Eloqua last week filed for an initial public offering of its stock. The registration statements accompanying these filings are like a striptease: often more interesting for what they hide than what they reveal. Eloqua’s was no exception.

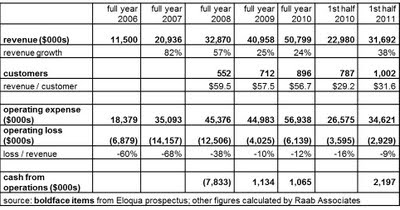

Let’s start with what they showed. This included the basics: revenue, customers, profits, and cash flow.

Revenue increased roughly $10 million per year from 2006 through 2010, which is nothing to sneeze at although the higher base meant the percentage rate slumped significantly in 2009 and 2010, to about 25%. Year to date in 2011, growth is back up to nearly 40%, which would translate to $70 million for full year 2011 if maintained.

Revenue increased roughly $10 million per year from 2006 through 2010, which is nothing to sneeze at although the higher base meant the percentage rate slumped significantly in 2009 and 2010, to about 25%. Year to date in 2011, growth is back up to nearly 40%, which would translate to $70 million for full year 2011 if maintained.

Client counts are reported only for 2008 through mid 2011. The first bit of news is that revenue per client was virtually flat during that period. I expected it to grow as Eloqua sold into larger accounts. Eloqua doesn’t offer an explanation, but my guess is heavy competition forced them to reduce prices during this period.

Operating expenses grew sharply through 2008, nearly outpacing revenue. The company tightened its belt in response to economic conditions in 2009, in particular by reducing marketing and sales costs by nearly $4 million (more on that later). It reinstated most of that budget the next year, but we can wonder how much the cutbacks slowed Eloqua’s revenue growth. The industry as a whole was almost certainly grew faster than 25% in 2009 and Raab Associates estimates it doubled in 2010.

On a brighter note, cash from operations has been positive since 2009 and looks great for the first half of 2011. The difference between positive cash flow and negative profits is one of those accounting mysteries I won’t claim to fully understand; as near as I can tell, it’s due to a combination of advance customer payments (which won’t be counted as revenue until they are earned) and non-cash expenses in paid in company stock.

So much for what Eloqua said. (Of course, these are just highlights – the full registration statement runs over 200 pages.) But what does it mean?

Ultimately, investors want to know whether Eloqua will ever show a profit. Companies in the early growth stage rarely do, so the losses to date are not necessarily cause for concern. Software-as-a-service vendors in particular love to point out that they get a recurring revenue stream from each customer, so there are future profits that are masked by first-year sales expenses. They also argue that much of their operating cost is fixed, so the incremental cost of servicing new customers is quite low. In both cases, then, present losses are a harbinger of future profit.

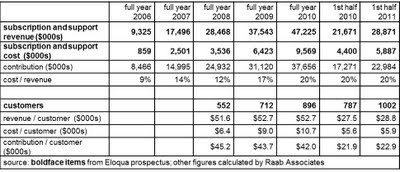

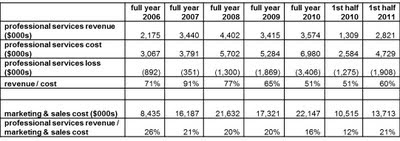

Let’s start with the servicing costs. Eloqua reports separate revenues for subscription and support (what I’d call servicing costs) and professional services. It also breaks out costs for those two categories. Professional services are under 10% of revenue and they jump depending on whether Eloqua performs them in-house or shares them with partners. They also run at a loss, which means they are more like a sales cost. In any case, let’s ignore them for now and focus on servicing costs.

What we see is that, instead of falling, the amount of revenue spent to support each client has actually increased as Eloqua added more clients. The good news is that it has pretty much stabilized around $45,000 per client or 20% of revenue in 2009 and 2010. The reason seems to be a substantial upgrading of Eloqua’s infrastructure in recent years, perhaps combined with competitive pressures that have prevented it from raising prices as it serves larger clients. A reasonable conclusion, at least for the short term, is that Eloqua’s operating margins won’t get much better as it grows.

