When your only tool is a hammer, everything looks like a nail. I’ve been illustrating the point recently by asking whether every system I see is really a Customer Data Platform (CDP). The question comes up because nearly every customer management system builds its own customer database, which is one core function of a CDP. What distinguishes CDPs is that they make their database accessible to other execution systems and add some type of customer management intelligence. This intelligence ranges from behavior flags, segment codes, or predictive model scores to treatment recommendations to full-blown campaign management. Sometimes the enriched data is all that’s exposed to the execution systems, although usually the underlying customer profiles are available as well. Often the CDPs support just one stage of the customer life cycle, such as acquisition or retention: this in itself doesn’t disqualify a system, since I expect that they’ll expand in the future. The other key feature is that CDPs are designed to be run by marketers, not IT staff, even though IT will usually play a role in connecting to company-managed data sources.

I bring all this up partly to clarify that I'm actually being more selective than you might think in deciding what to call a CDP and partly because I’m writing today about Aginity, which refers to itself as a “customer insight appliance” but I think can rightly be classified as a CDP. This in turn matters because CDPs solve a critical problem – marketers’ need for better customer databases – so identifying the widest possible range of CDP vendors increases the chances of each marketer finding a solution that fits her requirements.

On to Aginity itself. Functionally, the system is organized into layers for data loading, database management and analytics, and data consumption, which is exactly the model you’d expect from a CDP. Where it differs from most CDPs is the underlying technology. Aginity runs on a Netezza or similar "massively parallel processing" (MPP) data appliance that would typically run on-premise at the client, rather than being accessed remotely in a “Software as a Service” (SaaS) model.

Of course, most marketers couldn’t care less about this difference. They might care more if Aginity was a tool for IT departments, but in fact marketers can control most Aginity functions beyond the initial connections with source systems, and those connections require IT help even for SaaS systems.

Digging a bit deeper into the technical details (and feel free to skip the rest of this paragraph; it will not be on the final exam), Aginity uses a combination of relational and Hadoop data stores, which lets it add new data sources without formal data modeling. It uses a simple wizard that lets non-technical users add new data elements and expose them on a metadata layer. The system automatically generates scripts to load new data and distribute it appropriately on the data appliance. The system doesn't do the type of "fuzzy matching" needed to associate customer identities across different platforms when no direct link is available; it relies on the client or external partners to make those connections.

Once loaded, the data can be queried directly via SQL, typically using Aginity’s free Query Workbench, which is widely used for MPP databases throughout the industry. Or the data can be published using other Aginity tools that create data marts for external analysis and execution systems. The publishing tools can be run by a marketing analyst, although Aginity says most clients let IT staff use them so IT can enforce quality standards, governance rules, backup management, and similar best practices.

The net result is that Aginity can have a new customer database available to marketing in 90 days or less (often much less), compared with the six to twelve months this typically requires. It’s this speed and flexibility that make me consider Aginity a tool for marketers – and thus a CDP – rather than a tool for IT departments.

Aginity also provides some analytical and customer management features of its own. These include ability to add derived attributes such as lifetime value calculations and segment codes to customer records. These attributes can call on any data gathered by the system, a critical advantage of a CDP. Customer lists can be fed to external systems for direct execution, such as sending an email, or can be loaded into data marts that external systems access with their own segmentation and campaign management tools. Aginity currently provides a range of analysis features including dashboards, profile reports, and segment migration over time. It relies on external systems for advanced analytics such as predictive modeling and plans tighter integration with such systems to allow more precise control over customer treatments.

Aginity was founded in 2006 as a service firm to assemble data for analytics and marketing execution. Its current product, first released in January 2012, is based on tools it developed as a service agency. The company’s clients are concentrated among large retailers but include some ecommerce, manufacturing, and other industries that handle large amounts of customer data.

Wednesday, November 27, 2013

Friday, November 22, 2013

Marketing Automation News from Dreamforce: B2B More Integrated, B2C Stays Separate

I spent the early part of this week at Salesforce.com’s annual Dreamforce conference. Here are my observations.

The big news was for geeks. The main theme of the conference was Salesforce1, a new set of technologies that make it vastly easier to deliver and integrate mobile versions of Salesforce-based applications. It is apparently a major technical accomplishment and at least one of my technical friends was hugely impressed. But I can’t say I personally found it all that exciting. Perhaps we’ve reached the point where we expect technology to do pretty much everything, so the line between what's already available and what's new is only visible to experts. Any way you slice it, focusing on platform technology is much less exciting than last year's vision of "social enterprise".

The bad news was for B2B marketing automation. Conference presentations confirmed that Pardot, the B2B marketing automation system that Salesforce acquired as part of its ExactTarget acquisition, has been separated from the rest of ExactTarget and made part of the Sales cloud. There, Pardot is described only as providing lead scoring and nurture programs, which ignores landing pages, behavior tracking, and other features that B2B marketing automation usually provides (and Pardot includes). In terms of infrastructure, Pardot will eventually work directly from the CRM data objects, rather than maintaining its own synchronized database. (Data outside the CRM structure, such as detailed Web behaviors, will remain separate.)

