This is the blog of David M. Raab, marketing technology consultant and analyst. Mr. Raab is founder and CEO of the Customer Data Platform Institute and Principal at Raab Associates Inc. All opinions here are his own. The blog is named for the Customer Experience Matrix, a tool to visualize marketing and operational interactions between a company and its customers.

Tuesday, March 29, 2011

eBay Offers $2.4 Billion for GSI Commerce: More Support for Marketing Automation

I suppose that’s legitimately the main point of the story. But what I really want to know is what it means for marketing automation. Not that I’m obsessed or anything.

What makes the connection worth pondering is the approach to marketing automation taken by IBM, most recently in the Smarter Commerce initiative announced earlier this month. IBM defines marketing automation as digital analytics, and puts digital analytics at the center of the business universe. The broad argument is that online activities, including both paid advertising and social messages, drive consumer behavior and can therefore be used to improve both supply chain operations (creating and stocking the right products) and demand chain operations (creating sales and managing brand attributes).

This desire to merge marketing into the larger stream of business activities is shared by GSI Commerce (and now eBay) in their approach of offering marketing within a suite of ecommerce operations. It’s been intriguing over the past few years to watch GSI supplement its core operational services (order processing, fulfillment and call center) with marketing services including email (e-Dialog), agency (Silverlign), mobile (M3), affiliate (Pepperjam), retargeting (Fetchback), database (MBS), and attribution (ClearSaleing).

I fully realize that eBay/GSI’s focus is limited to retail while IBM’s scope is literally the entire world. But both are pushing the fundamental idea of marketing as a node within the larger organizational collective. This is quite different from marketing, and marketing automation, as a largely self-contained activity that only connects with the rest of the organization comes when it drives customers to make a purchase. It also suggests that the notion of “integrated marketing management” is fundamentally flawed – if you take “integrated marketing management” as referring to a system to tightly integrate activities within the marketing department..

There, I said it. It feels so good I’ll say it again: integrated marketing management is bad. Bad bad bad. Companies need to integrate their customer treatments across all functions. The role of marketing, and marketing automation, is to guide those treatments. To do that efficiently, marketing automation must be built into the operational systems, not sit outside them. The only thing that can be handled separately is marketing analytics, just like other types of specialized analytics. But the results of those analytics must be communicated to operational systems for execution. Those operational systems must themselves be tightly integrated with each other to ensure the treatments are coordinated.

You could argue that this coordination across operational systems is also a role for “marketing automation”. I agree it is, but don't think it's not the primary meaning of the term. Traditional marketing automation is about campaign planning, execution, and analysis.

Now, don’t take this to mean that I’ve swallowed the Smarter Commerce Kool-Aid. I still think it’s presented in ways that ignore the fact that most activity is still non-digital. (I also recognize that the folks are IBM are plenty smart enough to realize this, and expect that they’ll merrily include non-digital activities in their projects. Or they’ll argue that even non-digital activities are captured digitally and therefore included in their definition. The latter is true, but if "digital" encompasses everything, why use the term at all?)

Okay, that's just quibbling about words. I see a more important difference between whether you start with an operational platform and add analytics (the GSI approach, if I oversimplify a bit), or you start with analytics and tie it into operational systems (the IBM approach, for sure). In an ideal world, the operational systems would all have great customer management features and the operational approach would win. But here on Planet Earth, most companies have several customer-unfriendly operational systems that won’t go away any time soon. Connecting them into an external analytics system – even if the connections are a bit superficial – is probably the best bet for most organizations. (I could explain this with a wonderful analogy about running extension cords vs. rewiring the walls. But I won’t. You’re welcome.)

Bottom line: whether eBay intends to or not, their GSI purchase supports the broad view of marketing automation as an enterprise-wide utility, not a tool for intra-marketing efficiency. (Ha – and you thought I couldn’t write a concise sentence.)

Thursday, March 24, 2011

OMMA Metrics Conference: Online Ads Must Prove Real Value To Succeed

If there was an overriding theme to the event, it was frustration that online advertising isn’t attracting as much money as it should. There was more than a little ”TV-envy”: the feeling that TV gets more advertising because buying is based on simple, widely-accepted audience measures. Some speakers argued for duplicating this situation, by removing some middlemen and creating standard online audience measures.

Others pointed to a deeper issue: that online marketers can’t measure the value of their efforts in terms of revenue or brand metrics like awareness and preference. In this view, TV buyers accept simple measures like Gross Rating Points because these measures have proven over time to correlate with real business results. Media mix modeling has more recently confirmed this. But except for direct response, online media can’t show the same relationship. This forces online marketers to report endless (but never complete) data about who saw what and how they acted, in the hopes that piling on enough details will somehow make advertisers happy. It never does.

This is the online version of the old joke about the drunk who loses his keys in the alley but looks for them under the streetlamp “because the light is better”. Moral of story: no volume of irrelevant data can substitute for the information you really need.

In the case of online advertising, the dark alley is the connections between ad placements and final business results. Several speakers touched on parts of this. IBM’s Yuchun Lee gave an opening keynote that highlighted the pervasive influence of online information over all customer activities, not just online purchases. Adometry’s Steve O’Brien explicitly stated that attribution must measure the incremental impact of each marketing effort on final results (although I think he limited this to online results). ForeSee Results’ Larry Freed stressed the need to trace all online and offline behaviors to understand their true role in final outcomes. Others cited studies where careful measurement found that indirect results showed online to be much more powerful than direct attribution alone.

Yesterday’s speakers also raised the problem of scalability: that is, being able to duplicate and expand on success. This is one area where TV envy makes sense, because it’s easy to add more Gross Rating Points and be reasonably sure of getting the expected results. Online ad buying is more like buying print ads or mailing lists: you may have some sense of the audience demographics, but the only way to really know how it will perform is to run a test. But this isn't a measurement problem: simple, standard measures that hide true audience differences are only going to be unreliable predictors of actual results. What’s really needed are better testing methods to predict as quickly and cheaply as possible how each new audience will perform. The trick is you’re not just looking at immediate response, but all of those indirect effects that are so tricky to capture in the first place. Now you have to predict them in advance as well as measure them after the fact.

Nobody said it would be easy.

Wednesday, March 23, 2011

Infusionsoft Helps Clients Map Their Marketing Strategy

Infusionsoft this week staged the official coming out party for its latest release at its annual Infusioncon users conference. The big news was a one-step “web lead campaign” generator that automatically creates a Web landing page and three cross-linked email flows: a set of follow-up messages after the initial Web form; a “hot lead” track for people who click on a link in any follow-up message; and a “nurture” track for people who complete the follow-up sequence without clicking on anything. Users still need to build the initial Web form and put copy into all the blank emails. But Infusionsoft said that the automated set-up itself saves six to eight hours of work and even more time puzzling out the underlying concepts.

This may seem underwhelming: Infusionsoft has simply added campaign templates, which higher-end marketing automation systems have offered for years. Indeed, you could sniff that Infusionsoft is only now adding campaigns, in the sense of a container to link separate process flows. As if to drive the point home, the company was also previewing early designs for its next release, which will apparently center on a visual flow chart to build campaign diagrams: Dude, welcome to 2003!

Okay, that was totally unfair. First of all, some of these features are pretty impressive. For example, the system-generated forms and emails automatically include campaign-specific tracking codes, which most systems require users to add manually. And true branching campaigns – as opposed to sequential campaigns with splits inside each step – still aren’t found in most marketing automation systems (although those vendors argue they’re not needed. See last week’s post on eTrigue for details).

More important, the significance of Infusionsoft’s new features isn’t that they’re playing catch-up with systems built for larger companies. It’s that Infusionsoft has been tremendously successful – more than 6,000 clients and 20,000 individual users – without them.

In fact, the company’s research has found that nearly half its clients do almost no email, using the system instead primarily for sales automation and service. Others have used its sequential processes either separately, to automate a variety of annoying manual tasks, or by painstakingly stringing them together by themselves or with professional help.

