When I first described Customer Data Platforms two and half years ago, all the vendors offered an application such as predictive analytics or campaign management in addition to the "pure" CDP function of building the customer database. Since then, some "pure" CDPs have emerged, notably among vendors with roots in Web page tag management – Tealium, Signal, and Ensighten (which just raised $53 million). Other data collection specialists include Segment.com, Aginity, Umbel, Lytics, NGData, and Woopra, although some of these do supplement database building with predictive model scores, segmentation, and/or event-based triggers.

Openprise falls roughly into this second category. It’s primarily used to set up data processing flows for data cleaning, matching, and lead routing. But it can also apply segment tags and send out alerts when specified conditions are met. What it doesn’t do is maintain a permanent customer database accessible to other systems for campaigns and execution. This means Openprise doesn’t meet the technical definition of a CDP. But Openprise could post data to such a database. And since the essence of the CDP concept is letting marketers build the customer database for themselves, Openprise arguably provides the most important part of a CDP solution.

Current clients use Openprise in more modest ways, however. Most are marketing and sales operations staff supporting Salesforce.com and Marketo who use Openprise to supplement the limited data management capabilities native to those systems. Openprise also integrates today with Google Apps and the Amazon Redshift database. Integrations with Oracle Eloqua, HubSpot and Salesforce Pardot are planned by end of this year. The Marketo integration reads only the lead object, although the activities object is being added. The Salesforce integration reads leads, contacts, opportunities, campaigns and accounts and will add custom objects.

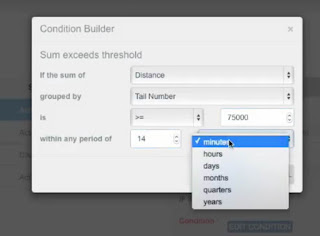

Openprise works by connecting data sources, which are typically lists but sometimes API feeds, to “pipelines” that contain a sequence of if/then rules. Each rule checks whether a record meets a set of conditions (the “if”) and executes specified actions on those that qualify (the “then”). The interface lets users set up the flows, rules, and actions without writing programming code or scripts, usually by completing templates made up of forms with drop-down lists of possible answers. For example, a complex condition such as “sum exceeds threshold” would have form with blanks where the user specifies the variable to sum, variable to group by, the comparison operator, threshold value, and time period. This still takes some highly structured thinking – it’s far from writing an English language sentence – but is well within the capabilities of anyone likely to be in charge of operating a marketing automation or CRM system.

Of course, the value of such a system depends on the actual actions it makes available. The two basic actions in Openprise are sending alerts and setting attribute values. Alerts can be based on complex rules and delivered via email or text message. Attribute values can be used to set segment tags, assign lead owners for routing, and cleanse data. Cleansing features include normalization to apply rules, standardize formats, and match against reference tables. The system can also fill in missing values based on relationships such as inferring city and state from Zip code. Matching can apply fuzzy methods, use rules to handle near-matches, and set priorities when several possible matches are available. Parsing can scan a text block for keywords and extract them.

Openprise already has special features to standardize job titles and roles and is working on company name clean up. It plans to add connectors for Dun and Bradsteet, Zoominfo and Data.com to verify and enhance customer information.

Updated records can be returned to the original source or sent to a different destination. The Amazon Redshift connector means Openprise could feed a data warehouse or CDP available to other analytic and execution systems. Users can assign access rights to different data sets and to different elements within a set. They can then have the system send file extracts of the appropriate data to different recipients, a feature often used to share data with channel partners. Most pipelines execute as batch processes, either on demand or on a user-specified schedule. Some can run in real time through API calls.

The system also provides some data analysis capabilities, including time series, ranking, pie charts, word frequency, calendars, time of day, and trend reports. These are used mostly to help assess data quality and to profile new inputs.

Openprise says new customers usually get about two hours of training, during which they map a couple of data sources and build a sample pipeline. The vendor also provides training videos and “cookbooks” that show how to set up common processes such as lead cleansing and merging two lists.

Pricing of Openprise is based on data volume processed, not number of records. Users can run 50 MB per month without charge. Running 100 MB per month costs $100 and running 1 GB per month costs $1,000. There also a free trial.

Openprise was released in late September and had accrued more than 30 users by mid-October. It is available on Marketo LaunchPoint and will eventually be added to Salesforce AppExchange.