What this means is that Salesforce sees B2B marketing automation as just an appendage of sales automation. This is pretty much the same constricted view of marketing automation that Salesforce management has held all along. The logical consequence is to make lead scoring and nurture campaigns standard features within the Sales offering and discard Pardot as a separate product. I should stress that no one at Salesforce said this was their plan, but it seems inevitable. If and when that does happen, only the most demanding companies will purchase a separate B2B marketing automation product.

To put a more optimistic spin on the same news: Salesforce will continue to let independent B2B marketing automation apps synch with Sales. If Salesforce does merge Pardot features into its core Sales product, then marketers who have a more expansive view of B2B marketing automation functions (or who simply want a system of their own) will be forced to buy from someone else.

The interesting news was that B2C marketing automation remains separate. Salesforce’s list of business groups includes the Sales Cloud, Service Cloud, and ExactTarget Marketing Cloud. Did you notice that just one of these has its own brand? As this suggests, and conference presentations confirm, Salesforce has kept B2C marketing distinct from its Sales and Service businesses, most importantly at the data and platform levels. The ExactTarget Marketing Cloud does now include Salesforce’s previously-purchased social marketing components, Radian6 social monitoring and Social.com social advertising. It also includes the iGoDigital predictive personalization technology that came along with the ExactTarget acquisition.

Salesforce did announce some plans to integrate the Marketing cloud with Sales and Service, but they are pretty much arm’s length: Marketing can receive alerts about changes in Sales (and I assume Service) data, even though that data remains separate; Sales and Service can send emails through the ExactTarget engine; Sales and Service can receive content recommendations from the Marketing predictive modeling tool. As near as I can tell, this is the same type of API-level integration available with any third-party system. For what it’s worth, the ExactTarget Marketing Cloud APIs are also part of Salesforce1, but don’t confuse that with sharing the same underlying platform.They don't.

The good news is the B2C marketing vision. It’s not really surprising that Salesforce kept its B2C platform separate, since Salesforce's core technology isn’t engineered for the massive data volumes and analytical processing needed for B2C in general and consumer Web marketing in particular. Happily, this technical necessity is accompanied by what strikes me as a sound vision for customer management. ExactTarget framed this around three goals: single view of the customer; managing the customer journey; and personalized content across all channels and devices. It described major features for each of these: a unified metadata layer to access (and optionally import) data from all sources; a “customer journey” engine to manage multi-step, branching flows; and predictive modeling to select the best offers and contents across email and Web messages.

This felt like a more coherent approach than Salesforce described for the Sales cloud, where external data and predictive modeling in particular were barely mentioned (or, more precisely, are still being left to App Exchange partners). The ExactTarget cloud still lacks tools to associate customer identities across email, phone, postal, social, and other systems, although there are plenty of partners to provide them. I didn’t get a close look at the details of the ExactTarget functions, which will really determine how well it competes with other customer management platforms. But the general approach makes sense.

News of the revolution may be exaggerated. Salesforce argued during the AppExchange Partner keynote that the AppExchange and Salesforce platform have created a “golden age of enterprise apps” by enabling small software developers to sell to big enterprises. One part of the argument is that the platform itself lets small vendors break through the credibility and scalability barriers that have historically protected large enterprise software vendors. The other is that end-users can purchase and deploy apps without involving the traditional gatekeepers in enterprise IT departments. A corollary to this is that end-users have different priorities than IT buyers – in particular, end users care more about ease of use – so successful software will be different.

Of course, this is exactly what the AppExchange partners wanted to hear and exactly the strategy behind Salesforce’s platform approach in the first place. But that doesn’t necessarily make it untrue: and, if correct, it would indeed be a revolution in the enterprise software industry.

But some revolutions are bigger than others. Even in an app-based world, individual users won't be making personal decisions about how to run core business processes. Rather, systems will be chosen at the department level because companies can more or less safely assume that whatever the department chooses will integrate smoothly with the corporate backbone. That's certainly a change but bear in mind that departmental buyers will have the same preference as corporate IT groups for working with the smallest possible number of vendors. This means there will still be the familiar tendency for individual vendors to add more functions over time. So industry dynamics may change less than you’d expect.

The big news was for geeks. The main theme of the conference was Salesforce1, a new set of technologies that make it vastly easier to deliver and integrate mobile versions of Salesforce-based applications. It is apparently a major technical accomplishment and at least one of my technical friends was hugely impressed. But I can’t say I personally found it all that exciting. Perhaps we’ve reached the point where we expect technology to do pretty much everything, so the line between what's already available and what's new is only visible to experts. Any way you slice it, focusing on platform technology is much less exciting than last year's vision of "social enterprise".

