have already completed a particular campaign. Users will look for the schedule and entry conditions among the campaign attributes, not as attributes of the first step in the campaign or of a separate list attached to the campaign. More sophisticated marketing programs may also give each step its own schedule and/or entry conditions, instead of the campaign attributes or in addition to them.

- select marketing contents from shared libraries. The libraries contain complete documents with shared elements such as headers, footers, layouts and color schemes, plus a body of text and data entry fields. Marketers can either use a document as-is or make a copy and then edit it. In practice, nearly every system has this sort of library, so it’s not a differentiator. But it’s still worth listing just in case you come across a system that doesn’t. More sophisticated approaches, such as templates shared across multiple documents, only add efficiency for more advanced marketing departments.

- build decision rules from prebuilt functions for specific situations, such as ‘X web page visits in past Y days’. This saves users from having to figure out how to build those functions themselves, which can be quite challenging. In the example given, it would require knowing which field in the database is used to measure Web page visits, how to write a query that counts something entries in that field, and how to limit the selection to a relative time period. There are a great many ways to get these wrong.

- build split tests into content, not decision flows. The easiest way to test different versions of an email or landing page is to treat the versions as a single item in the campaign flow, and have the system automatically serve the alternatives during program execution. The common alternative approach is to directly split the campaign audience, either at the start of the campaign or at a stage in the flow directly before the split itself. This results in a more complex campaign flow and is often more difficult to analyze.

- explicitly define lead scoring as a campaign step, but have it point to a central lead scoring function. This is a compromise between independently defining the lead scoring rules every time they’re used, and automatically scoring leads (after each event or on a regular schedule) without creating a campaign step at all. Independent score definitions are a great deal of extra work and can lead to painful inconsistencies, so it’s pretty clear why you would want to avoid them. Doing the scoring automatically is actually simpler, but may confuse marketers who don’t see the scoring listed as a step in their campaign flow.

- explicitly define lead transfer to sales as a campaign step, but have it point to a central lead transfer function. The logic here is the same as applies to lead scoring. A case could be made that transfer to sales should in fact be part of the lead scoring, but if nothing else you’d still want marketers to decide on for each campaign whether sending a lead to sales should also remove the lead from the current campaign. Once you have campaign-level decisions of that sort, the process should be a step in the campaign flow.

Friday, February 13, 2009

How Demand Generation Systems Handle Company Data: Diving into the Details

More than anything else, this exercise reinforced my understanding of how hard it is to answer a seemly simple question about a software product’s capabilities. My original approach in the Guide had simply been to ask vendors whether they had a separate company table in their system. In theory, this would imply that company data is stored once and applied to all the associated individuals, and that the demand generation system could aggregate data by company, use that data to calculate company-level lead scores, and change which company an individual is linked to. This turns out not to be the case. So I had to specifically ask about each of those capabilities, and even those questions don’t necessarily have simple answers.

This type of complexity is why I’ve always avoided simple summary grids that hide all the gory details. I’m perfectly aware – and people remind me quite often, should I forget – that most people find the details overwhelming and really just want a simple way to sekect a few systems to consider.

But it just doesn’t work that way. Yes, you can screen on non-functional criteria like cost, technical skills required, and vendor stability (not that those are exactly simple, either). But let’s say that leaves you with a dozen vendors, and you use some gross criteria to select the top three. If it turns out once you drill into details that two are missing some small-but-critical feature, you have to either go with the one remaining or start the process again with another set of candidates.

Starting again would be fine if you had the time, but let's face it: here in the real world you'll be under pressure to make a choice and will probably just choose whichever vendor remains standing. This isn’t necessarily so terrible, although your negotiating position will be weak and you might have missed another, better product.

But what if all three vendors fail on one detail or another? Now you’re really in trouble.