Another to look at it is this: campaign management is just one application for Infusionsoft, and to date it hasn’t been the dominant one. Rather, Infusionsoft clients have valued labor savings they gain from having one integrated system for marketing, sales, e-commerce, and service. Some of those savings are inherent in the integration itself – that is, files don’t need to be moved from one place to another. Other savings come from running simple automated processes against that integrated data. Only a few Infusionsoft users have added value by running more complex processes, although the crowd at Infusioncom was clearly eager to join them.

The other big announcement at Infusioncom wasn’t about technology at all. It was a new planning methodology called the “Perfect Customer Lifecycle”. It made immediate sense to me, in good part because it somewhat resembles the Customer Experience Matrix that long ago gave this blog its name.

Like the Matrix, the Perfect Customer Lifecycle is organized around the stages in a customer’s relationship with the company, from Attract Traffic through Collect Cash to Get Referrals. Infusionsoft developed it after realizing that few clients could see how the pieces of their marketing programs fit together, which made it difficult to prioritize and maintain focused.

The Perfect Customer Lifecycle replaces a previous Infusionsoft methodology that based on standard marketing programs shared by Infusionsoft’s most successful clients. Although Infusionsoft doesn’t put it this way, the critical difference I see is that one methodology is built around the customer while the other is built around the company. As with the Customer Experience Matrix – still used by my friend and the concept’s original developer, Michael Hoffman of ClientXClient – the customer-oriented approach makes it easy to track every step in the customer relationship and pinpoint opportunities for improvement.

The Perfect Customer Lifecycle illustrates how much effort Infusionsoft puts into helping its customers succeed. I don’t want to make too much of this, since many vendors – and surely all the good ones – care deeply about their customers’ success. But there's an extra passion at Infusionsoft that I think comes from serving small business people. (The company and its clients prefer the term “entrepreneur”; I’ve been toying with “micro-business” as a label. From a practical standpoint, I draw the line at $5 million in revenue and having a professional marketer on staff). The micro-business owner's life is tied to the company’s success in the way that even the most loyal employee's or corporate manager's life is not. I see the same passion for helping customers at other firms serving this market, notably OfficeAutoPilot.

(It doesn’t hurt that micro-business owners often see themselves as self-created Ayn Randian heroes and are more than little susceptible to flattery along those lines. But they're also passionately loyal to anyone who genuinely seems to care about helping them.)

That brings me to my central observation. Marketing automation for micro-businesses is fundamentally different from marketing automation for larger firms.

The technical difference is that micro-business systems expand beyond marketing to integrate marketing, sales, and service. Of course, this is the same scope as traditional CRM, but the micro-business systems add stronger process automation than most CRM products.

The integration and the process automation share the same root cause: small businesses lack the resources to build custom integration or tolerate process inefficiency. Larger firms are organized into departments where the costs of separation are less obvious, intra-departmental efficiency is often hidden from top management, and, probably most important, department heads want separate systems they control directly. Those departmental fiefdoms don’t exist at a micro-business because the owner makes all important decisions personally,

Micro-businesses also need more vendor services because they lack internal marketing expertise. Remember, pretty much by definition, these companies have no professional marketers on staff. The exceptions are small marketing agencies and business coaches, who form a major segment of successful micro-business marketing automation users. This makes sense: they’re the one group of micro-business owners equipped to figure out how to use the systems for themselves, or at least to ask vendors for the right kinds of help. Other micro-businesses nearly all rely heavily on the vendors for both technical and marketing assistance.

By contrast, the pioneering users of larger-company marketing automation systems have largely been technology firms. I think the driving force with this group has been comfort with technology – almost verging on blind faith – even when specific applications were unclear.

If micro-business marketing automation (which obviously shouldn’t be called “marketing automation”) is distinct from the rest of the industry, the next question is whether the adjacent segment is one group of firms from $5 million to $500 million in revenue, or that segment must be divided. My first instinct to look for a division, but when I think about the systems used by companies in that range, their functionality is not very different. You may I recently pointed out that Eloqua, Marketo and Pardot all have about half of their clients with under $20 million revenue (but I suspect very few under $5 million). So even the more powerful marketing automation systems have a lot of small(er) clients.

I do suspect that some mid-tier vendors skew towards the smaller end of the scale and others skew towards the higher end. But that has more to do with pricing and sales models than the products themselves. So maybe one big segment from $5 million to $500 million makes sense after all.