The bad news was for B2B marketing automation. Conference presentations confirmed that Pardot, the B2B marketing automation system that Salesforce acquired as part of its ExactTarget acquisition, has been separated from the rest of ExactTarget and made part of the Sales cloud. There, Pardot is described only as providing lead scoring and nurture programs, which ignores landing pages, behavior tracking, and other features that B2B marketing automation usually provides (and Pardot includes). In terms of infrastructure, Pardot will eventually work directly from the CRM data objects, rather than maintaining its own synchronized database. (Data outside the CRM structure, such as detailed Web behaviors, will remain separate.)

What this means is that Salesforce sees B2B marketing automation as just an appendage of sales automation. This is pretty much the same constricted view of marketing automation that Salesforce management has held all along. The logical consequence is to make lead scoring and nurture campaigns standard features within the Sales offering and discard Pardot as a separate product. I should stress that no one at Salesforce said this was their plan, but it seems inevitable. If and when that does happen, only the most demanding companies will purchase a separate B2B marketing automation product.

To put a more optimistic spin on the same news: Salesforce will continue to let independent B2B marketing automation apps synch with Sales. If Salesforce does merge Pardot features into its core Sales product, then marketers who have a more expansive view of B2B marketing automation functions (or who simply want a system of their own) will be forced to buy from someone else.

The interesting news was that B2C marketing automation remains separate. Salesforce’s list of business groups includes the Sales Cloud, Service Cloud, and ExactTarget Marketing Cloud. Did you notice that just one of these has its own brand? As this suggests, and conference presentations confirm, Salesforce has kept B2C marketing distinct from its Sales and Service businesses, most importantly at the data and platform levels. The ExactTarget Marketing Cloud does now include Salesforce’s previously-purchased social marketing components, Radian6 social monitoring and Social.com social advertising. It also includes the iGoDigital predictive personalization technology that came along with the ExactTarget acquisition.

Salesforce did announce some plans to integrate the Marketing cloud with Sales and Service, but they are pretty much arm’s length: Marketing can receive alerts about changes in Sales (and I assume Service) data, even though that data remains separate; Sales and Service can send emails through the ExactTarget engine; Sales and Service can receive content recommendations from the Marketing predictive modeling tool. As near as I can tell, this is the same type of API-level integration available with any third-party system. For what it’s worth, the ExactTarget Marketing Cloud APIs are also part of Salesforce1, but don’t confuse that with sharing the same underlying platform.They don't.

The good news is the B2C marketing vision. It’s not really surprising that Salesforce kept its B2C platform separate, since Salesforce's core technology isn’t engineered for the massive data volumes and analytical processing needed for B2C in general and consumer Web marketing in particular. Happily, this technical necessity is accompanied by what strikes me as a sound vision for customer management. ExactTarget framed this around three goals: single view of the customer; managing the customer journey; and personalized content across all channels and devices. It described major features for each of these: a unified metadata layer to access (and optionally import) data from all sources; a “customer journey” engine to manage multi-step, branching flows; and predictive modeling to select the best offers and contents across email and Web messages.

This felt like a more coherent approach than Salesforce described for the Sales cloud, where external data and predictive modeling in particular were barely mentioned (or, more precisely, are still being left to App Exchange partners). The ExactTarget cloud still lacks tools to associate customer identities across email, phone, postal, social, and other systems, although there are plenty of partners to provide them. I didn’t get a close look at the details of the ExactTarget functions, which will really determine how well it competes with other customer management platforms. But the general approach makes sense.

News of the revolution may be exaggerated. Salesforce argued during the AppExchange Partner keynote that the AppExchange and Salesforce platform have created a “golden age of enterprise apps” by enabling small software developers to sell to big enterprises. One part of the argument is that the platform itself lets small vendors break through the credibility and scalability barriers that have historically protected large enterprise software vendors. The other is that end-users can purchase and deploy apps without involving the traditional gatekeepers in enterprise IT departments. A corollary to this is that end-users have different priorities than IT buyers – in particular, end users care more about ease of use – so successful software will be different.

Of course, this is exactly what the AppExchange partners wanted to hear and exactly the strategy behind Salesforce’s platform approach in the first place. But that doesn’t necessarily make it untrue: and, if correct, it would indeed be a revolution in the enterprise software industry.

But some revolutions are bigger than others. Even in an app-based world, individual users won't be making personal decisions about how to run core business processes. Rather, systems will be chosen at the department level because companies can more or less safely assume that whatever the department chooses will integrate smoothly with the corporate backbone. That's certainly a change but bear in mind that departmental buyers will have the same preference as corporate IT groups for working with the smallest possible number of vendors. This means there will still be the familiar tendency for individual vendors to add more functions over time. So industry dynamics may change less than you’d expect.

Friday, November 15, 2013

ReachLocal Provides Turn-Key Lead Management for Small Business

There are about 3 million companies with revenue between $1 million and $5 million in the U.S., according to Manta. This is an enticingly huge market for marketing automation vendors, and one that seems largely untapped. The largest marketing automation vendor in the segment, Infusionsoft, has under 20,000 clients. This is barely scratching the surface.