Thursday, October 29, 2015

Friday, October 23, 2015

Why Time Is the Real Barrier to Marketing Technology Adoption and What To Do About It

I split my time this week between two conferences, Sailthru LIFT and Marketing Profs B2B Forum. Both were well attended, well produced, and well worth while. My personal highlights were:

- Sailthru introducing its next round of predictive modeling and personalization features and working to help users adopt them. As you probably don’t know, Sailthru automatically creates several scores on each customer record for things such as likelihood to purchase in the next week and likelihood to opt out of email. The company is making those available to guide list selection and content personalization for both email and Web pages. One big focus at the conference was getting more clients to use them.

- Yours Truly presenting to the Sailthru attendees about building better data. The thrust was that marketers know they need better data but still don’t give it priority. I tried to get them so excited with use cases – a.k.a. “business porn” – that they’d decide it was more important than other projects. If they wanted it badly enough, the theory went, they’d find the time and budget for the necessary technology and training. I probably shouldn’t admit this, but I was so determined to keep their attention that I resorted to a bar chart built entirely of kittens. To download the deck, kittens and all, click here.

- Various experts at Marketing Profs talking (mostly over drinks) about the growth of Account Based Marketing. The consensus was that ABM is still in the early stages where people don’t agree on what’s included or how to evaluate results. Specific questions included whether ABM should deliver actual prospect names (at the risk of being measured solely on cost per lead); what measurements really do make sense (and whether marketers will pay for measurement separately from the ABM system); and how to extend ABM beyond display ad targeting. Or at least I think that’s what we discussed; the room was loud and drinks were free.

- Me (again) advising Marketing Profs attendees on avoiding common mistakes when selecting a marketing automation vendor. My message here, repeated so many times it may have been annoying, was that users MUST MUST MUST define specific requirements and explore vendor features in detail to pick the right system. One epiphany was finding that nearly everyone in the room already had a marketing automation product in place – something that would not have been true two or three years ago. These are knowledgeable buyers, which changes things completely. (Click here for those slides which had no kittens but do include a nice unicorn.)

You may have noticed a common theme in these moments: trying to help marketers do things that are clearly in their interest but they're somehow avoiding. Making fuller use of predictive models, building a complete customer view, focusing on target accounts, and using relevant system selection criteria are all things marketers know they should do. Yet nearly all industry discussion is focused on proving their value once again, or – usually the next step – in explaining how to do it.

What's the real obstacle? Surveys often show that budget, strategy, or technology are the barriers. (See ChiefMartec Scott Brinker's recent post for more on this topic.) But when you ask marketers face to face about the obstacles, the reason that comes up is consistently lack of time. (My theory on the difference is that people pressed for time don’t answer surveys.) And time, as I hinted above, is really a matter of priority: they are spending their time on other things that seem more important.

So the way to get marketers to do new things is to convince them they are worth the time. That is, you must convince them the new things are more important than their current priorities. Alternately, you can make the new thing so easy that it doesn’t need any time at all. The ABM vendors I discussed this with – all highly successful marketers – were doing both of these already, although they were polite enough not to roll their eye and say “duh” when I brought it up.

How do you convince marketers (or any other buyers) that something they already know is important is more important than whatever they’re doing now? I’d argue this isn’t likely to be a rational choice: MAYBE you can find some fabulously compelling proof of value, but the marketers will probably have seen those arguments already and not been convinced. More likely, you'll need to rely on emotion. This means getting marketers excited about doing something (that’s where the “business porn” comes in) or scared about the consequences of not doing it (see the CEB Challenger Sales model, for example). In short, it’s about appealing to basic instincts – what Seth Godin calls the lizard brain – which will ultimately dictate to the rational mind.

What about the other path I mentioned around the time barrier, showing that the new idea takes so little time that it doesn’t require giving up any current priorities? That’s a more rational argument, since you have to convince the buyer that it’s true. But everything new will take up at least some time and money, so there’s still some need to get the buyer excited enough to make the extra effort. This brings us back to the lizard.

I’m not saying all marketing should be emotional. Powerful as they are, emotions can only tip the balance if the rational choice is close. And I’m talking about the specific situation of getting people to adopt something new, which is quite different from, say, selling an existing solution against a similar competitor. But I spend a lot of time talking with vendors who are selling new types of solutions and talking with marketers who would benefit from those solutions. Both the vendors and I often forget that time, not budget, skills or value, is the real barrier to adoption and that emotions are the key to unlocking more time. So emotions must be a big part of our marketing if we, and the marketers we're trying to serve, are ultimately going to succeed.

- Sailthru introducing its next round of predictive modeling and personalization features and working to help users adopt them. As you probably don’t know, Sailthru automatically creates several scores on each customer record for things such as likelihood to purchase in the next week and likelihood to opt out of email. The company is making those available to guide list selection and content personalization for both email and Web pages. One big focus at the conference was getting more clients to use them.