Regardless of how you split the market, it’s clear that both the micro-business and other (regular? corporate? grande?) segments are moving beyond pioneers towards mass adoption. Furthermore, both groups face exactly the same challenge: to make marketing automation easy enough for non-pioneers to adopt it.

Infusionsoft’s move towards campaign templates and visual flows is a big step in this direction. But those features alone won’t solve the problem: if they could, other products that already have them would be more widely adopted. The need to supplement simplicity with marketing training is why Infusionsoft is simultaneously moving ahead with the “Perfect Customer Lifecycle” and related programs.

Vendors selling to larger companies have also been stressing education. So far, though, their focus has seemed more tactical (“how to run a Webinar”) than strategic (“optimize the customer lifecycle”). Maybe that’s because their clients are professional marketers who already have the big picture or rely on marketing agencies and other service partners to provide it. Or – and this is my bet – the marketing automation vendors just haven’t yet recognized that they need to offer strategic frameworks. This is a delicate task since you don't want to insult your prospective buyers. Perhaps the frameworks will be disguised as deployment methodologies and best practices. If I’m right, it doesn’t bode well for vendors who believe that greater ease of use by itself can greatly expand adoption.

This line of thought (plus lack of sleep and coffee – most of this was written on a late night plane ride) leads a final question. If micro- and non-micro-marketing automation vendors are converging on features and strategy training, will the micro-business focus on process automation also be duplicated at larger companies? I can’t point to any evidence yet, but it wouldn't surprise me. Certainly all marketers are subject to the same pressure to operate more efficiently. If process automation does become more important, it will further increase the pressure for process optimization as part of successful deployments. Not to beat a dead horse.

Wednesday, March 16, 2011

eTrigue Puts a New Interface on Mature Marketing Automation Features

eTrigue officially announced its new DemandCenter marketing automation system on Tuesday, replacing an earlier product dating back more than five years.

The system is positioned as “marketing automation for the rest of us”, meaning that eTrigue considers it much easier to use than leading marketing automation products. If that sounds familiar, it’s because I recently mentioned similar claims from Net-Results , Act-On Software, and tMarketbright. All believe that the complexity of standard marketing systems is the major reason they have not been more widely adopted and that they can offer a simpler alternative.

Bear in mind that’s a two-part proposition. Even if these vendors are right that complexity is the key barrier to adoption, there’s no business opportunity unless their systems are simpler. Otherwise, they’ve simply explained why marketing automation can never succeed, or at least won’t succeed until a critical mass of marketers have been trained to handle a new level of complexity.

So let’s cut to the critical question: is DemandCenter easier to use than systems like Pardot, Marketo, and Genius? The answer is a definite…maybe. DemandCenter has a campaign flow interface that does seem easier to use than standard products. But the rest of it, while nicely done, doesn’t strike me as materially different.

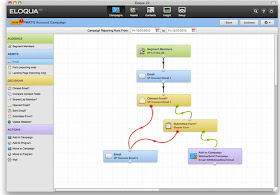

What makes the campaign builder different? Well, most systems use some variation of two basic approaches. One is to create a classic branching flow diagram, like a Visio chart. Here’s a state-of-the-art version from Eloqua:

This has the advantage of displaying the exact flow of leads, including branches that split apart and come together. It allows complex flows and is pretty much the way that most people diagram a campaign when they're planning it. But flow diagrams get confusing once you move beyond a handful of branches.

The other option is to build a list of steps without any branching. Rules within each step can still deliver different treatments to different segments, but everyone moves to the same next step at the same time. This is easier to follow but it lacks flexibility and you must look inside each step to see the details. Here is Marketo’s version:

DemandCenter lies somewhere in between. It lays out the steps within a single sequence on a row – similar to the list of steps but sideways. But it also allows distinct branches, showing each branch as its own row. This isn't perfect – you can’t draw lines to connect different boxes across branches, as in a flow diagram – but it’s probably more intuitive than the other approaches for moderately complex flows. Users can also collapse an entire, multi-branch campaign onto a single row and show multiple campaigns on the screen.