Ah, but what about sales costs? After all, the company pays those just once per client, while it earns its $45,000 per client each year. Once it earns back the sales cost, that future contribution is gravy (or, at least, contribution to other fixed costs).

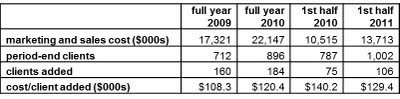

And what is each sale costing? The registration statement shows marketing and sales costs each year and year-end client counts. So we can easily calculate the number of clients added each year and, from that, the sales cost per new client. What we find is a rather frightening $120,000 per client in 2010, and about the same so far in 2011. At $45,000 contribution per year, that would take nearly 3 years to recoup. Ouch.

But that’s assuming all sales and marketing costs are spent on new clients. Some of them probably go to service existing clients – although that actually makes things worse, since those costs would recur each year and reduce the operating contribution. What makes things better, sort of, is recognizing that Eloqua actually loses some existing clients each year.

But that’s assuming all sales and marketing costs are spent on new clients. Some of them probably go to service existing clients – although that actually makes things worse, since those costs would recur each year and reduce the operating contribution. What makes things better, sort of, is recognizing that Eloqua actually loses some existing clients each year.

This is where what Eloqua didn’t reveal is intriguing. I couldn’t find retention rate anywhere in the registration statement. This is a critical variable in software-as-a-service economics and is regularly reported by public companies. I’m not aware of a rule against Eloqua reporting it, although I’ve never researched that point. (If anyone out there knows either way, please tell me.)

In the absence of real information, I’ll just blindly speculate. Let’s say Eloqua loses 20% of its customers each year – a figure that translates to better than 98% per month retention, which would be considered pretty good. We use that value in two ways: to calculate the number of clients Eloqua must sell to replace its losses, and to estimate the lifetime value of a client.

Adding in the replacement clients, the cost per new client comes down to about $70,000, for a payback of about 1.5 years at $45,000 contribution. That’s pretty respectable.

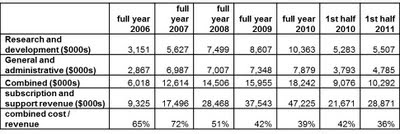

Attrition also reduces the lifetime value: at 20% per year, the five year value comes to about 3.4 years (1.0 + .80 + .64 + .51 + .41), or $151,000. Subtracting the sales cost, you still have a nice $81,000 contribution to other fixed costs over the five year period. Those other fixed costs (R&D and G&A) have been rising much more slowly – around 15% per year, to where they are now around 36% of revenue.

Attrition also reduces the lifetime value: at 20% per year, the five year value comes to about 3.4 years (1.0 + .80 + .64 + .51 + .41), or $151,000. Subtracting the sales cost, you still have a nice $81,000 contribution to other fixed costs over the five year period. Those other fixed costs (R&D and G&A) have been rising much more slowly – around 15% per year, to where they are now around 36% of revenue.

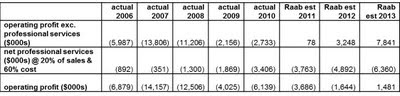

If we put all those figures together, assume a 30% growth rate, and ignore professional services, it looks like Eloqua should just about break even in 2011, make a reasonable profit in 2012, and make a substantial amount in 2013.

But can we really ignore professional services? As I mentioned earlier, it runs at a loss but has varied greatly over time: from recovering 91% in 2007 to just 51% in 2010. The closest relationship I can find is between professional services revenue and marketing and sales cost: both were cut in 2009 and have rebounded since.

A somewhat optimistic estimate of professional services losses might be the actual rate for 2011: revenue at 20% of sales cost and recovering 60% of expenses. At that level, my estimates push out profitability to 2013. On the other hand, Eloqua has considerable control over pricing of its services. Should market conditions improve, they might be able to raise prices again to something close to breakeven. So perhaps I’m being pessimistic.

Back to that earlier question: What does it all mean? Certainly that Eloqua can be profitable even at current levels of pricing, operating costs, and sales costs. Not every firm in the business can say that. Equally important, I suspect improvements are possible in each of those areas – and would fall straight to the bottom line. So, current losses notwithstanding, Eloqua's future looks pretty bright.

1 comment:

Strong and thoughtful analysis. Thanks.

Post a Comment