But this perspective is misleading. Many small businesses do their marketing through CRM, email, and search advertising. Search marketing is particularly important as online searches replace newspapers and telephone directories. Companies that provide small businesses with online directories and ratings, search engine optimization, Web sites, and paid search marketing all have client bases that dwarf the small business marketing automation industry.

Those other vendors could easily see marketing automation as a natural line extension, since it would help their clients make better use of the traffic those vendors generate. Last month ReachLocal – a $450 million public company that purchases online ads for more than 23,000 local businesses -- moved in exactly this direction.

ReachLocal’s new service, called ReachEdge, provides clients with a custom Web site, contact database, automated email streams to leads and customers, and automated alerts to company staff. All the Web and advertising design is done for the client. There’s no automated lead scoring or branching campaign flows: when a new lead enters the system via a Web form or phone call, the user receives an alert, reviews whatever information was provided on the form or voice mail message, and manually classifies the lead as active, long term, new customer, or existing customer. Each category kicks off its own stream of messages (to the leads) and alerts (to company users), which can be spaced over time. Messages are sent by email; alerts can be sent by text, email, or a mobile app. Users can enter notes, add tags, and record revenue on contact records, providing a very light CRM option, or they can manually export the contact list to an external CRM system. Revenue can be used in campaign Return on Investment reports.

And that’s it, features-wise. If you’re used to looking at all-in-one small business marketing automation systems like Infusionsoft, Ontraport, or Venntive, the list may seem laughably primitive. But it’s a safe bet that many ReachLocal advertising clients have no interest in anything more complicated. The stumbling block facing all of marketing automation – that it takes more training, skills, and effort than most potential users can invest – is higher for very small businesses than anyone else. ReachLocal has reduced its clients' preparation to a minimum, and then left it up to them to pursue each new lead individually.

When a vendor does this much of the work, the key questions are less about the system than quality of the marketing. ReachLocal said that each Web site is custom designed, based on interviews with each client by U.S.-based industry specialists. I looked at a samples for three different plumbers (here, here, and here) and found they were indeed different and detailed enough to be effective. I’ll assume that advertising and email are similar. ReachLocal’s service includes one hour of customization per month and a completely new Web site every two years. The price is $299 per month, which is comparable to low-end marketing automation systems although higher than simple auto-responders.

Let me be clear: ReachEdge doesn’t provide the process automation or even email segmentation of a conventional marketing automation system, let alone serious CRM, ecommerce, or external integration. So small businesses that want to market aggressively will probably find it insufficient. But small businesses that just want to generate a stream of new leads while they focus their energies elsewhere may well find ReachEdge an appealing alternative.

But this perspective is misleading. Many small businesses do their marketing through CRM, email, and search advertising. Search marketing is particularly important as online searches replace newspapers and telephone directories. Companies that provide small businesses with online directories and ratings, search engine optimization, Web sites, and paid search marketing all have client bases that dwarf the small business marketing automation industry.

Those other vendors could easily see marketing automation as a natural line extension, since it would help their clients make better use of the traffic those vendors generate. Last month ReachLocal – a $450 million public company that purchases online ads for more than 23,000 local businesses -- moved in exactly this direction.

ReachLocal’s new service, called ReachEdge, provides clients with a custom Web site, contact database, automated email streams to leads and customers, and automated alerts to company staff. All the Web and advertising design is done for the client. There’s no automated lead scoring or branching campaign flows: when a new lead enters the system via a Web form or phone call, the user receives an alert, reviews whatever information was provided on the form or voice mail message, and manually classifies the lead as active, long term, new customer, or existing customer. Each category kicks off its own stream of messages (to the leads) and alerts (to company users), which can be spaced over time. Messages are sent by email; alerts can be sent by text, email, or a mobile app. Users can enter notes, add tags, and record revenue on contact records, providing a very light CRM option, or they can manually export the contact list to an external CRM system. Revenue can be used in campaign Return on Investment reports.

And that’s it, features-wise. If you’re used to looking at all-in-one small business marketing automation systems like Infusionsoft, Ontraport, or Venntive, the list may seem laughably primitive. But it’s a safe bet that many ReachLocal advertising clients have no interest in anything more complicated. The stumbling block facing all of marketing automation – that it takes more training, skills, and effort than most potential users can invest – is higher for very small businesses than anyone else. ReachLocal has reduced its clients' preparation to a minimum, and then left it up to them to pursue each new lead individually.

When a vendor does this much of the work, the key questions are less about the system than quality of the marketing. ReachLocal said that each Web site is custom designed, based on interviews with each client by U.S.-based industry specialists. I looked at a samples for three different plumbers (here, here, and here) and found they were indeed different and detailed enough to be effective. I’ll assume that advertising and email are similar. ReachLocal’s service includes one hour of customization per month and a completely new Web site every two years. The price is $299 per month, which is comparable to low-end marketing automation systems although higher than simple auto-responders.