(Of course, nothing is truly unique. DemandCenter’s approach is conceptually similar to the interface introduced by Silverpop last year, which also showed branches as horizontal tracks. I liked that one too.)

So let's grant that eTrigue has built a somewhat better mousetrap. How much does it really matter? The campaign interface is just one of many components within a marketing automation system. A better campaign interface by itself is not enough to radically change the complexity of marketing automation as a whole.

Now, if all DemandCenter features were easier than the competition, that might change things. But while the rest of DemandCenter is well designed, nothing struck me as different enough to make a substantial difference in usability. So if superior ease of use is the only way for eTrigue to distinguish itself, it will have a very hard time.

But marketing automation systems actually compete on more than ease of use. eTrigue’s original product was originally developed in 2004/2005 by Silicon Valley marketing agency 3marketeers, which couldn’t find a system that met its own needs. The system has since been sold to about 150 clients. This long experience has led eTrigue to include capabilities that are missing in most low-to-mid-tier marketing automation products. These include:

- anonymous visitor look-up, based on IP address, with automatic exclusion of ISP addresses

- reporting on anonymous visitors as individuals (not companies) and indefinite retention of anonymous visitor histories (most systems erase the related cookies after a few months)

- real-time sales alerts triggered by lead behaviors

- ability to send leads directly from one campaign to another

- statistics for each campaign step visible in the campaign flow diagram

- a cube-based data mart for time-series analysis and other advanced reporting

- automated execution of reports on user-defined schedules

- precise user- and group-level security, including options to limit specific campaigns to specific users

- ability for Salesforce.com users to send emails through eTrigue

- tailored dashboards for each user

These are in addition to the usual marketing automation functions: email campaigns, landing pages and forms, lead scoring, and bi-directional integration with both Salesforce.com and Microsoft Dynamics.

That's a richer feature set than most marketing automation systems targeted towards the small and mid-size business. But pricing of DemandCenter is actually lower than most vendors in that segment, starting at $1,000 per month for a 10,000 name database. This includes implementation and training. The combination of mature features, a new interface, and low pricing makes eTrigue an attractive alternative even if it doesn’t break any major barriers for ease of use.

eTrigue also has a product aimed at salespeople, called SalesPro. This works directly from a Salesforce.com database, using the Salesforce.com email engine but applying eTrigue email authoring, campaign structures, Web tracking, and lead scores. The system doesn't include landing pages. It's priced at $500 per month for 10 users.

Wednesday, March 09, 2011

Act-On Software Stresses Ease of Use

I started last week to write a review of Act-On Software’s latest release but got distracted by the larger and sexier question of Act-On’s business strategy. So let me try again.

The new release is designed for marketers who want to start using the system with little or no training. The home page all but screams as much, with a huge central panel of “quick start” links to different types of projects. These include:

- outbound marketing programs (e-mail campaigns, events & webinars, and automated programs)

- program components (Web forms, landing pages, list management, media library)

- traffic monitoring (Twitter dashboard, Website visitors)

This mix of programs, components, and monitoring may be logically inconsistent, but it serves the practical purpose of giving marketers one-click access to common tasks. The section for each task continues this approach by combining all task-related functions including set-up, execution and reporting. By contrast, other systems often put reporting in a separate area.

The actual functions provided by Act-On are generally competitive with low-to-mid tier marketing automation products. Of course, every system has its own mix of strengths and weaknesses. In Act-On's case, unusual advantages include:

- “smart” content blocks that can be embedded like widgets in emails and Web pages. These include calendars, Webex invitations, surveys, payments via Paypal, and SMS alerts when a link is clicked.

- unusually close Webex integration, including direct posting of Act-On invitation forms to Webex registration lists and automatic import of attendee lists from Webex into Act-On.

- a “Twitter prospector” that executes automated searches, weeds out spam posts (identified by third-party links within the post), sends the remaining results to an in-box for review, and lets users apply standard templates to create replies.

- Web analytics based on user-assigned page names, so tracking can work without building codes into the URL structure

The system has some other strengths that are less unusual, but still hard to find:

- anonymous visitor tracking based on IP address lookup, with automated integration into Jigsaw to look up contact names and automated alerts for visits from named accounts. While some other system provide this, many marketing automation vendors rely on third-party products instead.

