I’m beginning to feel like Lucille Ball in the chocolate factory: predictive modeling systems are coming at me faster than I can review them. I had already planned this week to write about Wise.io and then yesterday omnichannel personalization vendor Sailthru announced their own predictive solution . Now, Sailthru is interesting in its own right – it’s a Customer Data Platform with strong decisioning capabilities – but they’ll have to wait their turn. This week, I’ll stick with Wise.io.

By now, you can probably recite along with me as I list the key differentiators for predictive systems. Let’s run through them with Wise.io as the subject.

• inputs. Wise.io connects to any system with an open API, which includes most major software-as-a-service products. Vendor staff does some basic mapping for each client, which usually takes a couple of hours at most. Most of that time is spent working with the client to decide what data to include in the feed. One important feature of Wise.io is that it can handle very large numbers of inputs – hundreds or thousands of elements – so there’s not much pressure to restrict the inputs too carefully. The system can also take non-API feeds such as batch data loads, although this takes more custom work. It can handle pretty much any type of data and includes advanced natural language processing to extract information from text.

• external data. Many predictive modeling systems, especially for B2B lead scoring, supplement the client’s data with company and individual information they gather themselves from sources like social networks, Web sites, job boards, and government files. Wise.io doesn’t do this.

• data management. Wise.io maintains a database of information it has loaded from source systems. It can accept inputs from multiple sources in different formats. Data is stored on Amazon S3 and Postgres, allowing Wise.io to handle very large volumes. But the system doesn’t link records belonging to the same individual or company unless they have already been coded with a common key.

• automation. Wise.io has almost fully automated the data loading, variable selection, model building, and scoring processes. The system has sophisticated features to automatically adjust for missing values, outliers, inconsistencies, and similar real-world problems that usually require human intervention. To build a new model, users simply select the items to predict and the locations to place the results. The system’s machine learning engine automatically uses existing records in the client’s database to create the model and then places the predictions in the specified fields.

• set-up time. New clients usually have their first model within one day, assuming credentials are available to connect with source systems and the vendor and client can quickly agree on what to import. This is about as quick as it gets. While other vendors work even faster, they do this by limiting themselves to prebuilt connectors to standard systems. There’s nothing wrong with that but bear in mind that even those vendors will take longer once you start to add other inputs.

