Everyone in marketing knows there’s a lot of new marketing technology, but how quickly is martech really growing? Many people cite changes in Scott Brinker’s iconic marketing technology landscape, which has roughly doubled in size every year since Brinker first published it in 2011. Brinker himself is always careful to stress that his listings are not comprehensive, and anyone familiar with the industry will quickly realize much of the growth in his vendor count reflects greater thoroughness and broader scope rather than appearance of new vendors. But no matter how many caveats are made, the ubiquity of Brinker’s chart leaves a strong impression of tremendously quick expansion.

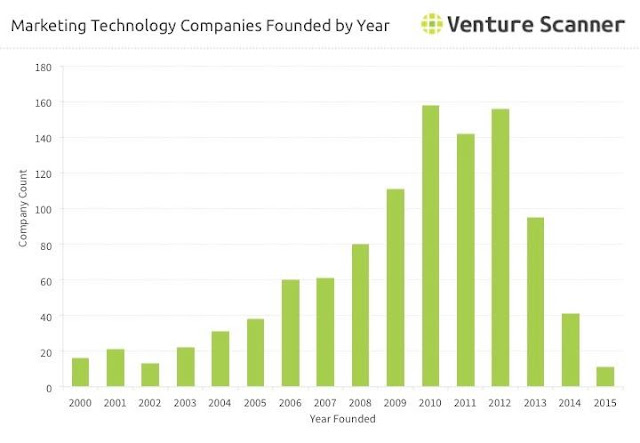

Fortunately, other data is available. Venture Scanner recently published the the number of companies founded by year for 1,295 martech firms in its database. This shows growth of around 12% per year from 2000 through 2012. (Figures for 2013 and later are almost surely understated because many firms started during those years have not yet been included in the data.)

A similar analysis from CabinetM, which has a database of 3,708 companies, showed a slightly higher rate of 14.5% per year for the same period.* Both sets of data show a noticeable acceleration after 2006: to about 16.5% for Venture Scanner and just under 16% for CabinetM.

These figures are still far from perfect. Many firms are obviously missing from the Venture Scanner data. CabinetM has apparently missed many as well: Brinker reported that comparison between CabinetM’s list and his own found that each had about 1,900 vendors the other did not. All lists will miss companies that are no longer in business, so there were probably more start-ups in each year than shown.

But even allowing for such issues, it’s probably reasonable to say that the number of vendors in the industry has been growing at something from 15% to 20% per year. That’s a healthy rate but nothing close to an annual doubling.

Note also that we’re talking here about the number of companies, not revenue. I suspect revenue is growing more quickly than the number of vendors but can't give a meaningful estimate of how much.

Are particular segments within the industry growing faster than others? CabinetM provided me with a breakdown of starts by year by category.** To my surprise, growth has been spread fairly evenly across the different types of systems. Adtech grew a bit faster than the other categories in 2006 to 2010 and content marketing has grown faster than the average since 2006. But the share of marketing automation and operations have been surprisingly consistent throughout the period covered. So while the number of marketing automation vendors has indeed grown quickly, other categories seem to growing at about the same pace.

So what, if anything, does this tell us about the future? It's certainly possible some of the drop-off in new vendors since 2013 reflects an actual slowdown in addition to the lag time before new vendors appear in databases. Funding data from Venture Scanner suggests that 2015 may have been a peak year for investments, although 2016 data is obviously incomplete.

Another set of funding data, from PitchBook, suggests 2014 was a peak but shows much less year-on-year variation than Venture Scanner. The inconsistency between the two sets of data makes it hard to accept either source as definitive.

So, what does this all mean? First of all, that people should calm down a bit: the number of martech vendors hasn't been doubling every year. Second, that industry growth may indeed be slowing, although it's too soon to say for sure. Third, whatever the exact figures, there are plenty of martech vendors out there and they're not going away any time soon. So marketers need to focus on a systematic approach to martech acquisition, balancing new opportunities against training and integration costs.

__________________________________________________________________________________

* Here's the actual CabinetM data. I'm mostly showing this to clarify that my "growth rate" is comparing the number of new companies vs. total industry size, and not the number of new companies this year vs new companies last year.

**CabinetM actually tracks 30 categories. I combined them into the seven groups used here.

Thursday, September 15, 2016

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment