I released the 2012 edition of our B2B Marketing Automation Vendor Selection Tool (VEST) report today, an event that deserves more hoopla that I’ve given it. The VEST provides by far the most detailed, objective information available on industry vendors. It includes nearly 200 data points on 21 products, thumbnail sketches of each vendor’s strengths and weaknesses, and three industry quadrants showing leaders in different market segments. It’s also interactive: you can change the weights assigned to different items and watch the vendors zoom around the quadrant as a result. For those of us who don’t get out much, that’s downright exciting.

Although the VEST is primarily intended to help people who are buying a marketing automation system, its database also provides a statistical portrait of the industry. After rooting around in the numbers like pig hunting truffles, here’s what I dug up:

Core marketing automation is growing fastest. We classify industry vendors into four groups:

- micro business vendors (Infusionsoft and OfficeAutoPilot)

- HubSpot (a category of its own because it’s not quite standard marketing automation and is big enough to treat separately)

- enterprise vendors (Neolane, Aprimo, Silverpop, and Oracle)

- core B2B marketing automation (everybody else: Eloqua, Marketo, Pardot, Genius, Act-On, et, al.)

The enterprise vendors don’t release meaningful installation counts – some refuse to provide any data and others don’t distinguish B2B from B2C clients. So we’ll exclude them from further analysis. The table below shows growth for the remaining groups:

As you see, core vendors grew almost twice as fast as the micro-business group and considerably faster than HubSpot. There was some speculation last year that the micro-business vendors were growing the fastest. Myth busted.

Revenue grew faster than installation counts. The previous table shows that combined growth across all categories is 46%. But that doesn’t mean much because the selling prices are so different. Adjusting for revenue per client, I estimate that industry revenue grew about 55% last year. I could show you my calculations, but then I'd have to...well, you know.

New leaders can still emerge, but venture funding is required. A year ago, the three largest core vendors were Eloqua, Marketo, and Genius, and Act-On was an also-ran. Today, the Marketo has more clients than Eloqua (although not more revenue), Pardot has replaced Genius in the third position, and Act-On is coming up fast.

It's no mystery why the market remains fluid: venture capital lets new entrants shoulder their way to the top. Of the five top-ranked core vendors, all but Pardot has substantial venture funding. None of the remaining ten core vendors do – and their average growth is much slower. Self-funded firms can survive but it’s unlikely they will become leaders.

Specialization is increasing. We ask vendors for client counts in four segments: micro-business (under $5 million revenue); small business ($5 to $20 million revenue), mid-size business ($20-$500 million revenue) and big business ($500 million and higher). Most gave us answers, although Act-On was a prominent hold-out.

It’s no surprise that the micro vendors sell almost exclusively to micro clients. HubSpot’s base is much more diverse, although the micro and small sectors still account for 75% of its base. Of the core vendors, Marketo and Genius are the most small business oriented, with the two smallest categories accounting for over half of their customers. Pardot is tightly focused on small and mid-size clients, reflecting their disciplined sales approach. Eloqua has by far the most big-business clients of any core vendor, a proportion that has grown dramatically since the first VEST report one year ago.

For more information on the new VEST report, visit www.raabguide.com/vest.

Showing posts with label marketing software evaluation. Show all posts

Showing posts with label marketing software evaluation. Show all posts

Wednesday, February 01, 2012

Tuesday, December 06, 2011

Assess Marketing Automation Vendor Services Before You Buy - Another New Workbook

I wrote yesterday about our new workbook for marketing automation cost estimates. Today I’ll describe the other one: evaluating vendor services. Both are available free at the Raab Guide Web site.

The problem with services is simple: you won’t use them until you’ve already bought the product. So the trick to evaluating them is to ask lots of questions in advance to understand whether they’ll meet your needs.

Of course, there are two parts to that mission: building a clear picture and knowing what you need. In terms of what you need, vendors offer three types of services:

Different companies have different needs in each area. Buyers must understand those needs to know what they want a vendor to provide. I've written extensively about needs analysis in other posts and workbooks, so I won’t repeat those discussions here.

Similarly, the new workbook assumes you know what you’re looking for. It focuses on how to get it by providing suggestions for who to talk to, what to ask them, and how to interpret their answers. Each service types involves talking to different people:

for deployment, talk to:

for support, talk to :

The workbook offers dozens specific questions in each of those areas. I suppose you could just send each company the list and get back written answers, but you’ll get much more value from telephone and personal interviews. These let you listen to the replies and ask follow-up questions to drill into topics of interest. You probably won't need to ask every question to every person; the first few answers will often be enough to give a good idea of how the company does things in each area.

The problem with services is simple: you won’t use them until you’ve already bought the product. So the trick to evaluating them is to ask lots of questions in advance to understand whether they’ll meet your needs.

Of course, there are two parts to that mission: building a clear picture and knowing what you need. In terms of what you need, vendors offer three types of services:

- deployment: help with setting up your system

- support: help in operating your system after it’s deployed

- account service: help in growing your business.

Different companies have different needs in each area. Buyers must understand those needs to know what they want a vendor to provide. I've written extensively about needs analysis in other posts and workbooks, so I won’t repeat those discussions here.

Similarly, the new workbook assumes you know what you’re looking for. It focuses on how to get it by providing suggestions for who to talk to, what to ask them, and how to interpret their answers. Each service types involves talking to different people:

for deployment, talk to:

- deployment staff to understand their skill level, typical projects, and project management methods

- sales staff to understand deployment services and pricing

- references to understand the types of services provided and the quality of work

for support, talk to :

- head of support to understand services, staff qualifications, training, and reward systems

- front-line support staff to understand the kinds of problems they handle, internal systems that help manage their work, and how they’re motivated

- sales staff to understand support services and pricing

- references to understand service levels and satisfaction

- head of account services to understand staff qualifications, measurement methods, and whether they have “success managers” separate from “account managers”

- account manager to understand their skills, training, workload, and objectives

- head of training to understand the kinds of training available, who delivers it, and if they understand how customers use the system

- head of professional services to understand the quality and scope of services

- head of partner relations to understand the types of partners and the company's investment in building a partner ecosystem

- sales staff to understand the types of account services and pricing

- references to understand the scope and quality of account services

The workbook offers dozens specific questions in each of those areas. I suppose you could just send each company the list and get back written answers, but you’ll get much more value from telephone and personal interviews. These let you listen to the replies and ask follow-up questions to drill into topics of interest. You probably won't need to ask every question to every person; the first few answers will often be enough to give a good idea of how the company does things in each area.

Monday, December 05, 2011

New Workbook: Estimating the Cost of Marketing Automation

We released two more vendor selection workbooks last week, both sponsored by Eloqua and available for free on the RaabGuide Web site. One is about estimating the cost of a marketing automation system and the other is about evaluating vendor services.

The cost workbook was a particular challenge because the subject is so complex. After much thought, I came up with four cost categories:

Analyzing all four items in depth is a big job. The good news is you don’t usually need to assess them all at once.

It's useful to understand these cost categories, but the real work is gathering the details for each component. This is where the workbook comes in: it lists of specific items to consider, so you have a framework to help ensure your analysis is complete. This is important: to take a real-world example, one of my consulting clients recently received quotes from two marketing automation vendors, one of which included email delivery and one of which did not. Recognizing the difference made it easy to prepare a true apples-to-apples comparison, but we could have easily missed it until later the process if we had not used a formal framework.

The cost workbook was a particular challenge because the subject is so complex. After much thought, I came up with four cost categories:

- direct system costs: the actual price paid for the marketing automation software itself. This is where most buyers focus their analysis, but it’s a tiny fraction of the value at play. Background research for the workbook suggested that automation costs are from 1% to 5% of an average marketing budget. This means that the direct system cost is pretty much insignificant compared with the marketing budget it will help to manage. To put it another way: even a small improvement in the other 95% to 99% of marketing costs can easily pay for a marketing automation system.

- operations costs: other costs related to running the marketing automation system, such as staff time and costs of related systems. Most of these are marketing operations costs, and there may be others in sales and IT. You’re already incurring many of them, so the analysis has to identify how much they’ll increase or decrease as a result of marketing automation. This is really hard since it takes a detailed understanding of your current processes and how they'll change. But the stakes are high: operations costs are about 25% of a typical marketing budget.

- marketing program costs: the expenses for specific marketing programs, such as advertising, trade shows, email, etc. These are the other 75% of the typical marketing budget. Marketing automation can reduce these costs substantially, both through reduced waste and through shifting funds to more effective programs.

- revenue: many marketers shy away from building revenue gains into their marketing automation calculation, but revenue is ultimately the reason for their investment. From an analytical perspective, it’s important not to double-count revenue gains (assuming the same marketing budget) and cost savings (from a lower marketing budget). It's also important to recognize that revenue isn’t 100% profit. The workbook describes how to do this. To keep things in perspective: marketing costs are under 10% of revenue at most firms, meaning that direct marketing automation are under 0.5% of revenue.

Analyzing all four items in depth is a big job. The good news is you don’t usually need to assess them all at once.

- building a business case for marketing automation needs only a rough estimate for direct system costs, since they’re so small compared with the revenue, marketing program costs, and operations.

- comparing marketing automation systems lets you focus on the system costs and changes in marketing operations costs, since those may vary considerably from one product to another. The impact on program costs and revenues should be about the same unless you're considering systems with widely different capabilities. But hopefully you identified your needs earlier in the process, so you'll only be comparing similar systems once you reach the final evaluation..

It's useful to understand these cost categories, but the real work is gathering the details for each component. This is where the workbook comes in: it lists of specific items to consider, so you have a framework to help ensure your analysis is complete. This is important: to take a real-world example, one of my consulting clients recently received quotes from two marketing automation vendors, one of which included email delivery and one of which did not. Recognizing the difference made it easy to prepare a true apples-to-apples comparison, but we could have easily missed it until later the process if we had not used a formal framework.

Thursday, February 03, 2011

B2B Marfketing Automation Vendor Selection Tool: What’s Inside and Why

Summary: Our new B2B Marketing Automation Vendor Selection Tool (VEST) has been carefully crafted to help marketers at every step of the selection process. I think it’s worth walking through the main components to explain why they’re there.

Here's a screen-by-screen look at the components of the VEST. For more information or to order, please click here.

Explanations

What It Is: This is basic information for people who are just starting to explore marketing automation. It includes a general introduction suggesting how to use the VEST and then provides explanations of what marketing automation means and why it’s important, an overview of the state of the industry, advice on running a selection project, and details on the vendor scoring.

What It Is: This is basic information for people who are just starting to explore marketing automation. It includes a general introduction suggesting how to use the VEST and then provides explanations of what marketing automation means and why it’s important, an overview of the state of the industry, advice on running a selection project, and details on the vendor scoring.

Why It’s There: Many buyers are new to marketing automation. They need a coherent explanation of what it is, why it matters, how it fits into the larger scheme of marketing technology, and how to go about selecting a tool. I think the industry veterans will also find these materials interesting, but they’re really aimed at bringing the newbies up to speed.

Sector Charts

What It Is: This is the vendor landscape chart that users love and analysts are apparently obligated to produce. It uses our vendor scores to plot the relative positions of products in terms of how well they fit buyer needs. This lets us place “leaders” in the upper right quadrant. There are four versions: one each based on weights for small, mid-size and large businesses, plus a custom chart with the user’s own weights. Sliders make it easy adjust the weights assigned to broad categories within product and vendor fit.

Why It’s There: The chart makes it easy for each user to identify the most likely candidates, quickly reducing the consideration set to something manageable. More important, having alternative sets of weights, allowing custom weights, and making easy to adjust category weights all encourage buyers to recognize that there’s no "one true leader" and therefore to think about what weights are really relevant to their own needs.

Vendor Profiles

What It Is: This gives concise descriptions of the strengths, weaknesses, market position, and most suitable clients for each vendor. These are accompanied by charts displaying key factoids, such as the number of clients, number of employees and year founded; the position of the vendor in each of the three sector charts; and the relative strength of specific categories within the product and vendor fit scores.

Why It’s There: Now that buyers have tentatively identified their best candidates, they can look here to get a better sense of the products. The descriptions are based on Raab Associates’ detailed product research, and thus highlight information not captured in the numeric scores. For the first time in the VEST, this section introduces the category details within the score totals. This provides the next level of detail and lets buyers to see how vendor strengths actually line up with their priorities.

Item Detail

What It Is: This shows the nearly 200 specific items used in scoring the vendors. It provides the detailed definitions used in rating each item for each vendor (typically on a scale of 0 to 2) and shows the weights assigned to each item in the small, mid-size and large scoring schemes. It also gives users another opportunity to view and adjust the category weights.

Why It’s There: This introduces the actual items used in the scoring, encouraging them to look even deeper below the surface. The definitions include explanations of when and why each item matters, helping to further the users’ understanding of important-but-subtle product differences. Showing the variation of weights for the same item in the different scoring schemes implicitly encourages users to consider what weight makes the most sense for them.

Compare Vendors

What It Is: This lets users select any three vendors and compare them side-by-side. Screens start with a summary view that shows the product and vendor fit totals and the sum of both raw and weighted values for the categories. Users can then drill into each category to see the item-level ratings and weighted scores for all three vendors.

Why It’s There: This lets users drill into the vendor details at the finest possible level, seeing exactly what is driving the category scores and exactly how the vendors differ. Showing the sum of the raw values along with the weighted values graphically illustrates the impact of the category weights on the summary scores, encouraging users to ensure that the category weights reflect their own priorities. By this point in the process, users should understand which items they care about most.

Custom Weights

What It Is: This lets users set the item and category weights they’ll use in their custom scoring. They can apply the standard small, mid-size or large weights as a starting point. They can also save their weights as a scenario to use in another session. They can save any number of those scenarios.

Why It’s There: This lets users create their own custom scores, based by now on a deep understanding of their own needs and the information embedded within the VEST. Custom scoring won’t make the selection decision for anyone, but it will facilitate comparisons between vendors and highlight key items to research in detail.

Here's a screen-by-screen look at the components of the VEST. For more information or to order, please click here.

Explanations

What It Is: This is basic information for people who are just starting to explore marketing automation. It includes a general introduction suggesting how to use the VEST and then provides explanations of what marketing automation means and why it’s important, an overview of the state of the industry, advice on running a selection project, and details on the vendor scoring.

What It Is: This is basic information for people who are just starting to explore marketing automation. It includes a general introduction suggesting how to use the VEST and then provides explanations of what marketing automation means and why it’s important, an overview of the state of the industry, advice on running a selection project, and details on the vendor scoring.Why It’s There: Many buyers are new to marketing automation. They need a coherent explanation of what it is, why it matters, how it fits into the larger scheme of marketing technology, and how to go about selecting a tool. I think the industry veterans will also find these materials interesting, but they’re really aimed at bringing the newbies up to speed.

Sector Charts

What It Is: This is the vendor landscape chart that users love and analysts are apparently obligated to produce. It uses our vendor scores to plot the relative positions of products in terms of how well they fit buyer needs. This lets us place “leaders” in the upper right quadrant. There are four versions: one each based on weights for small, mid-size and large businesses, plus a custom chart with the user’s own weights. Sliders make it easy adjust the weights assigned to broad categories within product and vendor fit.

Why It’s There: The chart makes it easy for each user to identify the most likely candidates, quickly reducing the consideration set to something manageable. More important, having alternative sets of weights, allowing custom weights, and making easy to adjust category weights all encourage buyers to recognize that there’s no "one true leader" and therefore to think about what weights are really relevant to their own needs.

Vendor Profiles

What It Is: This gives concise descriptions of the strengths, weaknesses, market position, and most suitable clients for each vendor. These are accompanied by charts displaying key factoids, such as the number of clients, number of employees and year founded; the position of the vendor in each of the three sector charts; and the relative strength of specific categories within the product and vendor fit scores.

Why It’s There: Now that buyers have tentatively identified their best candidates, they can look here to get a better sense of the products. The descriptions are based on Raab Associates’ detailed product research, and thus highlight information not captured in the numeric scores. For the first time in the VEST, this section introduces the category details within the score totals. This provides the next level of detail and lets buyers to see how vendor strengths actually line up with their priorities.

Item Detail

What It Is: This shows the nearly 200 specific items used in scoring the vendors. It provides the detailed definitions used in rating each item for each vendor (typically on a scale of 0 to 2) and shows the weights assigned to each item in the small, mid-size and large scoring schemes. It also gives users another opportunity to view and adjust the category weights.

Why It’s There: This introduces the actual items used in the scoring, encouraging them to look even deeper below the surface. The definitions include explanations of when and why each item matters, helping to further the users’ understanding of important-but-subtle product differences. Showing the variation of weights for the same item in the different scoring schemes implicitly encourages users to consider what weight makes the most sense for them.

Compare Vendors

What It Is: This lets users select any three vendors and compare them side-by-side. Screens start with a summary view that shows the product and vendor fit totals and the sum of both raw and weighted values for the categories. Users can then drill into each category to see the item-level ratings and weighted scores for all three vendors.

Why It’s There: This lets users drill into the vendor details at the finest possible level, seeing exactly what is driving the category scores and exactly how the vendors differ. Showing the sum of the raw values along with the weighted values graphically illustrates the impact of the category weights on the summary scores, encouraging users to ensure that the category weights reflect their own priorities. By this point in the process, users should understand which items they care about most.

Custom Weights

What It Is: This lets users set the item and category weights they’ll use in their custom scoring. They can apply the standard small, mid-size or large weights as a starting point. They can also save their weights as a scenario to use in another session. They can save any number of those scenarios.

Why It’s There: This lets users create their own custom scores, based by now on a deep understanding of their own needs and the information embedded within the VEST. Custom scoring won’t make the selection decision for anyone, but it will facilitate comparisons between vendors and highlight key items to research in detail.

Thursday, January 20, 2011

B2B Marketing Automation Vendor Comparisons: New Report Next Week and The Coolest Sample Yet

I suspect you may be getting tired of reading about the features in my new report comparing B2B marketing automation vendors, and want some actual information. Soon, I promise: the final data is all ready and only some light editing stands between you and a completed report. Well, that and the fact that the e-commerce features of the www.raabguide.com Website need some work. Either way, the report will come out next week -- even if I have to take credit card orders by phone.

But I finished the final interactive component of the report yesterday and I think it's exciting enough to be worth sharing. It lets you do what I think most buyers really want, which is to compare selected vendors side by side on their specific features. You can also compare their scores, which, since you can change the weights applied to different inputs, means you can get your very own, custom comparative ranking. If that's not fun, what is?

But there's more: you get to see the results in colorful graphs. Here's a screenshot:

You can also download an interactive sample. (This is scrambled data and vendor names are replaced by sports teams. Beware that the document uses Adobe Flash; Mac users in particular may need to use Adobe Reader rather than their usual viewer. And, alas, it won't work on your iPad.)

As you can see, the screen lets you pick up three vendors, a weight set (small, mid-size or large), and the type of data to view: a summary or the individual items within each category. For each item, you see the actual input values (2, 1 or 0 depending on whether the vendor complies fully, partly, or not at all) and the scores calculated once the weights are applied. You can change the category weights (by adjusting the figures in the little gray boxes at the right) and watch the scores themselves change as the individual weights are adjusted proportionately. The graphs also adjust immediately as you make changes.

My purpose in all this is to help buyers look beneath the scores themselves to understand where the scores came from. This lets them judge whether they really care about the factors that are driving the relative rankings. Similarly, making it easy to change the weights raises the question of which weights really are appropriate. Thinking about this should lead buyers to a better decision.

The screenshot above illustrates the importance of the weights. Look at Technology: there are pretty big differences between the different "vendors", but the category as a whole has such a low weight that these make little difference in the final rankings. This reflects a judgment on my part that small business buyers don't really care much about technology and that their technology needs are pretty simple.

If you squint hard enough, you'll also notice that the middle vendor has the highest total input value for Technology, but the lowest weighted score. That's pretty common because the weights do vary substantially from one item to the next. In this instance, the main reason is that small business scores apply negative weights to many advanced features, on the theory that they detract from value by adding complexity. You'll recall that I wrote about that in an earlier post.

The downloadable sample only has descriptions under all the other tabs, but everything else is actually ready. I'll make a formal announcement next week about price and availability of the new report.

But I finished the final interactive component of the report yesterday and I think it's exciting enough to be worth sharing. It lets you do what I think most buyers really want, which is to compare selected vendors side by side on their specific features. You can also compare their scores, which, since you can change the weights applied to different inputs, means you can get your very own, custom comparative ranking. If that's not fun, what is?

But there's more: you get to see the results in colorful graphs. Here's a screenshot:

You can also download an interactive sample. (This is scrambled data and vendor names are replaced by sports teams. Beware that the document uses Adobe Flash; Mac users in particular may need to use Adobe Reader rather than their usual viewer. And, alas, it won't work on your iPad.)

As you can see, the screen lets you pick up three vendors, a weight set (small, mid-size or large), and the type of data to view: a summary or the individual items within each category. For each item, you see the actual input values (2, 1 or 0 depending on whether the vendor complies fully, partly, or not at all) and the scores calculated once the weights are applied. You can change the category weights (by adjusting the figures in the little gray boxes at the right) and watch the scores themselves change as the individual weights are adjusted proportionately. The graphs also adjust immediately as you make changes.

My purpose in all this is to help buyers look beneath the scores themselves to understand where the scores came from. This lets them judge whether they really care about the factors that are driving the relative rankings. Similarly, making it easy to change the weights raises the question of which weights really are appropriate. Thinking about this should lead buyers to a better decision.

The screenshot above illustrates the importance of the weights. Look at Technology: there are pretty big differences between the different "vendors", but the category as a whole has such a low weight that these make little difference in the final rankings. This reflects a judgment on my part that small business buyers don't really care much about technology and that their technology needs are pretty simple.

If you squint hard enough, you'll also notice that the middle vendor has the highest total input value for Technology, but the lowest weighted score. That's pretty common because the weights do vary substantially from one item to the next. In this instance, the main reason is that small business scores apply negative weights to many advanced features, on the theory that they detract from value by adding complexity. You'll recall that I wrote about that in an earlier post.

The downloadable sample only has descriptions under all the other tabs, but everything else is actually ready. I'll make a formal announcement next week about price and availability of the new report.

Wednesday, June 16, 2010

Checklists for Selecting a Marketing Automation System

Summary: here are some checklists to help select a marketing automation system. For more details, attend my Focus Webinar on June 29.

On June 29, I'll be giving a Webinar on “Matching a Marketing Automation System to Your Needs”, part of a day-long set of all-star lead management presentations organized by the Focus online business community. (Click here to register; it’s free.) Here's a bit of a preview.