The only way to avoid these scenarios is to review the details up front. Thankfully, you don’t have to review all the details, but can limit yourself to the details that matter. Of course, this means you have to know what those details are, which in turn requires still more preliminary work. I was going to (and still may) write a separate post about this, but basically that means you have to lay out the details of the marketing programs you expect to execute with the system, and then identify the features needed to support those programs.

The good news here is you’ll need to lay out those programs anyway once you start using the system, so this is just a matter of time-shifting the work rather than adding it. Of course, doing more work now isn't easy, since you probably don't have a lot of free time. But knowing what you need will actually make the project go faster as well, so the payback will come fairly quickly.

So, the bottom line is that you really do need to look at product details early in the selection process. That said, I do think it’s possible to produce summaries that are linked to details, so people can more easily screen vendors against the summary criteria and then only look at the details of the most promising. I’m working on incorporating something along those lines into the Raab Guide.

Ok, now for the company-level data itself. Here are the questions I asked, with summaries of answers from the five vendors in the current Raab Guide (Eloqua, Manticore Technology, Market2Lead, Marketo, Vtrenz) plus two I’ll be adding shortly (Marketbright and Neolane.) As usual, even though I’ve looked at these products in detail, I’m ultimately reporting what the vendors told me. ("SFDC" stands for Salesforce.com.)

Question | Eloqua | Manticore | Market2 | Marketo | Vtrenz | Market | Neolane |

Is there a distinct company table linked in a one-to-many relationship with individual records? | yes, link set by Eloqua | no | yes, link set by SFDC | yes, link set by SFDC | no | yes, link set by SFDC | yes; typically use SFDC link but client could set own |

Are changes in company-level data copied to CRM company (account) records? | yes, if client chooses | no | no | not now; next release will allow client to choose | no | yes, if client chooses | yes, if client chooses |

Can the demand generation system establish or modify company-to-individual relationships, and have these changes apply to CRM records? | yes | no | no | not now; | no | no | yes, if client chooses |

Do demand generation reports give a consolidated company-wide view of activities (i.e., combined activities for all individuals associated with a company) | no; available in SFDC | no; available in SFDC | yes | no; available in SFDC | possible with special effort | yes for Web activities | yes |

Can demand generation lead scores be based on company-wide data (i.e., create a company-level score in addition to individual level scores)? | yes for attributes, no for behaviors | no | yes | yes | no | yes | yes |

If company-level scores are possible, can they be created within the normal score-building interface? | yes | n/a | yes | yes | n/a | yes | yes |

As you see, the answers even at this level of detail are more than simple yes or no. In the case of the first question, which is a restatement of the original question about whether a separate company table exists, “yes” answers must be extended to clarify whether the link between that table and the individual records is imported from Salesforce.com or can be set within the demand generation system. I explored this in most depth with Marketo, who clarified that any individual NOT linked to a company by Salesforce.com will be given its own company record (a one-to-one relationship), even if the database contains several individuals from the same organization. Users can edit that company data, but not the company data imported from Salesforce.

Market2Lead and Marketbright also use the company data and links imported from Salesforce.com. But while Market2Lead matches Marketo's policy of not changing company data in Salesforce.com, Marketbright lets clients determine what do to a field-by-field basis and actually have rules for different cases for the same field. (For example, you might want to let a demand generation user add data to a blank field, but not overwrite data where it exists.)

Just to add a bit more confusion: Marketo itself is changing its system to let clients decide during implementation whether to let users to override the Salesforce links and company data. Apparently some Marketo clients really wanted to do this, while others were firmly opposed.

The other especially knotty question is the one about company-level lead scores. All vendors with company tables can generate scores based on the data attributes in the company records. But I had also intended that question to include aggregate behavior of all individuals associated with a company – such as total emails opened or the date of the most recent Web site visit by anyone in the group.

Eloqua volunteered that they couldn’t do this, which I appreciated. The only other vendor I explored this with in detail was Marketo. They can in fact use behaviors in company scores, but only for individuals linked in Salesforce.com and only by using separate rules to assign points to individuals and to companies. That is, a Web download would have one rule to assign points to individual-level scores and another to assign points to the company score. This isn’t quite the same as building the company calculation by examining each individual independently . For example, Marketo's method can't limit the impact of a single hyperactive individual on the company score.