- tracking within Act-On emails sent through Microsoft Outlook. Such emails would otherwise be invisible to the marketing automation system.

- sequential campaign flows with conditional actions in each step and “early exit” conditions that can remove leads from the flow at any step. Most marketing automation systems offer conditional actions, which let the system send different messages to different lead segments. But an early exit rule is harder to find.

- a preinstalled library of stock images, such as form buttons. This simplifies content creation.

Act-On has also retained its list-oriented approach to the marketing database. This lets users manage the database as if it were a set of separate lists. (In reality, Act-On actually does store the leads in a traditional database. The same lead can belong to multiple lists.) Act-On can also push or pull data to Salesforce.com on a list-by-list basis, which gives users more control than moving all records at once. I've never seen the benefits of the list-based approach, but Act-On says its clients find it easier to grasp than traditional segments.

Act-On does have some weaknesses compared with most other products. These include limits on lead scoring and lack of progressive profiling.

As for that user interface: it's certainly attractive and does look easy, although I can't say whether it's substantially simpler than the competition. My general feeling remains that any initial advantage in ease of use quickly becomes irrelevant as marketers gain experience. After that, what really matters is having a system with the capabilities that match your needs. So any selection decision should consider long-term requirements in addition to the interface.

Pricing of Act-On starts at $500 per month, which is low for a mid-tier marketing automation product although it's limited to three users and 10,000 active contacts (plus an unlimited number of inactive contacts). No long-term contract is required and a 14 day free trial is available. Act-On has over 200 clients.

The Pond Just Got More Crowded: Google, Salesforce.com and Sequoia Invest in HubSpot

If you heard a loud thud late Tuesday afternoon, it was the sound of two shoes dropping. Salesforce.com and Google announced their long-anticipated entry into the marketing automation industry, in the baby-step form of investments in HubSpot. The $32 million fourth round of funding was led by Sequoia Capital, which apparently provided most of the money (numbers were not announced). It followed $33 million in earlier funding since the company was founded in 2006.

In many ways, this investment strikes me as more significant than last year’s acquisitions of Unica by IBM and of Aprimo by Teradata, which were widely touted as “validating” the concept marketing automation and involved vastly more money ($1 billion combined). Both Unica and Aprimo were long-established vendors with fundamentally stable products sold primarily to large enterprises: although their new owners may market them more broadly, they’ll be selling pretty much what IBM and Teradata always sold (big systems) to pretty much the same customers (big companies). Even the most ambitious vision articulated by the vendors – radically more integrated, analytically-driven marketing management – won’t really change their sector of the marketing automation industry.

But HubSpot plays in a different pond, where the frogs are more numerous and much livelier. It’s selling to small and mid-size companies and business-to-business marketers, who are just dipping their toes into marketing automation. It’s not yet clear which vendors will dominate the industry or what form the successful systems will take. And the current frogs are all small enough that a powerful newcomer could displace them, especially if it had a natural entry point such as, oh, Google AdWords or Salesforce.com’s CRM system.

During the analyst call that followed the announcement, HubSpot co-founders Brian Halligan and Dharmesh Shah made quite clear that they hoped to leverage the Google and Salesforece.com relationships in just this way. This will involve tighter technical integration with both Google and Saleforce.com, and apparently some marketing to the Salesforce.com customer base.

Of course, the entry of Salesforce.com as a direct competitor has long been the worst nightmare of B2B marketing automation vendors, who exist largely because Salesforce.com doesn’t give marketers what they need. A viable marketing solution within Salesforce.com would preempt many purchases of a separate marketing automation system in companies where Salesforce.com is already in place.

Yesterday’s announcement doesn’t mean the nightmare has come true – this is a small investment by Salesforce.com, not an acquisition, and it’s quite clear that HubSpot intends to go public on its own. But if Salesforce.com likes what it sees, who knows where that will lead? The same goes for Google, although Google Venture Partner Rich Miner went out of his way during the analyst call to say that the Google investment was financial (i.e., intended to make money on its own) rather than strategic (i.e., intended to extend Google’s own business).