- Yours Truly presenting to the Sailthru attendees about building better data. The thrust was that marketers know they need better data but still don’t give it priority. I tried to get them so excited with use cases – a.k.a. “business porn” – that they’d decide it was more important than other projects. If they wanted it badly enough, the theory went, they’d find the time and budget for the necessary technology and training. I probably shouldn’t admit this, but I was so determined to keep their attention that I resorted to a bar chart built entirely of kittens. To download the deck, kittens and all, click here.

- Various experts at Marketing Profs talking (mostly over drinks) about the growth of Account Based Marketing. The consensus was that ABM is still in the early stages where people don’t agree on what’s included or how to evaluate results. Specific questions included whether ABM should deliver actual prospect names (at the risk of being measured solely on cost per lead); what measurements really do make sense (and whether marketers will pay for measurement separately from the ABM system); and how to extend ABM beyond display ad targeting. Or at least I think that’s what we discussed; the room was loud and drinks were free.

- Me (again) advising Marketing Profs attendees on avoiding common mistakes when selecting a marketing automation vendor. My message here, repeated so many times it may have been annoying, was that users MUST MUST MUST define specific requirements and explore vendor features in detail to pick the right system. One epiphany was finding that nearly everyone in the room already had a marketing automation product in place – something that would not have been true two or three years ago. These are knowledgeable buyers, which changes things completely. (Click here for those slides which had no kittens but do include a nice unicorn.)

You may have noticed a common theme in these moments: trying to help marketers do things that are clearly in their interest but they're somehow avoiding. Making fuller use of predictive models, building a complete customer view, focusing on target accounts, and using relevant system selection criteria are all things marketers know they should do. Yet nearly all industry discussion is focused on proving their value once again, or – usually the next step – in explaining how to do it.

What's the real obstacle? Surveys often show that budget, strategy, or technology are the barriers. (See ChiefMartec Scott Brinker's recent post for more on this topic.) But when you ask marketers face to face about the obstacles, the reason that comes up is consistently lack of time. (My theory on the difference is that people pressed for time don’t answer surveys.) And time, as I hinted above, is really a matter of priority: they are spending their time on other things that seem more important.

So the way to get marketers to do new things is to convince them they are worth the time. That is, you must convince them the new things are more important than their current priorities. Alternately, you can make the new thing so easy that it doesn’t need any time at all. The ABM vendors I discussed this with – all highly successful marketers – were doing both of these already, although they were polite enough not to roll their eye and say “duh” when I brought it up.

How do you convince marketers (or any other buyers) that something they already know is important is more important than whatever they’re doing now? I’d argue this isn’t likely to be a rational choice: MAYBE you can find some fabulously compelling proof of value, but the marketers will probably have seen those arguments already and not been convinced. More likely, you'll need to rely on emotion. This means getting marketers excited about doing something (that’s where the “business porn” comes in) or scared about the consequences of not doing it (see the CEB Challenger Sales model, for example). In short, it’s about appealing to basic instincts – what Seth Godin calls the lizard brain – which will ultimately dictate to the rational mind.

What about the other path I mentioned around the time barrier, showing that the new idea takes so little time that it doesn’t require giving up any current priorities? That’s a more rational argument, since you have to convince the buyer that it’s true. But everything new will take up at least some time and money, so there’s still some need to get the buyer excited enough to make the extra effort. This brings us back to the lizard.

I’m not saying all marketing should be emotional. Powerful as they are, emotions can only tip the balance if the rational choice is close. And I’m talking about the specific situation of getting people to adopt something new, which is quite different from, say, selling an existing solution against a similar competitor. But I spend a lot of time talking with vendors who are selling new types of solutions and talking with marketers who would benefit from those solutions. Both the vendors and I often forget that time, not budget, skills or value, is the real barrier to adoption and that emotions are the key to unlocking more time. So emotions must be a big part of our marketing if we, and the marketers we're trying to serve, are ultimately going to succeed.

Teradata Adds a Data Management Platform To Its Marketing Cloud...Who Will Be Next?

Teradata on Tuesday announced it is adding a data management platform (DMP) to its marketing cloud through the acquisition of Netherlands-based FLXone. This is interesting on several levels, including:

- It makes Teradata the third of the big marketing cloud vendors to add a DMP, joining Oracle DMP (BlueKai) and Adobe Audience Manager. I already expected the other cloud vendors to do this eventually; now I expect that will happen even sooner. I’m looking at you, Salesforce.com.