This is pretty picky stuff, but that’s exactly the point: people who really care about these things tend to be pretty picky about the details. They should make sure they understand them before they buy a product, rather than risk unpleasant surprises after the fact.

Thursday, February 12, 2009

Infusionsoft: Impressive Marketing Power for a Very Low Price

The point of the story, other than showing why economists are poor comedians, is that the market is not always perfectly efficient. I suppose no one needs reminding of that in today’s economic situation. But most of us still assume there is a reasonable relationship between price and value. This is why it’s hard to imagine that low-priced software can deliver similar performance to mainstream products.

Now we come to Infusionsoft, which offers marketing automation, CRM and ecommerce for as little as $199 per month. Like a free breakfast at Denny’s, that sounds too good to be true. But the company has been around since 2001 and has thousands of customers, so there must be something to it. At least it’s worth a closer look.

I took that look last week and came away impressed. The company’s marketing is tightly targeted at very small businesses (under 25 employees) but its marketing features are competitive with demand generation products aimed at much larger firms. Three of the five core demand generation functions are clearly there: outbound email, Web forms, and lead nurturing campaigns. Of the other two, lead scoring is primitive at best (I only saw an ability to apply segment tags, which I suppose is all you really need; the company says lead scoring is available “but we don’t advertise it because we haven’t made it easy enough within the software yet”). The fifith core function, integration with Salesforce.com, is not provided because Infusionsoft has its own sales automation capabilities. If you really wanted it, the system does provide an API that would let someone with the right skills set it up.

If advanced lead scoring or Salesforce.com integration are show stoppers for you, then read no further. If not, the marketing automation functions in Infusionsoft are worth considering. Although I mentioned only email campaigns before, users can in fact import lists and then execute email, fax and voice broadcast from within Infusionsoft, or extract lists for direct mail, call center or other external vendors. Simple telemarketing could also be handled within the system using its CRM features. The system includes an email builder with the usual features such as personalization and required “unsubscribe” links. Infusionsoft enforces double opt-in email procedures, monitors its clients results closely, and has a ‘three strikes” policy to educate and if necessary remove clients who violate the rules.

Users can create landing pages and forms within the system, although they must load the HTML onto their own Web sites since Infusionsoft doesn’t host them. This differs from other demand generation vendors, who nearly always host those pages themselves. The practical impact is nil, since the Infusionsoft forms do post data to the client's Infusionsoft-hosted marketing database. I suspect the difference reflects the small-company orientation of Infusionsoft: while marketing departments in larger companies want to be independent of their Web team, Infusionsoft clients probably don't have a Web team separate from marketing (if they have a Web team at all).

Users can also specify the activities that follow submission of a form or other customer interaction. This is where the real power of Infusionsoft shines through. The activities can include assigning the lead to a sequence of follow up messages, assigning it a tag for later segmentation, or sending it to a salesperson or affiliate, either directly or through a round robin distribution. Different answers on Web forms can be linked to different sequences, and users can add filters that determine whether these actions take place. Subsequent events can add leads to new sequences and remove them from existing ones, thereby adjusting to customer behavior.

The result is enough fine-grained control over lead treatment to satisfy all but the most demanding marketers. To me, this is the essence of a lead nurturing system and probably the critical feature of demand generation in general. After all, any email client can send an email and any Web system can put up a landing page. It’s the multi-step, behavior-dependent campaign logic that’s otherwise hard to come by.

That said, the campaign manager you’re getting here is not as polished as the best mainstream demand generation systems. To that extent, at least, you get what you pay for. There’s no flow chart to visualize campaign flows and no easy way to do split testing. Nor is there branching within a sequence, although you could achieve the same effect by having one sequence feed into several other sequences with different entry conditions.