All this is good and kudos to HubSpot for getting this far and landing such powerful partners. The company also deserves praise for articulating a sound vision of future growth through expanded product features. This is as close as you can reasonably expect them to come to acknowledging that the existing HubSpot is far from a complete marketing automation solution. (See my December 2009 post for a more detailed discussion of HubSpot's capabilities; basically, they are still pretty weak in outbound email, lead scoring, and nurturing, which are all core components of standard B2B marketing automation. They also lack integrated CRM features – a hallmark of small business marketing automation – although the Salesforce.com connection probably makes that moot.)

Yet something really bothered me about yesterday’s announcement. HubSpot has always been quite clear that it is focused on small-to-mid-size businesses and that it offers “inbound marketing” rather than traditional marketing automation. In fact, it has always been highly dismissive of traditional outbound marketing as essentially obsolete – a claim it repeated again yesterday.

Despite this background, yesterday’s announcement positioned the firm’s competitors as the mid-to-large company B2B marketing automation vendors, listing Eloqua, Marketo, Genius, Manticore Technology, and Neolane by name. This wasn’t a casual comment – the press release twice called the HubSpot a marketing industry “leader” and included a pie chart showing “over 50% Market Share”, a claim that is only true if you (a) count clients, not revenue (an absurd mixing of apples and oranges in this case) and (b) ignore HubSpot’s most direct competitors, the other small business marketing automation vendors including Infusionsoft (6,000+ customers vs. HubSpot’s 4,000+) and OfficeAutoPilot (2,000+ customers). [Note: comments from Infusionsoft and HubSpot, posted below, suggest those vendors may compete less than I thought when I wrote this. But I still think excluding them from the analysis is wrong.]

Here’s what I consider a more realistic view of the market:

- Based on revenue, HubSpot had less than 7% of the B2B marketing automation market in 2010 ($15 million HubSpot revenue vs. $225 million total) (see my post of January 11, 2011) and an even smaller fraction if you include B2C marketing automation.

- Based on client counts, adding Infusionsoft and OfficeAutoPilot reduces HubSpot’s share to about 25% (data from our B2B Marketing Automation Vendor Selection Tool).

- The small business vendors, including Infusionsoft, OfficeAutoPilot,It's those firms, and other small-business-focused competitors including Act-On Software, Net-Results, and Marketbright, who have the most to fear from HubSpot.

Now, I wasn’t born yesterday and am rarely upset to see a company spin the facts in its favor. In fact, as a marketer myself, I have a grudging admiration for people who do it deftly. But a distortion this large really bothers me. I could say that’s because it harms the market by confusing people, but I think the real reason is more visceral: it insults my own intelligence and that of everyone else who is apparently expected to believe it. What’s even sadder is these particular claims are totally unnecessary: HubSpot is a strong company with a solid product and excellent story. It doesn't need exaggeration.

I’ve also found HubSpot to be quite open and honest in the past, which makes this all the more puzzling. I hope it’s just an aberration.

One other point from today: in a related blog post, Brian Halligan gives some insight into HubSpot’s business strategy and the reasons for this round of funding. I’ve no complaints about any of it. But there’s an intriguing graphic that shows HubSpot’s lead sources – intended to illustrate how HubSpot “eats our own dog-food” through inbound marketing. Am I reading this wrong, or does it show that (bad, obsolete, interruptive) email is their largest source of business, while organic search and social media barely register? Now THAT's what I call openness.

Tuesday, March 08, 2011

Webinar this Friday - 5 Things You Must Consider Before Purchasing Marketing Automation

This Friday I'll be presenting a 45 minute free Webinar, sponsored by Focus.com and hosted by the ever-popular Adam Needles, on preparing for a successful marketing automation deployment.