Let me be clear: ReachEdge doesn’t provide the process automation or even email segmentation of a conventional marketing automation system, let alone serious CRM, ecommerce, or external integration. So small businesses that want to market aggressively will probably find it insufficient. But small businesses that just want to generate a stream of new leads while they focus their energies elsewhere may well find ReachEdge an appealing alternative.

Friday, November 08, 2013

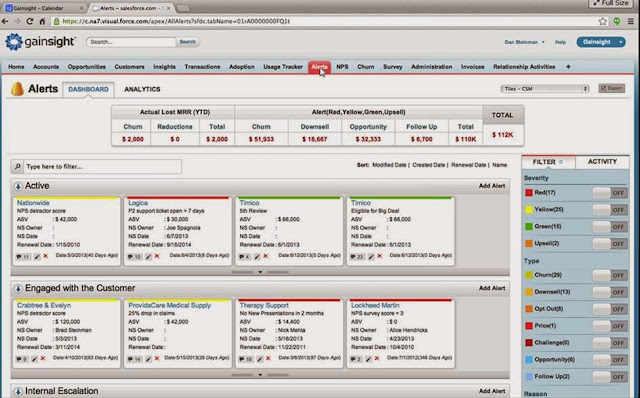

Gainsight Gives Customer Success Managers a Database of Their Own

I had a conversation last week with a vendor whose pitch was all about providing execution systems with a shared database that contains a unified view of customer information from all sources. Sadly, they were unfamiliar with the concept of a Customer Data Platform as I’ve been developing it over the past few months and didn’t realize that they fit the definition.

This post is not about that company.

Instead, it will be about another company I also spoke with last week, which I had originally considered a CDP but then decided wasn’t. After hearing their latest news, I still place them outside the border, but think they’re creeping closer and – for reasons I’ll explain later -- will some day reach the other side.

The company is Gainsight (formerly JBara), whose Web site positions it as ”a complete customer success platform”. That could easily be pure fluff – doesn’t every company contribute to its customers’ success? – but Gainsight actually means something concrete: it helps customer success managers identify churn risks and sales opportunities among their clients. As Gainsight sees it, this makes them the post-sales analogue to marketing automation systems (which manage acquisition) and CRM systems (which manage sales)*. This trichotomy** ignores customer service systems, which I'd consider the major post-sales management tools. But Gainsight is genuinely different from customer service, and in fact uses those systems as data sources. So even though Gainsight may not have created the third great category of customer-facing systems, it does do something important.

Specifically, Gainsight gathers information from online products, CRM, customer service, accounting, and customer surveys to create a complete view of how existing customers are using the products they own, whether they’re renewing or expanding their usage, what they’re paying, what sorts of service issues they’re having, and what attitudes they’ve expressed. It tracks this over time and uses the information in a variety of ways: to profile and summarize the health of each account; to send alerts about problems or opportunities; to display trends in usage, satisfaction, and other measures; and to analyze the customer base by relationship stage, revenue range, and other factors. The information is presented through Gainsight’s own interface, which runs on Salesforce.com’s Force.com platform, making it easy to integrate with Salesforce itself.

Gainsight originally stored all its data within Force.com, but it has recently started using MongoDB and Hadoop, which will allow it store details such as clickstreams and product usage history. The company has also expanded its "big data science" resources to identify the attributes of customers likely to churn or to purchase new services. This will help users define the rules that drive alerts. So far, there is no automated predictive modeling to build such rules, although that’s planned for the future. Data is typically loaded weekly, which Gainsight says is the most often that customers have requested.

Of course, once all that juicy customer data has been assembled in one place, companies could use it for more than customer success management. This is part of Gainsight’s master plan, which is to expand beyond customer success teams to account management, sales, and other departments.

This brings us (or me, at least) back to the question of whether Gainsight is a Customer Data Platform. It does build a multi-source customer database, which is the core CDP function. Although the data sources are largely limited to the client’s own systems, external sources are not essential for a CDP. In any event, Gainsight could probably add external sources fairly easily if a client wanted – especially now that it isn’t bound by the limits of Force.com. Gainsight isn’t yet doing predictive modeling or decision management beyond rule-based alerts, but those common CDP features are also optional, and Gainsight is moving in those directions. Gainsight clearly meets the CDP requirement of building a database controlled by users outside of IT, even though in this case the users are not marketers.

Where Gainsight gets disqualified is that a CDP by definition makes its data available to other systems to guide customer treatments. The Gainsight database is technically exposed already: users could query the Force.com data via the Salesforce API or write direct SQL queries against the new Mongo / Hadoop back-end. But so far Gainsight’s direction has been to use its data in its own applications and user interface. If Gainsight opened itself up as a data source, it would clearly be a Customer Data Platform.

Even as Gainsight stands today, it’s still more evidence supporting the CDP proposition that companies need a multi-source database – and a warning that multi-source databases themselves could proliferate into a new forest of single-purpose data silos if companies don't adopt a shared CDP instead. As this danger becomes clearer, Gainsight and other companies will need to either become general-purpose CDPs themselves or become applications that plug into a CDP built by someone else.