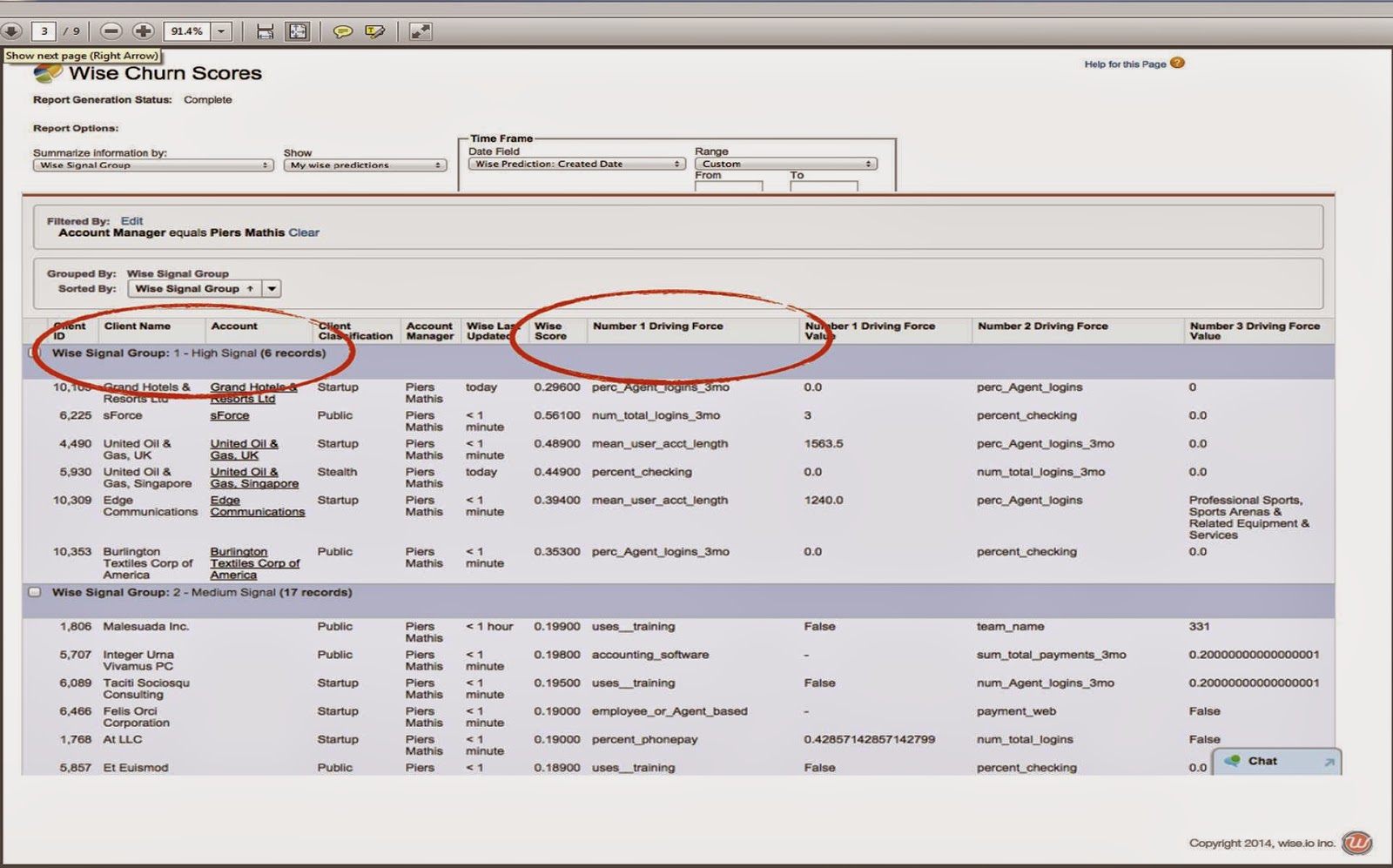

• outputs. Wise.io generates predictions, confidence scores for the predictions, and lists of drivers that show the reasons for the predictions. These are loaded into client systems where they can generate reports (see below) or be integrated with CRM or customer support agent interfaces.

• self-service. After the initial setup, clients can build new models for themselves through a simple interface that basically involves specifying the source data, item to predict, and destination for the results. Adding a new data source would take some help from the vendor but should be pretty quick unless the source lacks a standard API or export tools.

• update frequency. Wise.io will load data in real time as it is updated in client systems, assuming the client system supports this. Scores will reflect the latest data. The system continuously and automatically updates its models to reflect new results.

• applications. Wise.io can be used for pretty much any predictive application, but the company has focused its initial efforts on customer support and retention. This involves tasks such as identifying churn risks and assigning support cases to the proper agent.

• cost. Pricing is based on the number of predictions the system generates, whether those are support tickets, email messages, or customer lists. Enterprise edition installations start in the mid-five figures (i.e., around $50,000) and can go considerably higher. A new self-service edition is limited to specific marketing automation, customer support, and CRM systems and costs somewhat less.

• vendor. The company was launched in 2013 and has some modest venture funding (published figures range from $2.5 million to $3.5 million). It has about a dozen production clients and another two dozen or so in pilot. Client include both consumer and business marketers.

Thursday, October 30, 2014

Friday, October 24, 2014

SalesPredict Offers Highly Automated, Highly Flexible Predictive Modeling

A couple of weeks ago, I wrote that “predictive everywhere” is one of major trends in data-driven marketing. I meant both that predictive models guide decisions at every stage in many marketing programs, and that models are used throughout the organization by marketing, sales, and service.

I might have added a third meaning: that systems to do predictive modeling are everywhere as well. SalesPredict is a perfect example: a small vendor with a powerful system that just launched earlier this year. Back in, say, 2008, a product like this would be big news. Today, I simply add them to my list and try to understand what makes them different.

In this case, the main technical differentiator is extreme automation: SalesPredict imports customer data, builds models, scores current records, and deploys the results with virtually no human intervention. This is possible primarily because the painstaking work of preparing data for analysis – which is where model builders spend most of their time – is avoided by connecting to a few standard sources, currently Salesforce.com and Marketo with HubSpot soon to follow. Because it knows what to expect, the system can easily load customer data and sales results from those systems. It then enhances the data with business and demographic information from public Web pages, social profiles, and third party sources including Zoominfo, InsideView, and Orb Intelligence. Finally, it produces models that rank customers based on how closely they resemble members of any user-specified list, such as customers with deals that closed or who failed to renew. Results appear as lists in a CRM interface or as scores on a marketing databaset. The whole process takes just a few hours from making the Salesforce.com connection to seeing scored records, with most of the time spent downloading CRM data and scanning the Web for other information. Once SalesPredict is installed, models are continuously updated based on new CRM information and on feedback provided by users as they review the scored records. This enables the system to automatically adjust as buyer behaviors and conditions change.

User interface is a second differentiator. CRM users see a ranked list of customer records with a system-assigned persona derived using advanced natural language processing, suggested actions such as which products to offer, and the key data values that influenced the ranking. Users can drill further into each record to see more customer and company information including previous interactions, products owned, and won or lost deals. The company information is assembled from internal and external sources using SalesPredict’s own matching methods, so results are not at the mercy of data quality within the CRM. As previously noted, users can adjust a ranking if they feel the model is wrong; this is fed back to the system to adjust future predictions. Another screen shows which data values are most powerful in predicting success. This helps users understand the model and suggests criteria for targeting increased marketing investment. Although there’s no great technical wizardry required to provide these interfaces (except perhaps the name and account matching), they do make results more easily understood than many other predictive modeling products.