My message boils down to two words: "use case". That is, prepare detailed use cases for the tasks you need and then have each potential vendor demonstrate how their system would execute them. The point is to focus on your actual requirements and not a generic list of capabilities or vendor rankings.

Another way to put it is: eat your vegetables. Don’t try to avoid the hard work of figuring out what you need the system to do. You’ll have to do that anyway, during implementation. But if you wait until then, you may find out too late that you selected the wrong system.

Even buyers who assess their needs may need some help figuring out what features those needs imply. Here are five tables extracted from the Webinar with some useful details.

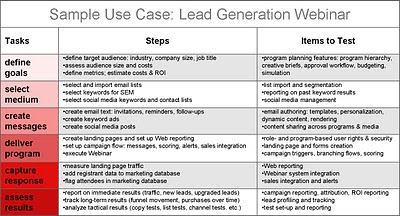

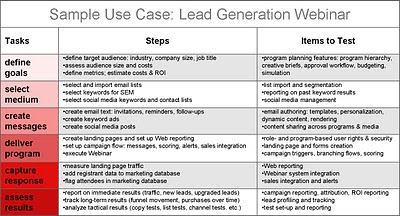

The first table shows a sample use case for a Webinar program. (Click on the image to enlarge it.) It illustrates the need for the use case to be specific, both in terms of describing a specific marketing program and of describing the steps to execute the program. Most marketers could put together the first two columns, Tasks and Steps, from their own knowledge. The remaining column, Items to Test, lists system features that may be unfamiliar to marketers who have not previously worked with a marketing automation system. You may need some help (say, from consultants like Raab Associates Inc.) with adding this column to your own use cases.

The second table looks at functions for different types of marketing programs. The premise is that you need different marketing programs for each step in the customer life cycle, starting with awareness generation and ending with retention. Ideally you’ll have programs in each category, but in practice some categories are more important than others. To help focus your selection process on those high-priority categories, the table describes when each category is likely to be important. It then lists the key system function for each category and the specific features related to those functions.

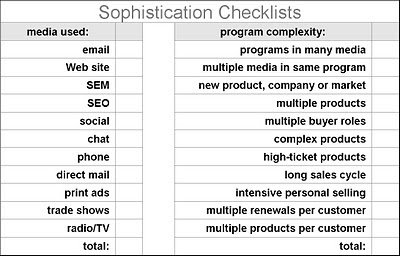

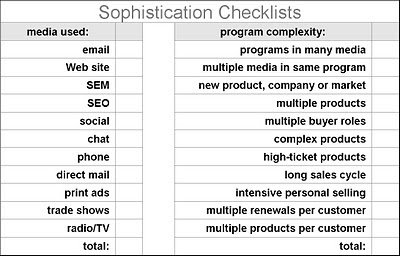

The third table helps to assess the complexity of your needs. The first column describes the media you'll use and the second lists business characteristics contributing to program complexity. Required media can be directly compared with the media supported by potential vendors. Program complexity is a little trickier, but I’d consider your needs complex if more than three or four of the factors are present.

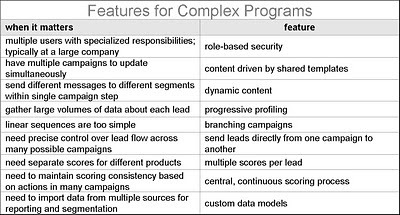

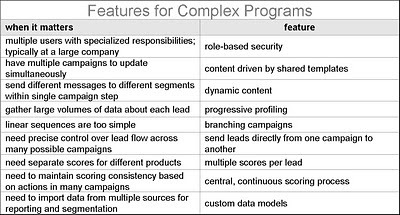

The fourth table is aimed at companies with complex programs. It lists specific requirements you may have and the features needed to meet them. Marketers who don’t need these features may be able to save some time and money by purchasing a system that doesn’t have them built in. On the other hand, some (but not all!) systems do a good job of hiding their advanced features when they’re not being used. So don't automatically rule out an advanced system without looking at it more closely. And bear in mind that you may need the more advanced features in the future.