You can register here. Details below:

Friday, March 11, 2011

10:00AM PST / 1:00PM EST

There’s plenty of information on why you need to buy marketing automation and, as statistics show, many marketing organizations (big and small) are jumping on board. But this webinar isn’t about why you should buy marketing automation – that’s been discussed at length by everyone in the business. Instead, Focus Expert David Raab will dive deeper to tell you the “how,” the “who,” the “when” and whether you are ready to automate your marketing in the first place. David will cover a number of factors to consider to know before you buy, including:

• The non-technology factors you must have in place to be successful

• Why your lead management program should drive your implementation

• How to organize the marketing department for success

f you’re interested but can’t attend the live event, register today and we will send you a link to the on-demand archive when available.

Friday, March 04, 2011

Are We Making Marketing Automation Harder Than Necessary?

Act-On Software officially relaunched its system earlier this week, offering a new interface and a new positioning. The interface is perfectly nice but the positioning is ultimately more important. The company’s press release puts the key claim succinctly: “The Act-On Integrated Marketing Platform disrupts the conventional wisdom that companies need marketing automation solutions that are expensive, complex, and require significant services engagements to get them up and running.”

I’m not sure that whoever speaks for “conventional wisdom” would agree that marketing automation solutions must be expensive and complex. My own position (loosely paraphrasing Einstein) is it should be as complicated and costly as necessary, but not more.

However, the real meat of that statement is the third item: “significant services engagements”. This refers to the idea that marketing automation must accompanied by comprehensive planning and process engineering, which often require external assistance. The oracles of conventional wisdom would probably agree. I know I do.

Act-On begs to differ. Their belief, outlined to me in January by Sales VP Shawn Naggiar and CMO David Applebaum, is that most marketers just want to get things done immediately with existing resources. Of course, no one could argue with that – we all want something for nothing. The real question is whether marketing automation can actually deliver value without marketers making a more substantial investment. Act-On is betting that they can, especially if aided by software that’s designed to make easy things simple. The company just received $4 million in funding from others willing to share the bet, on top of an initial $2.5 million.

It would be easy to dismiss Act-On’s proposition as something between wishful thinking and pandering, right up there with diet-free weight loss. But I’ve heard almost exactly the same argument recently from other vendors including Net-Results, Marketbright, and, to lesser extent, Genius.com. All cite the need for an intermediate step between the simplicity of email-only systems and the complexity of full-blown marketing automation. They see closing this gap as the critical requirement in spreading marketing automation to the masses, and as a great business opportunity for themselves. When so many smart people reach the same conclusion, it's worth serious consideration.

On the other hand, the vendors with the greatest success to date have stressed the importance of process. This is true not just at the high end of the market, but also at the low end, where Infusionsoft, OfficeAutoPilot and HubSpot all make huge efforts to educate and cajole their clients into using their systems fully.

Infusionsoft and OfficeAutoPilot are selling to much smaller businesses than Act-On, Net-Results, and the new Marketbright. Still, it's interesting that vendors at both ends of the spectrum have found that process focus is essential. Maybe success requirements are really different in the middle – but I’d say the burden of proof is on those making that claim.

If I want to start a good argument, I should probably end this post here. Drawing clear battle lines between vendors who believe in process and those who don't should certainly prompt some response.

But that wouldn’t be fair to either side. The process-oriented vendors do strive to make it easy to get started, and the start-up-oriented vendors do expect their clients’ processes to mature over time. And, while Act-On, Net-Results, Marketbright, and Genius all argue that their systems are substantially easier to use than products like Pardot, Marketo and LoopFuse, those vendors surely disagree. My own (fair but wimpy) opinion is that there are significant differences among individual systems but neither group is generally easier or more powerful than the other. Users have to do the hard work of matching the system to their particular needs and style. Eat your spinach.

That said, the role of process is an important and worthwhile subject for debate. The greatest danger I see facing the B2B marketing automation industry is that it will develop a reputation for failure. This is exactly what happened to CRM systems when people started to think that simply purchasing one was a guarantee of success. It took a long time and much hard work for the industry to overcome the stigma of the resulting failures. They have now established that careful planning and disciplined deployment are essential for clients to receive real benefits.

Perhaps we're doomed to repeat this history. It's the "trough of despair" in the hype cycle. But we can at least try to avoid it. My position is this: marketers can start small with their automation systems, but they should still go into the project recognizing that real value requires substantial change. Ignoring this reality is bad for everyone.