Gainsight was founded in 2009 and started taking paying customers in 2012. It now has about 20 clients, mostly large enterprises running an online service or Web site. Pricing is based on the number of modules used plus number of users, and averages around $50,000 to $60,000 per year for 20 to 50 users.

_____________________________________________________________________________________________

* Okay, CRM really is more than sales force automation, but that’s the term that Gainsight used and CRM is increasingly used in that narrower sense, mostly because that’s how Salesforce.com describes itself. Get over it.

** Yes, that’s a word.

This post is not about that company.

Instead, it will be about another company I also spoke with last week, which I had originally considered a CDP but then decided wasn’t. After hearing their latest news, I still place them outside the border, but think they’re creeping closer and – for reasons I’ll explain later -- will some day reach the other side.

The company is Gainsight (formerly JBara), whose Web site positions it as ”a complete customer success platform”. That could easily be pure fluff – doesn’t every company contribute to its customers’ success? – but Gainsight actually means something concrete: it helps customer success managers identify churn risks and sales opportunities among their clients. As Gainsight sees it, this makes them the post-sales analogue to marketing automation systems (which manage acquisition) and CRM systems (which manage sales)*. This trichotomy** ignores customer service systems, which I'd consider the major post-sales management tools. But Gainsight is genuinely different from customer service, and in fact uses those systems as data sources. So even though Gainsight may not have created the third great category of customer-facing systems, it does do something important.

Specifically, Gainsight gathers information from online products, CRM, customer service, accounting, and customer surveys to create a complete view of how existing customers are using the products they own, whether they’re renewing or expanding their usage, what they’re paying, what sorts of service issues they’re having, and what attitudes they’ve expressed. It tracks this over time and uses the information in a variety of ways: to profile and summarize the health of each account; to send alerts about problems or opportunities; to display trends in usage, satisfaction, and other measures; and to analyze the customer base by relationship stage, revenue range, and other factors. The information is presented through Gainsight’s own interface, which runs on Salesforce.com’s Force.com platform, making it easy to integrate with Salesforce itself.

Gainsight originally stored all its data within Force.com, but it has recently started using MongoDB and Hadoop, which will allow it store details such as clickstreams and product usage history. The company has also expanded its "big data science" resources to identify the attributes of customers likely to churn or to purchase new services. This will help users define the rules that drive alerts. So far, there is no automated predictive modeling to build such rules, although that’s planned for the future. Data is typically loaded weekly, which Gainsight says is the most often that customers have requested.

Of course, once all that juicy customer data has been assembled in one place, companies could use it for more than customer success management. This is part of Gainsight’s master plan, which is to expand beyond customer success teams to account management, sales, and other departments.

This brings us (or me, at least) back to the question of whether Gainsight is a Customer Data Platform. It does build a multi-source customer database, which is the core CDP function. Although the data sources are largely limited to the client’s own systems, external sources are not essential for a CDP. In any event, Gainsight could probably add external sources fairly easily if a client wanted – especially now that it isn’t bound by the limits of Force.com. Gainsight isn’t yet doing predictive modeling or decision management beyond rule-based alerts, but those common CDP features are also optional, and Gainsight is moving in those directions. Gainsight clearly meets the CDP requirement of building a database controlled by users outside of IT, even though in this case the users are not marketers.

Where Gainsight gets disqualified is that a CDP by definition makes its data available to other systems to guide customer treatments. The Gainsight database is technically exposed already: users could query the Force.com data via the Salesforce API or write direct SQL queries against the new Mongo / Hadoop back-end. But so far Gainsight’s direction has been to use its data in its own applications and user interface. If Gainsight opened itself up as a data source, it would clearly be a Customer Data Platform.

Even as Gainsight stands today, it’s still more evidence supporting the CDP proposition that companies need a multi-source database – and a warning that multi-source databases themselves could proliferate into a new forest of single-purpose data silos if companies don't adopt a shared CDP instead. As this danger becomes clearer, Gainsight and other companies will need to either become general-purpose CDPs themselves or become applications that plug into a CDP built by someone else.

Gainsight was founded in 2009 and started taking paying customers in 2012. It now has about 20 clients, mostly large enterprises running an online service or Web site. Pricing is based on the number of modules used plus number of users, and averages around $50,000 to $60,000 per year for 20 to 50 users.

_____________________________________________________________________________________________

* Okay, CRM really is more than sales force automation, but that’s the term that Gainsight used and CRM is increasingly used in that narrower sense, mostly because that’s how Salesforce.com describes itself. Get over it.

** Yes, that’s a word.

Friday, November 01, 2013

Bislr: A "Marketing Operating System" That Includes Marketing Automation As An App

There was a really interesting discussion this week over on Scott Brinker’s ChiefMartec blog about the evolution of marketing automation systems into “platforms” that each support a swarm of satellite applications connected through open APIs. This is something I’ve already thought and written about quite a bit, but the discussion did advance my understanding of whether any marketing automation vendor gains a business advantage if third party applications can connect to all of them. I think the answer is: probably not. This means the platform strategy provides less value than many vendors and investors assume, although it may be needed for competitive parity.

