So far as I know, Martech Fatigue Syndrome is not yet a real thing. But I've definitely sensed a certain weariness in recent discussions of marketing technology. The initial excitement about new opportunities has become exhaustion as marketers realize they need to keep making investments even though they're not using their existing systems to the fullest. See, for example, this Kitewheel study, which found 72% of agencies use less than 40% of their tools every week.

So what’s the problem? Have marketers simply purchased the wrong technologies – after all, they’re new at the system buying business and martech is filled with bright and shiny distractions. Or are they buying the right systems only to find that other roadblocks get in the way of success?

Many people have asked similar questions. So many, in fact, that I've found a half-dozen surveys in the past two months touched on the topic. You can see the questions and their answers at the bottom of this post.

But each survey asks different questions and gets slightly different answers. To look for over-all patterns, I’ve combined the answers on the following table, putting similar items on the same row and keeping related ones nearby. I’ve grouped the answers into general topic areas: organization, management support, marketing strategy, data management, delivery systems, and external factors. High-rated issues within each survey are shaded orange and low-rated issues are shaded green. In other words, orange cells are the biggest problems, green cells are the smallest, and white cells are in between.

The reason for all that careful arrangement is to see any clusters in the answers. Sure enough, some do emerge: the biggest problems are concentrated in organizational issues (lots of orange). The one exception that people think their own skills are perfectly adequate. Of course.

The management support area is mostly neutral except for a slash of orange for Return on Investment. That make sense: measuring ROI is always a challenge for marketers. To be clear, the answers are referring to the ROI of marketing programs in general, not martech investments in particular. If anything, the surprise is that related items like management support and budget are less of a roadblock.

Marketing strategy isn’t a major problem in most cases, with just one survey as an exception. As with skills, this basically means that marketers are confident they know how to do their jobs.

The next two items, data management and delivery systems, are where technology comes in. There’s more green here than orange, confirming our hunch that access to adequate technology isn’t marketers’ main problem.

The final group, external factors, is no problem at all.

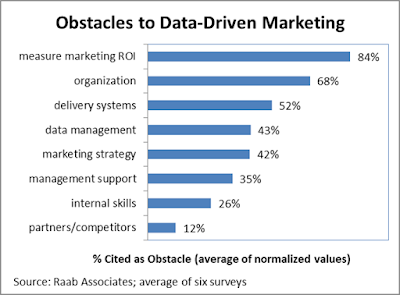

As a final bit of analysis, I've normalized all the answers to create a combined ranking for each category, splitting out ROI and internal skills since they are so different from everything else. Apologies in advance to any real statistician who is horrified at the procedural flaws in this approach. The rankings do seem to come out about right, and putting it all into one graph meets the goldfish attention span test.

Bottom line: measuring ROI and organizational roadblocks are the biggest reasons marketers fall to get value from technology. Finding good technology and knowing what to do with it are less of a concern. These answers aren't unexpected but now you have a data-driven answer next time anybody asks.

____________________________________________________________________

Survey Details:

|

Retail Touchpoints for Magnetic

| ||

Barriers to cross-channel experience:

| ||

55%

|

not enough data for full profile

| |

53%

|

internal organizational silos

| |

50%

|

don’t know what types of messages resonate best

| |

50%

|

struggle to get right message to the right person

| |

49%

|

delivery systems are not integrated

| |

49%

|

struggle to integrate first and third party data

| |

46%

|

don’t know how to use our data to create a better experience

| |

Winterberry Group for IAB Data Center of Excellence

| ||

Obstacles to value from data-driven marketing:

| ||

year ago

| ||

45%

|

26%

|

difficulty proving ROI

|

45%

|

35%

|

lack of internal experience

|

39%

|

45%

|

insufficient technology

|

36%

|

25%

|

siloed organization

|

25%

|

33%

|

inadequate first party data

|

23%

|

12%

|

tests have failed

|

20%

|

22%

|

lack of leadership support

|

19%

|

15%

|

competitive pressures

|

16%

|

8%

|

lack of guidance from agency/service partners

|

12%

|

17%

|

inadequate third party data

|

9%

|

7%

|

little demand from customers

|

|

Forbes Insights for Aprimo

| ||

Agile marketing challenges

| ||

47%

|

bureaucracy

| |

37%

|

proving ROI

| |

32%

|

employees not empowered

| |

27%

|

can’t connect agile marketing to business outcomes

| |

27%

|

hierarchical organization

| |

26%

|

budget

| |

23%

|

lack of management vision

| |

17%

|

lack right technology

| |

14%

|

lack IT talent

| |

14%

|

lack marketing talent

| |

12%

|

difficulty choosing right third party

| |

|

Kantar Vermeer for American Marketing Association

| ||

Not confident the organization’s marketing team

| ||

year ago

| ||

41%

|

33%

|

has right operating model (people/structure/processes/tools)

|

38%

|

27%

|

understands ROI of efforts

|

32%

|

28%

|

has clear strategy

|

30%

|

17%

|

is investing in right customers

|

29%

|

24%

|

is doing the right things

|

28%

|

24%

|

has clear brand position

|

25%

|

19%

|

has right capabilities

|

|

Monetate

| ||

Obstacles to 1-to1 personalization

| ||

91%

|

organizational constraints block personal accountability

| |

79%

|

automating decisions at scale

| |

68%

|

assemble real time customer view with full context

| |

65%

|

understand buyer behavior in context

| |

62%

|

creating compelling offers and content

| |

55%

|

integrating third party data

| |

54%

|

data quality

| |

48%

|

understanding who to personalize when in which channel

| |

38%

|

sustainable data architecture

| |

|

Econsultancy for Adobe

| ||

Most difficult customer experience components to master

| ||

40%

|

strategy

| |

39%

|

journey design

| |

38%

|

process

| |

37%

|

data

| |

35%

|

technology

| |

34%

|

culture

| |

32%

|

collaboration

| |

31%

|

skills

| |