- Unlike Oracle and Adobe, Teradata has stated (in a briefing about the announcement) that it intends to use the DMP as the primary data store for all components of its suite. I see this as a huge difference from the other vendors, who maintain separate databases for each of their suite components and integrate them largely by swapping audience files with a few data elements on specified customers. (In fact, Adobe just last week briefed analysts on a new batch integration that pushes Campaign data into Audience Manager to build display advertising lookalike audiences. The process takes 24 hours.)

Of course, we’ll see what Teradata actually delivers in this regard. It's also important to recognize that performance needs will almost surely require intermediate layers between the DMP's primary data store and the actual execution systems. This means the distinction between a single database and multiple databases isn’t as clear as I may be seeming to suggest. But I still think it’s an important difference in mindset. In case it isn’t obvious, I think real integration does ultimately require running all systems on the same primary database.

- It is still more evidence of the merger between ad tech and martech. I know I wrote last week that this is old news, but there’s still plenty of work to be done to make it a reality. One consequence of "madtech" is complete solutions are even larger than before, making them even harder for non-giant firms to produce. That’s the primary lesson I took away from last week’s news that StrongView had been merged into Selligent: although StrongView’s vision of omni-channel “contextual marketing” made tons of sense, they didn’t have the resources to make it happen. (See J-P De Clerck's excellent piece for in-depth analysis of the StrongView/Selligent deal.) I’m not sure the combined Selligent/StrongView is big enough either, or that Sellingent owner HGGC will make the other investments needed to fill all the gaps.

To be clear: I'm not saying small martech/adtech/madtech firms can't do well. I think they can plug into a larger architecture that sits on top of a customer data platform and perhaps a shared decision platform. But I very much doubt that a mid-size software firm can build or buy a complete solution of its own. If you're wondering just who I have in mind...well, Mom always told me that if I couldn’t say something nice, I shouldn’t say anything at all. So I won’t name names.

- It makes Teradata the third of the big marketing cloud vendors to add a DMP, joining Oracle DMP (BlueKai) and Adobe Audience Manager. I already expected the other cloud vendors to do this eventually; now I expect that will happen even sooner. I’m looking at you, Salesforce.com.

- Unlike Oracle and Adobe, Teradata has stated (in a briefing about the announcement) that it intends to use the DMP as the primary data store for all components of its suite. I see this as a huge difference from the other vendors, who maintain separate databases for each of their suite components and integrate them largely by swapping audience files with a few data elements on specified customers. (In fact, Adobe just last week briefed analysts on a new batch integration that pushes Campaign data into Audience Manager to build display advertising lookalike audiences. The process takes 24 hours.)

Of course, we’ll see what Teradata actually delivers in this regard. It's also important to recognize that performance needs will almost surely require intermediate layers between the DMP's primary data store and the actual execution systems. This means the distinction between a single database and multiple databases isn’t as clear as I may be seeming to suggest. But I still think it’s an important difference in mindset. In case it isn’t obvious, I think real integration does ultimately require running all systems on the same primary database.

- It is still more evidence of the merger between ad tech and martech. I know I wrote last week that this is old news, but there’s still plenty of work to be done to make it a reality. One consequence of "madtech" is complete solutions are even larger than before, making them even harder for non-giant firms to produce. That’s the primary lesson I took away from last week’s news that StrongView had been merged into Selligent: although StrongView’s vision of omni-channel “contextual marketing” made tons of sense, they didn’t have the resources to make it happen. (See J-P De Clerck's excellent piece for in-depth analysis of the StrongView/Selligent deal.) I’m not sure the combined Selligent/StrongView is big enough either, or that Sellingent owner HGGC will make the other investments needed to fill all the gaps.

To be clear: I'm not saying small martech/adtech/madtech firms can't do well. I think they can plug into a larger architecture that sits on top of a customer data platform and perhaps a shared decision platform. But I very much doubt that a mid-size software firm can build or buy a complete solution of its own. If you're wondering just who I have in mind...well, Mom always told me that if I couldn’t say something nice, I shouldn’t say anything at all. So I won’t name names.

Thursday, October 15, 2015

EverString Takes Another $65 Million and (More Important) Launches Predictive Ad Targeting Solution

EverString announced a $65 million funding round and new ad targeting product on Tuesday. (It also released a new survey on predictive marketing which is probably interesting, but I just can't face after last weekend’s data binge.)

The new funding is certainly impressive, although the record for a B2B predictive marketing vendor is apparently InsideSales’ $100 million Series C in April 2014. It confirms that EverString has become a leader in the field despite its relatively late entry.