(Side note: Infusionsoft has a public ideas forum for users to suggest and vote on enhancements. Split testing currently ranks number five, behind four refinements to the ecommerce features. This probably means that most users find the marketing features relatively adequate, at least compared with the ecommerce capabilities which definitely looked much less mature. The public forum itself certainly shows a healthy attitude by Infusionsoft towards its own customers. The company also has excellent online documentation and an active user forum for questions and answers.)

On the other hand, Infusionsoft actually does a better job than some demand generation systems of tracking marketing costs. Users can attach a fixed cost and per-response cost to each lead source, which can be an outbound marketing campaign or an inbound source such as Web ads, trade shows, or traditional advertising. Users can also attach a piece cost to each message in a sequence. Revenue for individual customers can be captured with the shopping cart or from opportunities in the CRM system.

This information is presented in a variety of standard reports, although, perplexingly, I couldn’t find one that related the cost of a campaign to the revenue from its respondents. Reports do track response rates, conversion rates, and movement of opportunities through stages in the sales funnel. Standard reports can be run against user-specified date ranges and sometimes against user-specified customer segments. Users can’t create their own reports within the system, but can export their data to analyze elsewhere.

User rights (i.e., which users can do what) are actually more fine-grained in Infusionsoft than in many demand generation systems. Infusionsoft needs the control because it will be used by people throughout the company than a typical marketing system. Infusionsoft also includes contact management and project workflow features, such as tracking tasks and appointments, that aren’t found in most demand generation products.

Infusionsoft pricing starts at $199 per month for a system limited to 10,000 leads and 25,000 emails per month. This version has pretty much all the features needed for demand generation. Going to $299 per month adds ecommerce, sales automation, affiliate management and the API. Even people who don’t need those features might pay the extra money just to move the volume limits to 100,000 leads and 100,000 emails and go from two to four users. $499 per month buys the same features but higher volumes and one more seat. Clients can also add seats for $59 for the base version or $79 per month for the higher two. Implementation costs range from $1,999 to $5,999 depending on the version. [Note: in July 2009, Infusionsoft dropped its implementation fees. Other prices were unchanged.]

Any way you slice it, Infusionsoft would be a tremendous value for a marketing department that could use it instead of a mainstream demand generation system. That’s not to say the choice is a slam-dunk: you may need some of the missing features, and there are other demand generation products that also underprice the mainstream vendors (see last week’s post). Still, if money is tight and your needs are limited, Infusionsoft is certainly an option to consider.

Wednesday, February 11, 2009

Tuesday, February 10, 2009

Blog Posts I'll Never Write (With Apologies to Borges)

In that same spirit, here are summaries of three blog posts I doubt I’ll ever have time to actually write.

1. The Future of Technology Analysts. This is a reaction to a blog post Do CRM Analysts Provide Value for Money? by veteran consultant Graham Hill. Basically he concludes that the ‘big-name’ analysts don’t tell him much that he he can’t pick up from his own experience or other sources like blogs, books and academic papers. He does feel that ‘niche’ analysts provide more value.

As a ‘niche’ analyst myself, I tend to agree. But the more important issue is the movement away from traditional analysts to a community or peer-to-peer model. Rather than listen to expensive experts, marketers want to hear from other marketers, whom I think they perceive as more practical and less self-interested. This implies a change in the business model of analysts and consultants, who must deliver concrete business solutions rather than simply offering knowledge that clients can’t get elsewhere.

This is probably a good thing in the long run, although it does raise the question of who will do original research when no one will pay the analysts for the results. (This is a special case of the larger issue raised by the Internet, where professional journalists are squeezed out by volunteers who work for free but may not do a thorough or accurate job.) People will need to evolve new mechanisms to judge the value of different information sources—a problem that is widely recognized but nowhere near being solved.

2. A Cookbook for Demand Generation. Probably the biggest obstacle to selling demand generation systems is that many marketers don’t know what to do with them. This reminds me of the little cookbooks that come with kitchen appliances, which give a few simple recipes that make use of the appliances’ capabilities. How about a little demand generation cookbook that would describe a dozen or so starter projects, each with a list of ingredients (emails, landing pages, etc.), step-by-step instructions for setting them up, and maybe a snapshot of the expected results? I guess we could call it “The Joy of Demand Gen.” The goal is to make this as non-intimidating as possible.

3. Taxonomy for Twitter Analytics. I think there is a hierarchy of analytical methods for Twitter and other social media. The simplest layer would be to count mentions of a company or product. The next would be to list the people who are making those mentions, ranked by frequency. Then you’d measure the influence of those people based on number of followers, links, reposts/retweets, etc. Next look at the content of the mentions: are they positive or negative? Finally, really understand the content, taking into account things like sarcasm and emoticons, and maybe convert this into some sort of long-term attitude measure (enthusiastic, skeptical, objective, etc.). Most or all of these measures are available to some degree, but I don’t think I’ve seen them all linked together in a single solution.

Wednesday, February 04, 2009

Low Cost Systems for Demand Generation

But what really concerns me is that these people are apparently limiting their consideration to just those two products. I do recognize that they are the best known vendors in the space (with apologies to Vtrenz, whose identity is somewhat blurred since its purchase by Silverpop). But there are plenty of other options, particularly for marketers with limited budgets. Marketo is certainly a fine product, but marketers should still look around before picking it by default. Here are some alternatives that will come in at or below Marketo’s published starting price of $2,400 per month (or $1,500 for their “Lite” version). (To be fair, many of the vendors below charge an installation of that can be several thousand dollars or more, while Marketo doesn't. But even including that, the first year cost for most of these will be less.) :

Manticore Technology: a full-featured demand generation product. See my 2007 blog entry for some information or buy the Raab Guide to Demand Generation Systems for a detailed review. (Just kidding...or am I?) Pricing on their Web site is quite close to Marketo’s: $1,000 a month for a limited edition and $2,400 per month for all the bells and whistles, and no extra charge for installation.

Pardot: another pretty powerful product; see my blog review from December 2008. But much better pricing at the low end $750 per month for the smallest complete system, and $1,250 per month for something that should be adequate for larger firms.

OfficeAutoPilot: this is the current incarnation of what used to be Moonray. I took a detailed look at a beta of the next release a couple of weeks ago and liked both the interface and breadth of functionality. I’m just waiting for the official release (due in for late February) to publish a detailed review. [Click here to read the review, published in April.] Pricing for a full-featured system was $597 per month—quite a bargain. Even cheaper options are available if you need fewer functions.

Treehouse Interactive: another company I spoke with recently, and another one I’m not writing about yet because they showed me some features that won’t be released for a while (early March). [Click read my March 18 review.] The company has a low profile but has been selling its demand generation product for nearly ten years. It offers a pretty complete set of features, with shortfalls in some areas balanced by strengths in others. More important to people who need it, the company offers partner management and channel sales management products that integrate with its demand generation offering. Pricing starts at $599 per month.

Infusionsoft: I spoke with them just yesterday, and there’s nothing preventing me from writing about them in detail except that I do like to sleep occasionally. Maybe next week. [I got to it on February 12. Read it here.] They aim to be a complete business operating system for very small companies (under 25 employees). So they offer not just demand generation but everything from contact management to e-commerce. However, marketing is their core function and they provide a decent set of features, although certainly not as polished as some other products I’ve mentioned. On the other hand, pricing starts at $199 per month for a 2 user system with pretty much all of their marketing features, and you’d be hard-pressed to spend more than $500 per month unless you want lots of users for non-marketing functions such as sales automation or order entry. Although you may not be familiar with them, the company is five years old and has more than 12,000 (yes, that's twelve thousand) clients.

Active Conversion: I had a chat with president Fred Yee last August although I didn’t publish a detailed review. [I did publish a real review in July 2009.] They focus on email nurturing campaigns and marketing measurement. The system didn’t do landing pages or forms when I spoke with Fred, although he tells me it does now. Pricing starts at $250 per month and averages around $500.