The other issue that just started to surface as the discussion petered out was the nature of platform integrations. Part of this had to do with the scope of the integration available (that is, which functions are accessible via the API). Another aspect was whether it matters how hard it is to create the integrated applications. Traditionally, marketer automation users have needed just a little technical skill to connect an existing application through an API, but the developers themselves have needed considerably more skill to create the connectors.

I had a related discussion on Wednesday with Act-On Software, which just announced its own open API and expanded partner exchange Act-On's technical lead said part of this project involving reworking its APIs from SOAP to RESTful protocols precisely because REST connectors are easier for partners to create. A separate talk with Bislr, which calls itself a “marketing operating system” and considers marketing automation itself just another app, offered an even more extreme contrast, describing Bislr’s goal of making app development something that even “semi-professional developers” can do.

It's debatable whether Bislr’s approach is significantly different from being a marketing automation “platform”, but Bislr itself is clearly part of a new generation. The current marketing automation leaders – Oracle Eloqua, Marketo, Salesforce Pardot, Silverpop, Act-On, etc. – date from the mid-2000s and were originally built to feed leads to Salesforce.com. The newer products, including Leadsius, Salesformics, Leadsberry, Target360, and Inbox25 as well Bislr, were all launched after 2010 and some are barely out of beta. Their function lists closely resemble the older marketing automation products, but they differ in other ways including primary integration with CRM systems other than Salesforce, lower pricing, focus on ease of use at the expense of advanced features, more native social media integration, and, presumably, more modern technology under the hood. Apologies if that description seems a bit vague: the only one of vendors I’ve looked at in any detail in Bislr. So let’s talk a little more about them.

As previously mentioned, Bislr presents itself as a “marketing operating system” that hosts user-selected apps in the same way as a smartphone or tablet. Conceptually, this allows greater flexibility than traditional marketing automation systems, because users could load the app of their choice for a particular purpose and could only add functions they really want. This truly is different from the current marketing automation "platforms", which provide a core of standard marketing automation functions before any external products are added. But so far, all of Bislr's apps come from Bislr itself, so Bislr does effectively provide its own set of core functions and users can't substitute another app for those functions if they prefer. The closest Bislr comes to the vision is in content creation, where basic functions are built into its email, landing page, and form design apps, but users can also employ a separate app called BislrFX for much more elaborate HTML5 “responsive design”.

Bear in mind that Bislr’s intention is precisely to allow such third-party applications, and indeed to make it easier to build them for Bislr than other products. The system is built on a cloud-based non-SQL database, which should help. But, ironically, the more different Bislr is from other marketing automation products, the more third-party vendors will need to change their standard integrations to connect with it. To me, this is a big problem with the platform strategy: even though third party vendors would like to connect with as many platforms as possible, there’s at least some cost in adding each new partner. At a minimum, the vendors will connect with the most popular systems first. More worrisome, if the industry becomes so concentrated that a few marketing automation vendors have most of the clients, the third party vendors may never bother to build connectors for the other systems. So, even though the platform strategy theoretically allows smaller marketing automation vendors to compete by giving them features they didn’t build themselves, it might not really play out that way. We can expect the larger marketing automation vendors to gently push things in that direction by letting third party products offer advanced functions that are unique to one marketing automation system – making the third party products less attractive on other platforms. At least, that’s what I’d do if I were in their shoes.

But I digress. Until Bislr adds outside apps, buyers should look at Bislr's existing apps in comparison with corresponding features of conventional marketing automation systems.

The list is includes all standard marketing automation features:workflows, email, attribute- and behavior-based lead scoring (separate apps for each), social sharing and listening, landing pages, Web forms, calls to action, a/b testing, real time reporting, CRM integration with Salesforce.com and NetSuite, Webinar integration with GoToWebinar (due soon), campaign tracking, and “Web hooks” to integrate via external systems. It also adds some that are less common, including social data appending, blogging, and Web content management.

The quality of the apps was also impressive. Bislr says its goal is to provide easy-to-use versions of the most important functions, not to offer every possible feature. But the workflow engine provided a wide range of prebuilt actions, triggers, and conditions. The email, landing page, form, and call to action options all seemed reasonably complete. Social data appending can search 27 sources, will automatically identify potential matches, and adds social activity to each customer profile. Users can create dynamic lists and see a detailed history of an individual’s interactions.

On the other hand, Bislr said it doesn’t synchronize with custom objects from Salesforce.com and it doesn’t directly control which users can edit specific marketing campaigns or assets. It does let clients control access by creating multiple accounts within a single implementation, for example allowing a global enterprise to have different accounts for different regions or product groups plus a global account to share materials, contacts, and reporting.

Bottom line: Bislr is worth a look based on what it delivers today, whether or not it fulfills its broader vision tomorrow. Pricing starts at $1,000 per month and is based on a combination of contact count and features available. The system was launched in February 2013 and has about 100 current clients, including 40 mid-size or larger enterprises.