The final differentiator is flexibility. The system can model against any user-defined list, meaning that SalesPredict can score new leads, identify churn risk, or find the most likely buyers for new products. Recommendations also draw on a common technology, whether the system is suggesting which products a customer is most likely to buy, which content they are most likely to download, or which offers they are most likely to accept. That said, SalesPredict’s primarily integration with Salesforce.com, user interface, and company name itself suggest the vendor’s main focus is on helping sales users spend their time on the most productive lead. This is somewhat different from predictive modeling vendors who have focused primarily on helping marketers with lead scoring.

Is SalesPredict right for you? Well, the automation and flexibility are highly attractive, but the dependence on CRM data may limit its value if you want to incorporate other sources. Pricing was originally based on the number of leads but is currently being revised, with no new details available. However, it’s likely that the company will remain small-business-friendly in its approach. SalesPredict currently has about 15 clients, mostly in the technology industry but also with some in financial services and healthcare.

I might have added a third meaning: that systems to do predictive modeling are everywhere as well. SalesPredict is a perfect example: a small vendor with a powerful system that just launched earlier this year. Back in, say, 2008, a product like this would be big news. Today, I simply add them to my list and try to understand what makes them different.

In this case, the main technical differentiator is extreme automation: SalesPredict imports customer data, builds models, scores current records, and deploys the results with virtually no human intervention. This is possible primarily because the painstaking work of preparing data for analysis – which is where model builders spend most of their time – is avoided by connecting to a few standard sources, currently Salesforce.com and Marketo with HubSpot soon to follow. Because it knows what to expect, the system can easily load customer data and sales results from those systems. It then enhances the data with business and demographic information from public Web pages, social profiles, and third party sources including Zoominfo, InsideView, and Orb Intelligence. Finally, it produces models that rank customers based on how closely they resemble members of any user-specified list, such as customers with deals that closed or who failed to renew. Results appear as lists in a CRM interface or as scores on a marketing databaset. The whole process takes just a few hours from making the Salesforce.com connection to seeing scored records, with most of the time spent downloading CRM data and scanning the Web for other information. Once SalesPredict is installed, models are continuously updated based on new CRM information and on feedback provided by users as they review the scored records. This enables the system to automatically adjust as buyer behaviors and conditions change.

User interface is a second differentiator. CRM users see a ranked list of customer records with a system-assigned persona derived using advanced natural language processing, suggested actions such as which products to offer, and the key data values that influenced the ranking. Users can drill further into each record to see more customer and company information including previous interactions, products owned, and won or lost deals. The company information is assembled from internal and external sources using SalesPredict’s own matching methods, so results are not at the mercy of data quality within the CRM. As previously noted, users can adjust a ranking if they feel the model is wrong; this is fed back to the system to adjust future predictions. Another screen shows which data values are most powerful in predicting success. This helps users understand the model and suggests criteria for targeting increased marketing investment. Although there’s no great technical wizardry required to provide these interfaces (except perhaps the name and account matching), they do make results more easily understood than many other predictive modeling products.

The final differentiator is flexibility. The system can model against any user-defined list, meaning that SalesPredict can score new leads, identify churn risk, or find the most likely buyers for new products. Recommendations also draw on a common technology, whether the system is suggesting which products a customer is most likely to buy, which content they are most likely to download, or which offers they are most likely to accept. That said, SalesPredict’s primarily integration with Salesforce.com, user interface, and company name itself suggest the vendor’s main focus is on helping sales users spend their time on the most productive lead. This is somewhat different from predictive modeling vendors who have focused primarily on helping marketers with lead scoring.

Is SalesPredict right for you? Well, the automation and flexibility are highly attractive, but the dependence on CRM data may limit its value if you want to incorporate other sources. Pricing was originally based on the number of leads but is currently being revised, with no new details available. However, it’s likely that the company will remain small-business-friendly in its approach. SalesPredict currently has about 15 clients, mostly in the technology industry but also with some in financial services and healthcare.

Friday, October 17, 2014

Dreamforce 2014: Process Is More Important Than Analytics

|

| photo by Dion Hinchcliffe |

The analytics cloud* is a step forward only because Salesforce has been so far behind: it bulk loads data into a star schema relational database using inverted index for speed, which is a solid but old-fashioned approach. Of course, it’s cloud-based but so are other, newer approaches that are ultimately more flexible and scalable. Solutions to the really hard problems of entity association (matching identifiers for the same person in different systems) and predictive analytics are not included. Nor does the system handle real-time updates or allow queries by external systems for purposes like message personalization. The visualization itself is indeed fast and pretty, but it’s not obviously superior to Birst (also cloud-based), Tableau, or QlikView. The core technology was acquired when Salesforce.com bought EdgeSpring last June.