But the new product is what’s really intriguing. Integration between marketing and advertising technologies has now gone from astute prediction to overused cliché, so nobody gets credit for creating another example. But the new EverString product isn’t the usual sharing of a prospect list with an ad platform, as in display retargeting, Facebook Custom Audiences, or LinkedIn Lead Accelerator. Rather, it finds prospects who are not yet on the marketer’s own list by scanning ad exchanges for promising individuals. More precisely, it puts a tag on the client's Web site to capture visitor behavior, combines this with the client's CRM data and EverString's own data, and then builds a predictive model to find prospects who are similar to the most engaged current customers. This is a form of lookalike modeling -- something that was separately mentioned to me twice this week (both times by big marketing cloud vendors), earning it the coveted Use Case of the Week Award.

Once the prospects are ranked, EverString lets users define the number of new prospects they want and set up real time bidding campaigns with the usual bells and whistles including total and daily budgets and frequency caps per individual. EverString doesn’t identify the prospects by name, but it does figure out their employer and track their behaviors over time. If this all rings a bell, you’re on the right track: yes, EverString has created its very own combined Data Management Platform / Demand Side Platform and is using it build and target audience profiles.

In some ways, this isn’t such a huge leap: EverString and several other predictive marketing vendors have long assembled large databases of company and/or individual profiles. These were typically sourced from public information such as Web sites, job postings, and social media. Some vendors also added intent data based on visits to a network of publisher Web sites, but those networks capture a small share of total Web activity. Building a true DMP/DSP with access to the full range of ad exchange traffic is a major step beyond previous efforts. It puts EverString in competition with new sets of players, including the big marketing clouds, several of which have their own DMPs; the big data compilers; and ad targeting giants such LinkedIn, Google, and Facebook. Of course, the most direct competitors would be account based marketing vendors including Demandbase, Terminus, Azalead, Engagio, and Vendemore. While we’re at it, we could throw in the mix other DMP/DSPs such as RocketFuel, Turn, and IgnitionOne.

At this point, your inner business strategist may be wondering if EverString has bitten off more than it can chew or committed the cardinal sin of losing focus. That may turn out to be the case, but the company does have an internal logic guiding its decisions. Specifically, it sees itself as leveraging its core competency in B2B prospect modeling, by using the same models for multiple tasks including lead scoring, new prospect identification, and, now, ad targeting. Moreover, it sees these applications reinforcing each other by sharing the data they create: for example, the ad targeting becomes more effective when it can use information that lead scoring has gathered about who ultimately becomes a customer.

From a more mundane perspective, limiting its focus to B2B prospect management lets EverString concentrate its own marketing and sales efforts on a specific set of buyers, even as it slowly expands the range of problems it can help those buyers to solve. So there is considerably more going on here than a hammer looking for something new to nail.

Speaking of unrelated topics*, the EverString funding follows quickly on the heels of another large investment – $58 million – in automated testing and personalization vendor Optimizely, which itself followed Oracle’s acquisition of Optimizely competitor Maxymiser. I’ve never thought of predictive modeling and testing as having much to do with each other, although both do use advanced analytics. But now that they’re both in the news at the same time, I’m wondering if there might be some deeper connection. After all, both are concerned with predicting behavior and, ultimately, with choosing the right treatment for each individual. This suggests that cross-pollination could result in a useful hybrid – perhaps testing techniques could help evolve campaign structures that use predictive modeling to select messages at each step. It’s a half-baked notion but does address automated campaign design, which I see as the next grand challenge for the combined martech/adtech (=madtech) industry. On a less exalted level, I suspect that automated testing and predictive modeling can be combined to give better results in their current applications than either by itself. So I’ll be keeping an eye out for that type of integration. Let me know if you spot any.

_____________________________________________________________

*lamest transition ever

The new funding is certainly impressive, although the record for a B2B predictive marketing vendor is apparently InsideSales’ $100 million Series C in April 2014. It confirms that EverString has become a leader in the field despite its relatively late entry.

But the new product is what’s really intriguing. Integration between marketing and advertising technologies has now gone from astute prediction to overused cliché, so nobody gets credit for creating another example. But the new EverString product isn’t the usual sharing of a prospect list with an ad platform, as in display retargeting, Facebook Custom Audiences, or LinkedIn Lead Accelerator. Rather, it finds prospects who are not yet on the marketer’s own list by scanning ad exchanges for promising individuals. More precisely, it puts a tag on the client's Web site to capture visitor behavior, combines this with the client's CRM data and EverString's own data, and then builds a predictive model to find prospects who are similar to the most engaged current customers. This is a form of lookalike modeling -- something that was separately mentioned to me twice this week (both times by big marketing cloud vendors), earning it the coveted Use Case of the Week Award.