The other issue that just started to surface as the discussion petered out was the nature of platform integrations. Part of this had to do with the scope of the integration available (that is, which functions are accessible via the API). Another aspect was whether it matters how hard it is to create the integrated applications. Traditionally, marketer automation users have needed just a little technical skill to connect an existing application through an API, but the developers themselves have needed considerably more skill to create the connectors.

I had a related discussion on Wednesday with Act-On Software, which just announced its own open API and expanded partner exchange Act-On's technical lead said part of this project involving reworking its APIs from SOAP to RESTful protocols precisely because REST connectors are easier for partners to create. A separate talk with Bislr, which calls itself a “marketing operating system” and considers marketing automation itself just another app, offered an even more extreme contrast, describing Bislr’s goal of making app development something that even “semi-professional developers” can do.

It's debatable whether Bislr’s approach is significantly different from being a marketing automation “platform”, but Bislr itself is clearly part of a new generation. The current marketing automation leaders – Oracle Eloqua, Marketo, Salesforce Pardot, Silverpop, Act-On, etc. – date from the mid-2000s and were originally built to feed leads to Salesforce.com. The newer products, including Leadsius, Salesformics, Leadsberry, Target360, and Inbox25 as well Bislr, were all launched after 2010 and some are barely out of beta. Their function lists closely resemble the older marketing automation products, but they differ in other ways including primary integration with CRM systems other than Salesforce, lower pricing, focus on ease of use at the expense of advanced features, more native social media integration, and, presumably, more modern technology under the hood. Apologies if that description seems a bit vague: the only one of vendors I’ve looked at in any detail in Bislr. So let’s talk a little more about them.

As previously mentioned, Bislr presents itself as a “marketing operating system” that hosts user-selected apps in the same way as a smartphone or tablet. Conceptually, this allows greater flexibility than traditional marketing automation systems, because users could load the app of their choice for a particular purpose and could only add functions they really want. This truly is different from the current marketing automation "platforms", which provide a core of standard marketing automation functions before any external products are added. But so far, all of Bislr's apps come from Bislr itself, so Bislr does effectively provide its own set of core functions and users can't substitute another app for those functions if they prefer. The closest Bislr comes to the vision is in content creation, where basic functions are built into its email, landing page, and form design apps, but users can also employ a separate app called BislrFX for much more elaborate HTML5 “responsive design”.

Bear in mind that Bislr’s intention is precisely to allow such third-party applications, and indeed to make it easier to build them for Bislr than other products. The system is built on a cloud-based non-SQL database, which should help. But, ironically, the more different Bislr is from other marketing automation products, the more third-party vendors will need to change their standard integrations to connect with it. To me, this is a big problem with the platform strategy: even though third party vendors would like to connect with as many platforms as possible, there’s at least some cost in adding each new partner. At a minimum, the vendors will connect with the most popular systems first. More worrisome, if the industry becomes so concentrated that a few marketing automation vendors have most of the clients, the third party vendors may never bother to build connectors for the other systems. So, even though the platform strategy theoretically allows smaller marketing automation vendors to compete by giving them features they didn’t build themselves, it might not really play out that way. We can expect the larger marketing automation vendors to gently push things in that direction by letting third party products offer advanced functions that are unique to one marketing automation system – making the third party products less attractive on other platforms. At least, that’s what I’d do if I were in their shoes.

But I digress. Until Bislr adds outside apps, buyers should look at Bislr's existing apps in comparison with corresponding features of conventional marketing automation systems.

The list is includes all standard marketing automation features:workflows, email, attribute- and behavior-based lead scoring (separate apps for each), social sharing and listening, landing pages, Web forms, calls to action, a/b testing, real time reporting, CRM integration with Salesforce.com and NetSuite, Webinar integration with GoToWebinar (due soon), campaign tracking, and “Web hooks” to integrate via external systems. It also adds some that are less common, including social data appending, blogging, and Web content management.

The quality of the apps was also impressive. Bislr says its goal is to provide easy-to-use versions of the most important functions, not to offer every possible feature. But the workflow engine provided a wide range of prebuilt actions, triggers, and conditions. The email, landing page, form, and call to action options all seemed reasonably complete. Social data appending can search 27 sources, will automatically identify potential matches, and adds social activity to each customer profile. Users can create dynamic lists and see a detailed history of an individual’s interactions.

On the other hand, Bislr said it doesn’t synchronize with custom objects from Salesforce.com and it doesn’t directly control which users can edit specific marketing campaigns or assets. It does let clients control access by creating multiple accounts within a single implementation, for example allowing a global enterprise to have different accounts for different regions or product groups plus a global account to share materials, contacts, and reporting.

Bottom line: Bislr is worth a look based on what it delivers today, whether or not it fulfills its broader vision tomorrow. Pricing starts at $1,000 per month and is based on a combination of contact count and features available. The system was launched in February 2013 and has about 100 current clients, including 40 mid-size or larger enterprises.

Subscribe to:

Posts (Atom)