The mobile app builder for Salesforce1** is the sort of innovation only a geek would love: after all, most people don’t think much about system building in general, let alone get excited about making it easier to build mobile apps for Salesforce. But it’s certainly the more important of the two announcements, because it illustrates how broad the scope of Salesforce has become. The most impressive demonstrations were operational processes such as remote order-taking and customer support, which are far removed from traditional sales automation. They also illustrated how absolutely central mobile devices have become to most business processes, something we all vaguely realize but are still not necessarily acting upon. Business processes need to be reimagined from a mobile perspective, taking into account the possibilities of doing things instantly while on-site at a store, a shopper’s home, traveling, or whatever. This is no longer a new thought, but few companies have actually done it. By providing a drag-and-drop mobile app builder, Salesforce opens up possibilities for companies to innovate along these lines quickly, easily, and cheaply. That’s important to everyone, not just Salesforce geeks.

In fact, the closest thing I had to a deep thought during the conference was that people put too much emphasis on distributing data for decisions and not enough about distributing processes. Demonstrations for tools like Wave always show users drilling into sales data to uncover weak pickle sales at convenience stores in Milwaukee – something that’s exciting the first time but you don’t do on a regular basis. By contrast, a distributed process like better store shelf allocations provides continuous benefits, even though it doesn’t require a human analyst to have a brilliant insight. A really good organization has smoothly running processes that handle each situation according to rules that require little or no judgment. (Of course, a certain amount of discretion by empowered employees is still necessary –but I’d argue the sorts of decisions that make for, say, a great hotel experience have nothing to do with advanced data analysis.) People like decision management guru James Taylor have long known this and distinguished operational decisions from strategic decisions, so I guess this isn’t really a new thought, either. But, like the growing centrality of mobile, it’s something that companies need to address by giving them resources. Winners will; losers won’t. It’s that simple.

And while I’m being blunt: two Hawaiian dances in a keynote is two Hawaiian dances too many.

_____________________________________________________________*a.k.a. “Wave”, apparently to justify many Hawaii-themed promotions and an appearance by the Beach Boys.

**called “Lighting”, which suggests it was named separately from Wave, since it's unsafe to surf during electrical storms. But nomenclature notwithstanding, the two systems do seem to work together.

Tuesday, October 14, 2014

CommandIQ Gives Marketers Flexible Database and Messaging Options

The market for Customer Data Platforms is still young, which means that products have yet to converge on a standard set of features. The only thing that’s certain is a CDP will create a multi-source database of customer information. Among the still-optional features are identity association (stitching together individual identifiers from different sources), predictive modeling, decision logic to run marketing campaigns, and message delivery. None of those are required for a CDP to fulfill its core purpose of giving marketers a unified customer database to support coordinated customer treatments across channels. But each adds value that makes a system easier to sell than a database alone. So it’s possible that the market will end up dominated by a configuration that includes several of them.

CommandIQ, released early this year, takes a relatively barebones approach: a shared multi-source database plus decision logic for individual messages. (The system actually does have predictive modeling capabilities but the vendor has chosen not to expose them, having found most users lack interest.) It has some message delivery capabilities for email and mobile but relies primarily on integrations with third-party email vendors, pushes to mobile operating systems, API calls, and flat file exports.

Since the system focused on database and message selection features, let’s look at those in more depth. CommandIQ accepts inputs from pretty much any source, loading them into the Redshift column store database. This gives users fast access to large volumes of data in any schema. The system can use any identifier selected by the client and can capture relationships between IDs, such as linking a mobile device to an email address opened on that device. But it doesn’t find near matches based on similarities among inputs, append external data to customer profiles for enrichment or cleansing, or offer semantic processing for unstructured data. All those would be provided by external services linked into the system.

Message selection incorporates three functions: segment selection, message creation, and scheduling. Selections define who will see the message. They can use any information in the system database: there is no distinction between events like email opens and attributes like customer address. A point-and-click query builder lets users create complex logic such as “opened three emails within the past two weeks”. Users can also “deep link” a message to specific locations within an app or Web site.

Message creation begins by specifying which system that will execute the message: users select from predefined connections to different email vendors, Andoid and iOS apps, and HTTP posts. A drag-and-drop email builder lets users create HTML messages including personalized contents drawn from the system database. Users can also embed API calls within a message to get dynamic product recommendations from the system when the message is rendered. The system supports a/b testing, control groups held out from a message, and frequency caps that can block a message after customers reach a specified total in each channel. When a message has versions for different channels, the system can deliver the message in the highest-priority channel for which a user address is available.

Scheduling supports one-time and repeated execution. Event-triggered messages can execute continuously, although the system doesn’t support true real-time interactions because of delays in loading data from external sources. The vendor plans to add immediate execution in the near future. There is no direct way to create multi-step message sequences, although these could be set up through selection conditions that filter on previous messages.

CommandIQ was developed for an online game company that wanted an efficient way to push messages to customers based on specific behaviors. That’s a situation where multi-step sequences don’t much matter, mobile platforms are critical, and where users are typically identified through log-ins. Similar conditions apply to other online businesses including ecommerce and elearning…which is exactly where the company has found the bulk of its initial clients. Companies that need more complicated campaigns or have more challenging matching problems could also use the system but might find it a little more work than some alternatives.

Pricing for CommandIQ is based on the number of users, connections, and customization. A basic version starts at $899 per month while enterprise installations run from $5,000 to $15,000 per month. The system currently has less than 20 enterprise clients.