Once the prospects are ranked, EverString lets users define the number of new prospects they want and set up real time bidding campaigns with the usual bells and whistles including total and daily budgets and frequency caps per individual. EverString doesn’t identify the prospects by name, but it does figure out their employer and track their behaviors over time. If this all rings a bell, you’re on the right track: yes, EverString has created its very own combined Data Management Platform / Demand Side Platform and is using it build and target audience profiles.

In some ways, this isn’t such a huge leap: EverString and several other predictive marketing vendors have long assembled large databases of company and/or individual profiles. These were typically sourced from public information such as Web sites, job postings, and social media. Some vendors also added intent data based on visits to a network of publisher Web sites, but those networks capture a small share of total Web activity. Building a true DMP/DSP with access to the full range of ad exchange traffic is a major step beyond previous efforts. It puts EverString in competition with new sets of players, including the big marketing clouds, several of which have their own DMPs; the big data compilers; and ad targeting giants such LinkedIn, Google, and Facebook. Of course, the most direct competitors would be account based marketing vendors including Demandbase, Terminus, Azalead, Engagio, and Vendemore. While we’re at it, we could throw in the mix other DMP/DSPs such as RocketFuel, Turn, and IgnitionOne.

At this point, your inner business strategist may be wondering if EverString has bitten off more than it can chew or committed the cardinal sin of losing focus. That may turn out to be the case, but the company does have an internal logic guiding its decisions. Specifically, it sees itself as leveraging its core competency in B2B prospect modeling, by using the same models for multiple tasks including lead scoring, new prospect identification, and, now, ad targeting. Moreover, it sees these applications reinforcing each other by sharing the data they create: for example, the ad targeting becomes more effective when it can use information that lead scoring has gathered about who ultimately becomes a customer.

From a more mundane perspective, limiting its focus to B2B prospect management lets EverString concentrate its own marketing and sales efforts on a specific set of buyers, even as it slowly expands the range of problems it can help those buyers to solve. So there is considerably more going on here than a hammer looking for something new to nail.

Speaking of unrelated topics*, the EverString funding follows quickly on the heels of another large investment – $58 million – in automated testing and personalization vendor Optimizely, which itself followed Oracle’s acquisition of Optimizely competitor Maxymiser. I’ve never thought of predictive modeling and testing as having much to do with each other, although both do use advanced analytics. But now that they’re both in the news at the same time, I’m wondering if there might be some deeper connection. After all, both are concerned with predicting behavior and, ultimately, with choosing the right treatment for each individual. This suggests that cross-pollination could result in a useful hybrid – perhaps testing techniques could help evolve campaign structures that use predictive modeling to select messages at each step. It’s a half-baked notion but does address automated campaign design, which I see as the next grand challenge for the combined martech/adtech (=madtech) industry. On a less exalted level, I suspect that automated testing and predictive modeling can be combined to give better results in their current applications than either by itself. So I’ll be keeping an eye out for that type of integration. Let me know if you spot any.

_____________________________________________________________

*lamest transition ever

Tuesday, October 06, 2015

Marketers Are Struggling to Keep Up With Customer Expectations: Here's Proof

How pitiful is this: My wife left me alone all last weekend and the most mischief I could get into was looking for research about cross-channel customer views. The only defense I can make is I did promise a client a paper on the topic, which I finished Sunday night. But then I decided it was way too wonky and wrote a new, data-free version that people might actually read.

But you, Dear Reader, get the benefit of my crazy little binge. Here’s a fact-filled blog post that uses some my carefully assembled information. (Yes, there was actually much more. I’m so ashamed.)

