Whoa. What the heck does that last sentence mean? Let me unpack it a bit:

- By “system-assembled customer journey” I mean the systems automatically derive a customer journey from the customer data they’ve assembled. That’s quite different from pre-defining an ideal customer journey and trying to force customers to follow it. It’s even more different from taking conventional multi-step campaigns and calling them "journeys”. A true "system-assembled journey" would be built by examining the sequence of events for each customer and finding the most common paths to purchase. This still isn't a purely objective process because some human or machine judgement is still needed to exclude irrelevant details, assign interactions to journey stages, and select the most important sequences. But it's much more data-driven than starting with an marketer-created design.

- By “journey as the framework for message selection” I mean that marketing messages or campaigns are triggered when customers reach a particular journey step. Again, this is different from defining selection rules separately for each campaign, which is how conventional marketing automation and real-time interaction systems work. It’s also different from systems that draw journey maps but don’t connect them with campaigns for execution. Attaching all campaigns to a single journey map simplifies creation of selection rules and provides greater visibility into relationships among campaigns. In other words, journey orchestration makes it easier to coordinate customer treatments across multiple campaigns, which is one of the key problems with conventional marketing automation and interaction management approaches.**

Ok, let’s assume you’re now convinced that “journey orchestration engine” has a specific meaning that describes something useful. Your next question, presumably, is where can I buy one? (Oh, you’re not that easy to sell? Listen closely: It’s new. It’s bright. It’s shiny. New. Bright. Shiny. Newbrightshiny. Now are you ready to buy? I thought so.) My blog post listed three vendors from the MarTech show: Pointillist, Usermind, and Thunderhead. I promise I’ll review those soon. But I had already spoken with another relevant vendor before the show, Hive9. So let’s start with them.

If you look at Hive9’s Web site, you may wonder whether I’ve sent you to the right place. They position themselves as “marketing performance management” with no mention of anything resembling journey orchestration. That’s because Hive9 actually has three connected modules: one for marketing planning, one for marketing measurement, and one for optimization (which is what I’m calling journey orchestration). These were all developed within B2B marketing agency Bulldog Solutions, which spun off Hive9 about a year ago.

The planning module was the original product. It lets marketers set up a hierarchy with plans at the top, going down to programs, campaigns, and tactics. Tactics have owners, budgets, start and end dates, revenue targets, types (usually a channel or asset) and other attributes such as journey stage, audience, business unit, geography, and language. These can be tailored to each client. Tactics can be tied to Workfront for project management, filtered on pretty much any attribute, and displayed on a Gantt chart-style calendar. Integration with Oracle Eloqua and Salesforce.com lets a new tactic automatically create a corresponding campaign in either system. Each plan can have a marketing funnel with its own set of stages and targets for conversion rates, velocity, and deal size.

The measurement module reads information from plans and imports revenue, accounts, opportunities, and contacts from CRM, marketing automation, and other systems. Standard integrations are available for Salesforce.com, Oracle Eloqua, Marketo, Google Analytics, Adobe Marketing Analytics, and other systems. Other sources can be integrated through API connections or flat file imports. The system relies primarily on customer identifiers provided by source systems although it can stitch together identities when different systems share some IDs.

Once the data is loaded, the measurement module provides dashboards and other reports to show marketing results including revenue impact; counts, conversion rates and velocity by funnel stage; and whatever other data the client has integrated, such as social sentiment or customer satisfaction. Revenue impact can be measured with first-touch, last-touch, evenly-weighted, position-based, and several other algorithms. The vendor plans to add statistically inferred weights in April. Results can be filtered by plan, audience, tactic type, assets, or other attributes; compared across time periods; and examined for trends. Dashboards are customized by the vendor for each client, although Hive9 plans to add self-service capabilities in the future.

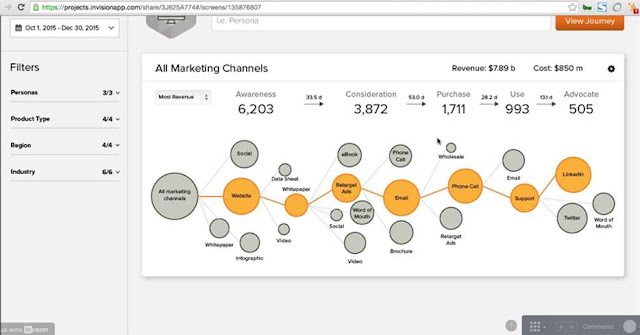

The optimization module is where journey orchestration happens. Journey stages are defined within the optimization module. Tactics can be tagged directly with stages, or stages can be assigned to assets which are themselves assigned to tactics. Events or assets managed in other systems can also be tagged with a journey stage and channel. However the connection is made, campaign responses are tagged with channel and journey stage and then assembled into a journey map. The map shows the number of interactions by channel and stage and highlights the most common path taken by buyers. This isn’t fully automated journey mapping because the stages are preassigned by the marketer. But the system does discover the most popular paths and most effective marketing assets on its own. So that’s pretty close.

The optimization module is where journey orchestration happens. Journey stages are defined within the optimization module. Tactics can be tagged directly with stages, or stages can be assigned to assets which are themselves assigned to tactics. Events or assets managed in other systems can also be tagged with a journey stage and channel. However the connection is made, campaign responses are tagged with channel and journey stage and then assembled into a journey map. The map shows the number of interactions by channel and stage and highlights the most common path taken by buyers. This isn’t fully automated journey mapping because the stages are preassigned by the marketer. But the system does discover the most popular paths and most effective marketing assets on its own. So that’s pretty close.Even more important, the optimization module can contain rules that trigger external marketing campaigns when a customer enters a given journey stage. This is what really qualifies Hive9 as a journey optimization engine. Here's how it works: users can set up a rule tied to journey stage, product type, or customer attribute such as industry or persona. Customers who qualify for a rule can be sent to specified marketing automation campaign. Rules can avoid repeating messages to the same person and can select a “next best message” for the external system to deliver. This definitely qualifies as journey orchestration.

Hive9 pricing starts around $25,000 per year for mid-market clients. Modules are priced separately. Fees are based on the size of the company marketing budget for the planning module, on the number of records, dashboards, and data sources for the the measurement module, and on the number of touchpoints for the optimization module.

________________________________________________________________________________

* Also, this lets me call systems that do this “journey optimization engines”, giving a three letter acronym of JOE, which is so darn cute.

** You may notice that “journey optimization” sounds a lot like what I’ve previously called “state-based marketing”. Both do select marketing treatments based on a customer’s location within a state/stage framework. If I had to draw distinction, I’d say that journeys suggest forward progression from one stage to the next, while movement among states is not necessarily linear. Similarly, journey orchestration engines send marketing messages through other systems, while state-based systems could use internal or external delivery functions. In other words, journey orchestration is a special type of state-based system.