CommandIQ, released early this year, takes a relatively barebones approach: a shared multi-source database plus decision logic for individual messages. (The system actually does have predictive modeling capabilities but the vendor has chosen not to expose them, having found most users lack interest.) It has some message delivery capabilities for email and mobile but relies primarily on integrations with third-party email vendors, pushes to mobile operating systems, API calls, and flat file exports.

Since the system focused on database and message selection features, let’s look at those in more depth. CommandIQ accepts inputs from pretty much any source, loading them into the Redshift column store database. This gives users fast access to large volumes of data in any schema. The system can use any identifier selected by the client and can capture relationships between IDs, such as linking a mobile device to an email address opened on that device. But it doesn’t find near matches based on similarities among inputs, append external data to customer profiles for enrichment or cleansing, or offer semantic processing for unstructured data. All those would be provided by external services linked into the system.

Message selection incorporates three functions: segment selection, message creation, and scheduling. Selections define who will see the message. They can use any information in the system database: there is no distinction between events like email opens and attributes like customer address. A point-and-click query builder lets users create complex logic such as “opened three emails within the past two weeks”. Users can also “deep link” a message to specific locations within an app or Web site.

Message creation begins by specifying which system that will execute the message: users select from predefined connections to different email vendors, Andoid and iOS apps, and HTTP posts. A drag-and-drop email builder lets users create HTML messages including personalized contents drawn from the system database. Users can also embed API calls within a message to get dynamic product recommendations from the system when the message is rendered. The system supports a/b testing, control groups held out from a message, and frequency caps that can block a message after customers reach a specified total in each channel. When a message has versions for different channels, the system can deliver the message in the highest-priority channel for which a user address is available.

Scheduling supports one-time and repeated execution. Event-triggered messages can execute continuously, although the system doesn’t support true real-time interactions because of delays in loading data from external sources. The vendor plans to add immediate execution in the near future. There is no direct way to create multi-step message sequences, although these could be set up through selection conditions that filter on previous messages.

CommandIQ was developed for an online game company that wanted an efficient way to push messages to customers based on specific behaviors. That’s a situation where multi-step sequences don’t much matter, mobile platforms are critical, and where users are typically identified through log-ins. Similar conditions apply to other online businesses including ecommerce and elearning…which is exactly where the company has found the bulk of its initial clients. Companies that need more complicated campaigns or have more challenging matching problems could also use the system but might find it a little more work than some alternatives.

Pricing for CommandIQ is based on the number of users, connections, and customization. A basic version starts at $899 per month while enterprise installations run from $5,000 to $15,000 per month. The system currently has less than 20 enterprise clients.

Wednesday, October 08, 2014

New Frontiers in Data Driven Marketing

I recently gave a talk on New Frontiers in Data Driven Marketing, which managed to incorporate Barbie, Fred Astaire and Ginger Rogers, General Winfield Scott, and The Three Stooges. Let’s just say you had to be there. But even without celebrities, I think the list is worth a quick look as you start planning for next year’s marketing programs.

New Challenges

• Integrate ad tech and martech. We’ve seen this coming for some time but it’s now much more obvious as marketing automation vendors like Oracle and Adobe, display ad targeters like Bizo (now part of LinkedIn) and Demandbase, and even tag managers like Signal (formerly BrightTag) and Tealium come at the challenge from different directions. The core issue is that marketing campaigns in advertising, traditional outbound media, and new social and inbound media all target increasingly-identifiable audiences rather than anonymous cookies, site visitors, viewers, or prospect lists. This makes it more possible to work across all media to improve targeting, to coordinate messages for each individual, and to measure the incremental impact of each promotion. This, in turn, requires integrated systems to gather the necessary data in a single location, track interactions with individuals, send appropriate messages, and monitor results. Look for more integration along those lines from big platform players and for cooperation among specialized solutions as they seek to participate in the consolidated approach.

• Extract meaning from big data. Everybody loves big data but few people talk about the downside: sloshing huge buckets of information into a giant data lake means that everybody has to do their own refining before they can do anything useful. Of course, analysts have always spent a lot of time on data prep and veterans will scoff at the implication that most data warehouses are pristine. But the ease of adding new feeds to big data stores, especially of unstructured data, means that users now face a “do it yourself data quality” challenge that's much greater than before. To make things even harder, direct access to data has expanded to many business users who don’t have the data management skills or sensitivity of expert analysts. This is a problem I haven’t seen discussed very much, but you can be certain it is coming to a desktop near you.

• Translate offers across media and campaigns. All that cross-channel coordination means marketers have more ways to present the right message to each individual, which turn means each message much be available in the format of each touchpoint. “Responsive design” addresses one piece of the problem, making it easy for the same Web content to render effectively on different devices. But there are plenty of other touchpoints that responsive design doesn’t reach, including display ads, call centers, and social media. So far, most of the energy related to this issue has been spent in making it easier for a single system to send messages to multiple channels, not in automatically adjusting messages to account for different amounts of content or user mindset in a given context. This is another area that has received little attention so far, especially in terms of refinements like testing and optimization.