Customer Expectations are Rising

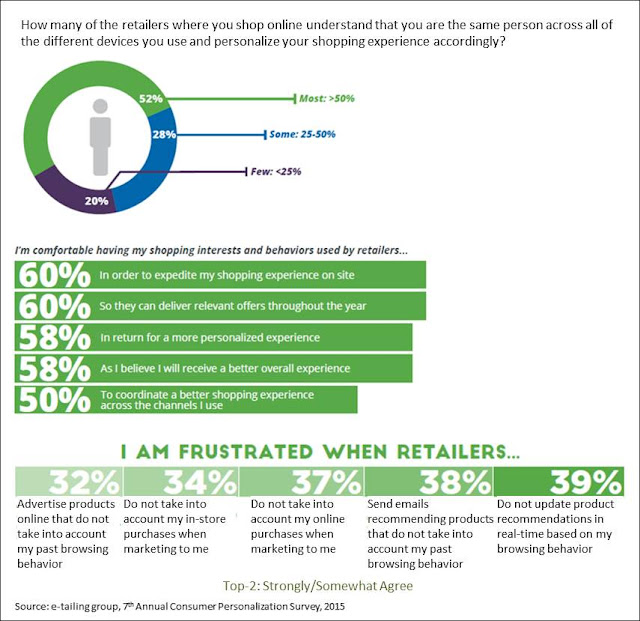

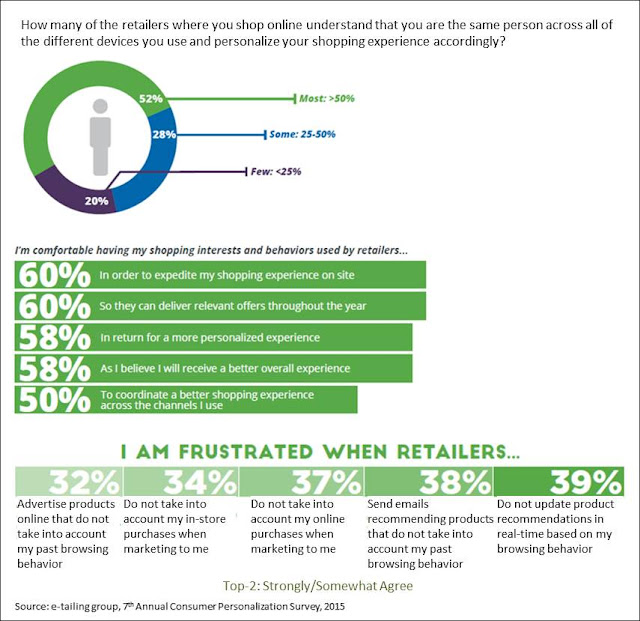

Let's start with a truth universally acknowledged – that customers have rising expectations for personalized treatment. Unlike Jane Austen, I have facts for my assertion: e-tailing group's 7th Annual Consumer Personalization Survey found that 52% of consumers believe most online retailers can recognize them as the same person across devices and personalize their shopping experience accordingly. An even higher proportion (60%) want their past behaviors used to expedite the shopping experience, and one-third (37%) are frustrated when companies don’t take that data into account.

Switching to customer service, Microsoft’s 2015 Global State of Multichannel Customer Service Report found that 68% of U.S. consumers had stopped doing business with a brand due to a poor customer service experience and 56% have higher expectations for customer service than a year ago. So, yes, customer expectations are rising and failing to meet them has a price.

Switching to customer service, Microsoft’s 2015 Global State of Multichannel Customer Service Report found that 68% of U.S. consumers had stopped doing business with a brand due to a poor customer service experience and 56% have higher expectations for customer service than a year ago. So, yes, customer expectations are rising and failing to meet them has a price.

Marketers Know They Need Data

Marketers certainly see this as well. In a Harris Poll conducted for Lithium Technologies, 82% of 300 executives agreed that customer expectations have gotten higher in the past three years. Focusing more specifically on data, Experian's 2015 Data Quality Benchmark Report, which had 1200 respondents, found that 99% agreed some type of customer data is essential for marketing success. Marketers are backing those opinions with money: when Winterberry Group asked a select set of senior marketers what was driving their investments in data-driven marketing and advertising, the most commonly cited reason was the need to deliver more relevant communications and be more customer-centric. .

Few Have the Data They Need

But marketers also recognize that they have a long way to go. In Experian’s 2015 Digital Marketer study, 89% of marketers reported at least one challenge with creating a complete customer view.

Econsultancy’s 2015 The Multichannel Reality study for Adobe found that just 29% had succeeded in creating such a view, 15% could access the complete view in their campaign manager, 14% integrate all campaigns across all channels, and 8% were able to adapt the customer experience based on context in real time. In other words, the complete view is just the beginning. In other words, marketers are nowhere near as good at personalizing experiences as consumers think.

Real-Time Isn't a Luxury

Given the challenges in building any complete view, is real-time experience coordination too much to ask? Customers don’t think so; in fact, as we've already seen, they assume it’s already happening. Marketers, of course, are more aware of the challenges, but they too see it as the goal. In a survey of their own clients, marketing data analysis and campaign software vendor Apteco Ltd found that 12% of respondents were already using real-time data, 31% were sure they needed it and 37% felt it might be useful. Just 17% felt daily updates were adequate.