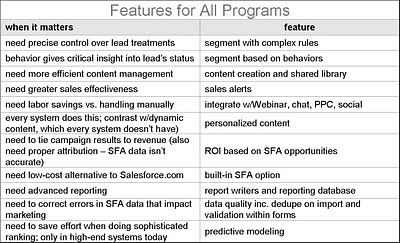

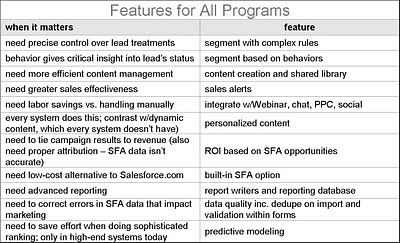

The fifth table applies to all companies regardless of complexity. It lists features that are present in nearly all systems, but vary widely in their details. For each one, you’ll have to think carefully about your specific needs and see how well each vendor can handle them.

These tables don't list all the features you might need in a marketing automation system. Nor do they address other important considerations such as ease of use, support, partners and stability. I'll talk about all those in the Webinar, so be sure to tune in.

On June 29, I'll be giving a Webinar on “Matching a Marketing Automation System to Your Needs”, part of a day-long set of all-star lead management presentations organized by the Focus online business community. (Click here to register; it’s free.) Here's a bit of a preview.

My message boils down to two words: "use case". That is, prepare detailed use cases for the tasks you need and then have each potential vendor demonstrate how their system would execute them. The point is to focus on your actual requirements and not a generic list of capabilities or vendor rankings.

Another way to put it is: eat your vegetables. Don’t try to avoid the hard work of figuring out what you need the system to do. You’ll have to do that anyway, during implementation. But if you wait until then, you may find out too late that you selected the wrong system.

Even buyers who assess their needs may need some help figuring out what features those needs imply. Here are five tables extracted from the Webinar with some useful details.

The first table shows a sample use case for a Webinar program. (Click on the image to enlarge it.) It illustrates the need for the use case to be specific, both in terms of describing a specific marketing program and of describing the steps to execute the program. Most marketers could put together the first two columns, Tasks and Steps, from their own knowledge. The remaining column, Items to Test, lists system features that may be unfamiliar to marketers who have not previously worked with a marketing automation system. You may need some help (say, from consultants like Raab Associates Inc.) with adding this column to your own use cases.

The second table looks at functions for different types of marketing programs. The premise is that you need different marketing programs for each step in the customer life cycle, starting with awareness generation and ending with retention. Ideally you’ll have programs in each category, but in practice some categories are more important than others. To help focus your selection process on those high-priority categories, the table describes when each category is likely to be important. It then lists the key system function for each category and the specific features related to those functions.

The third table helps to assess the complexity of your needs. The first column describes the media you'll use and the second lists business characteristics contributing to program complexity. Required media can be directly compared with the media supported by potential vendors. Program complexity is a little trickier, but I’d consider your needs complex if more than three or four of the factors are present.

The fourth table is aimed at companies with complex programs. It lists specific requirements you may have and the features needed to meet them. Marketers who don’t need these features may be able to save some time and money by purchasing a system that doesn’t have them built in. On the other hand, some (but not all!) systems do a good job of hiding their advanced features when they’re not being used. So don't automatically rule out an advanced system without looking at it more closely. And bear in mind that you may need the more advanced features in the future.

The fifth table applies to all companies regardless of complexity. It lists features that are present in nearly all systems, but vary widely in their details. For each one, you’ll have to think carefully about your specific needs and see how well each vendor can handle them.

These tables don't list all the features you might need in a marketing automation system. Nor do they address other important considerations such as ease of use, support, partners and stability. I'll talk about all those in the Webinar, so be sure to tune in.

Subscribe to:

Posts (Atom)