Act-On Software: a slightly different take, with strong Webinar support and an option to use its own low-cost sales automation system as an alternative to Salesforce.com Price starts at $499 per month. I reviewed it here in March.

Before I get any complaints from other vendors in the industry, let me stress that the systems I've listed above are ones that I know have low price points. My own consideration set also includes Marketbright, Market2Lead, MarketingGenius, LeadLife, LoopFuse, LeadGenesys, , eTrigue and SalesFusion360, although I haven't looked at all of those in detail.

Obviously you need to evaluate these products in depth before deciding which is right for you. There are free papers on the Raab Guide site that can help you organize this process and of course I do consult in this area for a living. But the point of today's post isn't that you should run a thorough selection project. It's simply that should recognize that you do have choices, and take advantage of them.

Monday, February 02, 2009

QlikView Is Champion In Aberdeen AXIS (But Is This Graph Necessary?)

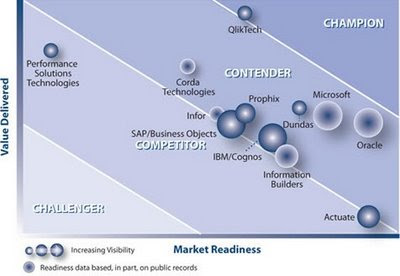

Here is the AXIS itself, with QlikView alone at the top:

And therein lies the problem. Fond as I am of QlikView, I can’t imagine any measure by which it would be a dominant business intelligence tool, let alone rank so far above its competitors. So I was more than a little perplexed to see the Aberdeen ranking, especially because I wasn’t aware that Aberdeen produced something similar to the Forrester “waves” and Gartner “magic quadrants”.

Indeed, it turns out that the AXIS program is brand new. The BI report is the second to be issued but will be followed by several per quarter. Aberdeen’s materials describe its reports as “unlike other comparative products that primarily focus on feature and functionality”, but to my eye it looks pretty similar. Apparently what makes it “the market’s first technology solution software provider assessment tool that is truly customer-centric” is that one of its two dimensions, “value delivered”, is based on Aberdeen’s surveys that identify best-in-class companies.

Exactly how this relates to the vendor rankings is unclear, although I could find out if I paid $895 for the report. Maybe a higher “value delivered” ranking means the product is used by more best-in-class companies, although I rather doubt it given QlikView's still-limited market penetration. More likely, the higher ranked products are viewed by users as delivering greater value, perhaps with some weighting towards the relative performance of the companies doing the ranking. I’ve no doubt that QlikView users are more enthusiastic than any other vendors’, both because it truly is a great product but also because it’s still in the relatively early adapter stage where users tend to be highly motivated and vocal. Perhaps Aberdeen looks at the features desired by best-in-class companies and compares those to the features delivered by the different products, although this too seems unlikely.

The second dimension of “market readiness” is described by Aberdeen as based on “evaluation of responses to a standardized vendor questionnaire, analyst briefings, public records and customer interviews.” This sure sounds like a conventional feature-and-function assessment to me.

As someone who has been evaluating software for many years, I fully appreciate the appeal of these sorts of matrices. Vendors love them because, if they’re ranked near the top, it gives them something to crow about. Buyers love them because they can save work by considering only the top-ranked alternatives (even though vendors piously warn this is inappropriate). The analyst firms love them because they get lots of publicity, both directly because the press loves a horse race and from the winning vendors who promote them.

I have always avoided producing such rankings, even when people ask for them, precisely because they make it too easy for buyers to avoid the essential work of assessing products against their own needs. Still, the commercial advantages of the rankings are so great that I may yet feel impelled to produce them. That being the case, I can’t really criticize Aberdeen for rolling out their own. But I do hope they make a serious effort at educating people on what the "AXIS" means and how it should and shouldn’t be used.