New Technologies

• Predictive everywhere. Most marketers are now familiar with basic predictive modeling applications like lead scoring and content recommendations. But big data and multiplying channels offer them opportunities to do so much more – and, given the alternative of poor customer treatments, they really have no choice. Happily, the technology to build predictive models has kept up with marketer needs, so it’s increasingly possible for automated systems to build and deploy dozens or hundreds of models with almost no marketer input. This means programs can be designed to incorporate predictive models in all kinds of treatment decisions, from content recommendations to sales call prioritization to banner ad selection. In fact, the technology in this area is probably ahead of marketers, who need to learn how to identify modeling opportunities, to structure programs to use models effectively, and to monitor model results.

• Natural language processing for unstructured data management. Natural language processing (or NLP, as the cool kids say) and unstructured data are different things and both relatively established. I’m listing them here because unstructured data must become at least semi-structured to be useful, through processes such as tagging and indexing. Doing this efficiently at big data volumes requires automated solutions, which is where NLP comes into play. There are plenty of other NLP applications, such as sentiment analysis, speech processing, data gathering, and even some slick “copy generation” methods (for example, Persado and Captora, which I described briefly last June ). But I think making sense of unstructured data is NLP’s killer app.

New Opportunities

• Mobile/local marketing. Okay, maybe not so new. But still at the frontiers, since marketers are struggling to take advantage of what’s unique about mobile systems rather than just treating them as tiny desktops. Mobile apps are one part of this, since they’re separate from regular Web sites and emails. Location- and context-aware programs are another aspect: the potential is obvious even though it’s not yet clear how to best exploit it. There are some pretty serious privacy concerns to address here, although it’s never clear whether those will be real obstacles or evaporate as customers overcome their initial surprise at how much marketers can tell about them and get back to playing Clash of Clans.

• Advanced attribution. I’m talking here about attribution based on a nearly complete view of all customer interactions with a brand: Web and email messages, of course, but also search, display, broadcast and print advertisements, in-store and near-store* interactions, purchase and service histories, social messages and networks, device telemetry, and only the NSA knows what else. Once you have all that data and have managed to link identities across different sources, you can apply some truly whiz-bang analytics to estimate the incremental impact of different messages on short- and long-term customer behaviors. This goes beyond the simplifying assumptions of first-touch, last-touch and fractional attribution approaches. If it works properly, it promises to revolutionize how marketing budgets are managed and to give a substantial business edge to companies that master it first.

• Journey mapping. Another old concept, but one that’s gaining a lot of new attention. I’ll give a shout-out to my friends at SuiteCX who have built some slick mapping tools that I never quite get around to reviewing. If I had to speculate why journey mapping is suddenly so popular, I’d guess it’s because it’s become so obvious that the traditional purchase funnel has exploded into maze of hopscotch courts, with customers leaping from one spot to the next like crickets on a frying pan. Journey mapping is one way to make sense of it all, or at least apply a bit of order to the natural chaos. It relates closely to multi-channel programs, attribution and mobile/local marketing as well, if you think about it. No wonder it’s climbing to be king of the buzz hill.

_______________________________________________________

* I just made that up.

New Challenges

• Integrate ad tech and martech. We’ve seen this coming for some time but it’s now much more obvious as marketing automation vendors like Oracle and Adobe, display ad targeters like Bizo (now part of LinkedIn) and Demandbase, and even tag managers like Signal (formerly BrightTag) and Tealium come at the challenge from different directions. The core issue is that marketing campaigns in advertising, traditional outbound media, and new social and inbound media all target increasingly-identifiable audiences rather than anonymous cookies, site visitors, viewers, or prospect lists. This makes it more possible to work across all media to improve targeting, to coordinate messages for each individual, and to measure the incremental impact of each promotion. This, in turn, requires integrated systems to gather the necessary data in a single location, track interactions with individuals, send appropriate messages, and monitor results. Look for more integration along those lines from big platform players and for cooperation among specialized solutions as they seek to participate in the consolidated approach.

• Extract meaning from big data. Everybody loves big data but few people talk about the downside: sloshing huge buckets of information into a giant data lake means that everybody has to do their own refining before they can do anything useful. Of course, analysts have always spent a lot of time on data prep and veterans will scoff at the implication that most data warehouses are pristine. But the ease of adding new feeds to big data stores, especially of unstructured data, means that users now face a “do it yourself data quality” challenge that's much greater than before. To make things even harder, direct access to data has expanded to many business users who don’t have the data management skills or sensitivity of expert analysts. This is a problem I haven’t seen discussed very much, but you can be certain it is coming to a desktop near you.

• Translate offers across media and campaigns. All that cross-channel coordination means marketers have more ways to present the right message to each individual, which turn means each message much be available in the format of each touchpoint. “Responsive design” addresses one piece of the problem, making it easy for the same Web content to render effectively on different devices. But there are plenty of other touchpoints that responsive design doesn’t reach, including display ads, call centers, and social media. So far, most of the energy related to this issue has been spent in making it easier for a single system to send messages to multiple channels, not in automatically adjusting messages to account for different amounts of content or user mindset in a given context. This is another area that has received little attention so far, especially in terms of refinements like testing and optimization.