Real-Time Must Also Be Cross-Channel

It’s important to not to confuse real-time personalization with tracking customers across channels or even identifying customers at all. In a survey by personalization vendor Evergage, respondents who were already doing real-time personalization were most often basing it on immediately observable, potentially anonymous data including type of content viewed, location, time on site, and navigation behavior. Yet the marketers in that same study gave the highest importance ratings to identity-based information including customer value, buying/shopping patterns, and buyer persona. It’s clear that marketers recognize the need for a complete customer view even if they haven't built one.

Summary

What are we to make of all this, other than the fact that I need to get out more? I'd summarize this in three points:

- customer expectations are truly rising and you'll be penalized if you don't meet them

- marketers know that meeting expectations requires a complete customer view but few have built one

- the complete view has to be part of a real-time integrated, real-time to deliver the necessary results

None of this should be news to anyone. But perhaps this data will help build your business case for investments to solve the problem. If so, my lost weekend will not have been in vain.

.

But you, Dear Reader, get the benefit of my crazy little binge. Here’s a fact-filled blog post that uses some my carefully assembled information. (Yes, there was actually much more. I’m so ashamed.)

Customer Expectations are Rising

Let's start with a truth universally acknowledged – that customers have rising expectations for personalized treatment. Unlike Jane Austen, I have facts for my assertion: e-tailing group's 7th Annual Consumer Personalization Survey found that 52% of consumers believe most online retailers can recognize them as the same person across devices and personalize their shopping experience accordingly. An even higher proportion (60%) want their past behaviors used to expedite the shopping experience, and one-third (37%) are frustrated when companies don’t take that data into account.

Switching to customer service, Microsoft’s 2015 Global State of Multichannel Customer Service Report found that 68% of U.S. consumers had stopped doing business with a brand due to a poor customer service experience and 56% have higher expectations for customer service than a year ago. So, yes, customer expectations are rising and failing to meet them has a price.

Switching to customer service, Microsoft’s 2015 Global State of Multichannel Customer Service Report found that 68% of U.S. consumers had stopped doing business with a brand due to a poor customer service experience and 56% have higher expectations for customer service than a year ago. So, yes, customer expectations are rising and failing to meet them has a price.Marketers Know They Need Data

Marketers certainly see this as well. In a Harris Poll conducted for Lithium Technologies, 82% of 300 executives agreed that customer expectations have gotten higher in the past three years. Focusing more specifically on data, Experian's 2015 Data Quality Benchmark Report, which had 1200 respondents, found that 99% agreed some type of customer data is essential for marketing success. Marketers are backing those opinions with money: when Winterberry Group asked a select set of senior marketers what was driving their investments in data-driven marketing and advertising, the most commonly cited reason was the need to deliver more relevant communications and be more customer-centric. .

Few Have the Data They Need

But marketers also recognize that they have a long way to go. In Experian’s 2015 Digital Marketer study, 89% of marketers reported at least one challenge with creating a complete customer view.

Econsultancy’s 2015 The Multichannel Reality study for Adobe found that just 29% had succeeded in creating such a view, 15% could access the complete view in their campaign manager, 14% integrate all campaigns across all channels, and 8% were able to adapt the customer experience based on context in real time. In other words, the complete view is just the beginning. In other words, marketers are nowhere near as good at personalizing experiences as consumers think.

Real-Time Isn't a Luxury

Given the challenges in building any complete view, is real-time experience coordination too much to ask? Customers don’t think so; in fact, as we've already seen, they assume it’s already happening. Marketers, of course, are more aware of the challenges, but they too see it as the goal. In a survey of their own clients, marketing data analysis and campaign software vendor Apteco Ltd found that 12% of respondents were already using real-time data, 31% were sure they needed it and 37% felt it might be useful. Just 17% felt daily updates were adequate.

Real-Time Must Also Be Cross-Channel

It’s important to not to confuse real-time personalization with tracking customers across channels or even identifying customers at all. In a survey by personalization vendor Evergage, respondents who were already doing real-time personalization were most often basing it on immediately observable, potentially anonymous data including type of content viewed, location, time on site, and navigation behavior. Yet the marketers in that same study gave the highest importance ratings to identity-based information including customer value, buying/shopping patterns, and buyer persona. It’s clear that marketers recognize the need for a complete customer view even if they haven't built one.

Summary

What are we to make of all this, other than the fact that I need to get out more? I'd summarize this in three points:

- customer expectations are truly rising and you'll be penalized if you don't meet them

- marketers know that meeting expectations requires a complete customer view but few have built one

- the complete view has to be part of a real-time integrated, real-time to deliver the necessary results

None of this should be news to anyone. But perhaps this data will help build your business case for investments to solve the problem. If so, my lost weekend will not have been in vain.

.

Subscribe to:

Posts (Atom)