New Technologies

• Predictive everywhere. Most marketers are now familiar with basic predictive modeling applications like lead scoring and content recommendations. But big data and multiplying channels offer them opportunities to do so much more – and, given the alternative of poor customer treatments, they really have no choice. Happily, the technology to build predictive models has kept up with marketer needs, so it’s increasingly possible for automated systems to build and deploy dozens or hundreds of models with almost no marketer input. This means programs can be designed to incorporate predictive models in all kinds of treatment decisions, from content recommendations to sales call prioritization to banner ad selection. In fact, the technology in this area is probably ahead of marketers, who need to learn how to identify modeling opportunities, to structure programs to use models effectively, and to monitor model results.

• Natural language processing for unstructured data management. Natural language processing (or NLP, as the cool kids say) and unstructured data are different things and both relatively established. I’m listing them here because unstructured data must become at least semi-structured to be useful, through processes such as tagging and indexing. Doing this efficiently at big data volumes requires automated solutions, which is where NLP comes into play. There are plenty of other NLP applications, such as sentiment analysis, speech processing, data gathering, and even some slick “copy generation” methods (for example, Persado and Captora, which I described briefly last June ). But I think making sense of unstructured data is NLP’s killer app.

New Opportunities

• Mobile/local marketing. Okay, maybe not so new. But still at the frontiers, since marketers are struggling to take advantage of what’s unique about mobile systems rather than just treating them as tiny desktops. Mobile apps are one part of this, since they’re separate from regular Web sites and emails. Location- and context-aware programs are another aspect: the potential is obvious even though it’s not yet clear how to best exploit it. There are some pretty serious privacy concerns to address here, although it’s never clear whether those will be real obstacles or evaporate as customers overcome their initial surprise at how much marketers can tell about them and get back to playing Clash of Clans.

• Advanced attribution. I’m talking here about attribution based on a nearly complete view of all customer interactions with a brand: Web and email messages, of course, but also search, display, broadcast and print advertisements, in-store and near-store* interactions, purchase and service histories, social messages and networks, device telemetry, and only the NSA knows what else. Once you have all that data and have managed to link identities across different sources, you can apply some truly whiz-bang analytics to estimate the incremental impact of different messages on short- and long-term customer behaviors. This goes beyond the simplifying assumptions of first-touch, last-touch and fractional attribution approaches. If it works properly, it promises to revolutionize how marketing budgets are managed and to give a substantial business edge to companies that master it first.

• Journey mapping. Another old concept, but one that’s gaining a lot of new attention. I’ll give a shout-out to my friends at SuiteCX who have built some slick mapping tools that I never quite get around to reviewing. If I had to speculate why journey mapping is suddenly so popular, I’d guess it’s because it’s become so obvious that the traditional purchase funnel has exploded into maze of hopscotch courts, with customers leaping from one spot to the next like crickets on a frying pan. Journey mapping is one way to make sense of it all, or at least apply a bit of order to the natural chaos. It relates closely to multi-channel programs, attribution and mobile/local marketing as well, if you think about it. No wonder it’s climbing to be king of the buzz hill.

_______________________________________________________

* I just made that up.

Wednesday, October 01, 2014

V12 Launchpad Combines Prospect Database with Outbound Campaigns

V12 Group got its start in 2002 by appending demographic, behavioral, and other data to email lists. Since then, the company has added tools to help marketers make better use of this data, culminating in 2012 with Launchpad, which combined email and postal prospect lists, delivery services, display ads, and response analysis. This year V12 further expanded Launchpad by adding the ability to import and enhance clients’ own customer lists. It's still far from a complete marketing automation system: there are no multi-step workflows, event triggers, recurring campaigns, behavior tracking, CRM synchronization, touchpoint integration, or transaction database. But Launchpad does provide a way to assemble audiences and execute outbound promotions, placing it somewhere between simple email systems like Constant Contact and full-scale marketing automation products.

The core of Launchpad is its list selection interface. This is used to select names from V12’s master database of 208 million postal addresses, 80 million email addresses, and 150 million Web browser cookies; to segment previously purchased names; to retarget email responders and Web site visitors; and to select from the client’s own uploaded lists. Geographic selections begin with a U.S. state map but can also be based on Zip code, political boundaries, distance from a specified point, or user-drawn polygons. They can be further narrowed by demographics, behaviors, auto ownership, and other attributes. Users can also get lists of prospects similar to their uploaded customers, based on a system-generated predictive model. Audience counts are updated in seconds as users adjust their selections. If the audience is larger than desired, the user can specify a quantity and the system will automatically extract a random sample of that size. Users can also apply suppression lists, exclude previously selected names, and specify whether the system returns all individuals, one name per household, or one name per postal address.

For email campaigns, the system also lets users create emails based on templates, from uploaded HTML, or from scratch using a graphical page builder. Users can send test emails and include seed names. There is no built-in split test capability, although this is planned for future release. Today, users can copy an existing campaign as the foundation for a test version, but they would need to suppress the original audience as part of the list specification. Users can also deploy a standard, V12-hosted form to capture responses. Once a campaign is built, users can save it to a shopping cart where V12 shows the cost. V12 manually reviews each campaign to ensure it complies with spam regulations and other requirements. V12 sends the emails from its own domain. It will not provide actual email addresses on purchased names but does provide postal addresses on purchased names and on email responders. The company is adding integration with post card mailers.

Launchpad supports mobile marketing through mobile-friendly emails, mobile landing pages to capture user permissions, and text messages send to names where the client has received direct (first party) permission. Display advertising is handled through integration with MediaMath’s TerminalOne advertising system, which includes the V12 cookie pool as an audience option: users can select audience segments based on the V12 cookies, but cannot target specific individuals directly. Users can also set campaign and daily budgets, CPM targets, frequency caps, start and end dates, ad sources, inventory types, and geographic targets. Retargeting can be done through email lists or ad pixels. The CRM option lets clients upload their own customer lists, including custom fields, but doesn’t offer any type of contact management or associated data tables. Social media posting and listening is under development.

Reports include campaign quantities and responses, allow users to drill down to individual responders, and can calculate a simple Return on Investment based on actual costs and user-provided assumptions for response value.

Launchpad is offered directly to marketers but is sold largely through resellers including MasterCard, US Bank, SwissRe, Gannett, and YP Direct. Those firms offer the system to their own clients as a service. Direct pricing starts at $50 per month for a bundle including 1,000 emails to V12-provided prospects. Users can also purchase individual services such as data enhancements, prospect names, or customer record storage on a cost per thousand basis. The client base is ramping up quickly through the reseller channel: it is currently around 260 and expected to reach 1,000 by end of 2014 and projected to 5,000 by end of 2015. Most clients are small to mid-size B2C marketers ($1 million to $100 million revenue) although there are some B2B and larger B2C firms.

The core of Launchpad is its list selection interface. This is used to select names from V12’s master database of 208 million postal addresses, 80 million email addresses, and 150 million Web browser cookies; to segment previously purchased names; to retarget email responders and Web site visitors; and to select from the client’s own uploaded lists. Geographic selections begin with a U.S. state map but can also be based on Zip code, political boundaries, distance from a specified point, or user-drawn polygons. They can be further narrowed by demographics, behaviors, auto ownership, and other attributes. Users can also get lists of prospects similar to their uploaded customers, based on a system-generated predictive model. Audience counts are updated in seconds as users adjust their selections. If the audience is larger than desired, the user can specify a quantity and the system will automatically extract a random sample of that size. Users can also apply suppression lists, exclude previously selected names, and specify whether the system returns all individuals, one name per household, or one name per postal address.

For email campaigns, the system also lets users create emails based on templates, from uploaded HTML, or from scratch using a graphical page builder. Users can send test emails and include seed names. There is no built-in split test capability, although this is planned for future release. Today, users can copy an existing campaign as the foundation for a test version, but they would need to suppress the original audience as part of the list specification. Users can also deploy a standard, V12-hosted form to capture responses. Once a campaign is built, users can save it to a shopping cart where V12 shows the cost. V12 manually reviews each campaign to ensure it complies with spam regulations and other requirements. V12 sends the emails from its own domain. It will not provide actual email addresses on purchased names but does provide postal addresses on purchased names and on email responders. The company is adding integration with post card mailers.

Launchpad supports mobile marketing through mobile-friendly emails, mobile landing pages to capture user permissions, and text messages send to names where the client has received direct (first party) permission. Display advertising is handled through integration with MediaMath’s TerminalOne advertising system, which includes the V12 cookie pool as an audience option: users can select audience segments based on the V12 cookies, but cannot target specific individuals directly. Users can also set campaign and daily budgets, CPM targets, frequency caps, start and end dates, ad sources, inventory types, and geographic targets. Retargeting can be done through email lists or ad pixels. The CRM option lets clients upload their own customer lists, including custom fields, but doesn’t offer any type of contact management or associated data tables. Social media posting and listening is under development.

Reports include campaign quantities and responses, allow users to drill down to individual responders, and can calculate a simple Return on Investment based on actual costs and user-provided assumptions for response value.

Launchpad is offered directly to marketers but is sold largely through resellers including MasterCard, US Bank, SwissRe, Gannett, and YP Direct. Those firms offer the system to their own clients as a service. Direct pricing starts at $50 per month for a bundle including 1,000 emails to V12-provided prospects. Users can also purchase individual services such as data enhancements, prospect names, or customer record storage on a cost per thousand basis. The client base is ramping up quickly through the reseller channel: it is currently around 260 and expected to reach 1,000 by end of 2014 and projected to 5,000 by end of 2015. Most clients are small to mid-size B2C marketers ($1 million to $100 million revenue) although there are some B2B and larger B2C firms.

Subscribe to:

Posts (Atom)