Summary: Treehouse Interactive has been slowly enhancing its marketing automation system with features that appeal to experienced users. Its new clients are larger firms and half are switching from another marketing automation product that they found inadequate. This might foreshadow attrition problems at other vendors.

It’s been nearly two years since my last review of Treehouse Interactive. Here's an update.

The big news is, well, that there’s no big news. Treehouse has been quietly but steadily growing its business (up 30% this year), improving its product, and attracting more demanding clients. One telling statistic is that about half its new customers are replacing an existing marketing automation system – a sure sign that Treehouse offers features that only an experienced marketer will realize are missing from other products.

A bit of background: Treehouse started in 1997 with the Sales View sales automation product. It added Marketing View marketing automation in 1999 and Reseller View partner management after that. Its marketing automation system offers the usual range of functions: email, Web analytics, landing pages, multi-step campaigns, lead scoring, CRM integration, ROI reporting. The greatest divergence from industry norms is Treehouse contacts always enter campaigns by completing a form. Other systems select campaign members with rules that can access a broader set of data.

In addition, Treehouse originally required all subsequent campaign steps to execute the same actions on the same schedule. This is considerably more rigid than the branching capabilities built into most marketing automation products. Treehouse has since enabled imported data to trigger campaign actions, and promises behavior-based triggers in the near future. See my original post for more details.

Treehouse’s developments since that post have largely played to its strengths. I’ll group these into themes, with the caveat that I’m combining enhancements introduced at different times in the past year and a half.

- form integration. Treehouse has continued to expand how clients can use its forms, which were already more powerful than most. The system can now generate HTML code to embed forms within external Web pages, allowing users to create standard Javascript or Facebook-compatible non-Javascript versions, or both. It can also post form responses using HTTP Send commands, which can send data to GoToWebinar (replacing GoToWebinar’s own registration forms) or to other systems such as product registration, CRM and customer support. The HTTP Send avoids API calls or Web Services, although Treehouse offers data exchange through Web Services as well. The system also has an “instant polling” feature to embed surveys within any Web page.

- CRM synchronization. When I last wrote about Treehouse, it had just added Salesforce.com integration. It has since added a connector for Oracle CRM On Demand. It has also improved its CRM integration to synchronize data in real time, show Treehouse events within the CRM interface, and allow salespeople to add leads to campaigns and remove them. CRM integration is handled through forms that map fields from one system to another. These forms also contain update rules (controlling when data from one system replaces data in the other) and action rules (specifying when to take actions such as sending an email or updating a list subscription). The action rules are particularly significant in the context of Treehouse’s forms-based campaign design, since they provide a way to modify lead treatments that isn’t based on the original form entries.

- Web analytics. The system now builds separate Web activity profiles for individuals (whether identified or anonymous, so long as they have a cookie), for all individuals associated with a company, and for companies identified via IP address but lacking an associated individual. An individual’s lead score can be based on both individual and company Web behaviors. The system has expanded its referral reporting to track results by the exact referring URL. The CRM integration can now capture the search phrase and other referral details for leads imported from Salesforce.com Web to Lead forms: this required special processing since Salesforce.com embeds the information within a text string.

- download and document management. Treehouse can now tie multiple downloads to a single request form. It can list the leads that downloaded a specific document (a feature Treehouse says is unique, although I can only confirm that it's rare), as well as counting total downloads and downloads by unique leads. Downloads are now part of contact history along with emails, campaigns, purchases, click-throughs and form actions. The system also maintains a library of available documents. These can be stored outside of Treehouse so long as there’s a tag for Treehouse to call them.

- social media integration. Marketing messages can include a button that lets recipients create social media messages with an embedded URL. The messages will be sent under the recipient’s own identity in systems including Facebook, MySpace, Twitter, LinkedIn and Digg. Although many demand generation vendors now offer some type of social sharing, Treehouse introduced this feature back in May 2009. Emails and forms can also include a forward-to-a-friend button that allows recipients to enter several email addresses at once.

- other advanced features. These include fine-grained access permissions, split and multivariate testing, easy addition of new tables linked to contact records, and support for non-Roman languages such as Chinese. All are features particularly relevant to larger or more sophisticated clients.

Treehouse pricing has changed a bit since my original post, now starting at $749 per month for up to 7,500 contacts in the database. This is still firmly in small business territory, although Treehouse’s advanced features really make it a better fit for more sophisticated marketers, who are usually at larger companies. The company is a particularly good fit for channel marketers who can benefit from its Reseller View system.

Treehouse now has nearly 200 total clients, of which more than half use Marketing View. This makes it one of the smaller players competing for mid-to-upper size clients, a particularly crowded niche. But the firm is self-funded and profitable, and it's selling on features, not cost. So I'd expect it to be a reliable vendor, even if someone else eventually dominates its segment.

This is the blog of David M. Raab, marketing technology consultant and analyst. Mr. Raab is founder and CEO of the Customer Data Platform Institute and Principal at Raab Associates Inc. All opinions here are his own. The blog is named for the Customer Experience Matrix, a tool to visualize marketing and operational interactions between a company and its customers.

Monday, November 29, 2010

Tuesday, November 23, 2010

Alterian Alchemy Knits Together Marketing Components

Summary: Alterian just announced Alchemy, which provides a new interface and tight integration across existing components.

Alterian last week announced a new generation of products called Alchemy. It’s positioning these as “customer engagement solutions” rather than “campaign management” solutions. The general idea seems to be that customer engagement involves digital dialogs while traditional campaign management is mostly about outbound messages.

Happily, there’s more here than new labels. The main changes, set for release next March, are:

- an integrated framework to share customer information and marketing data (campaign plans, contents, etc.) across channels. This is supported by a new capability to read data in Microsoft SQL Server databases without first loading it into Alterian’s own database engine.

- a new user interface built using the Microsoft Silverlight platform. This is highly configurable and includes specific new tools for building queries, campaigns, and dashboards. The campaign builder in particular has been updated to support trigger-driven, multi-step processes in a branching flow chart.

The company also plans to expand integration with KXEN for predictive analytics, although it hasn’t set a release date.

Alchemy will also include revised and expanded versions of Alterian's social media, Web content management, Web analytics, and email solutions. These will be released throughout the first half of next year. A detailed roadmap is available in the Alchemy FAQ.

Pricing for Alchemy hasn’t been announced, but it will be somewhat higher than current Alterian products. The old products will remain available to serve what Alterian now refers to as “traditional” marketers.

Alchemy is a bit tough to assess. It doesn't add many new functions, but Alterian already had an extremely broad set of capabilities. I think what’s really happening is it knits together products that Alterian had previously acquired but not truly integrated. This is delivering on an old promise, not creating a revolution. Still, it should let marketers do a substantially better job at managing customer relationships across all channels. Revolutionary or not, that's an improvement well worth having.

Alterian last week announced a new generation of products called Alchemy. It’s positioning these as “customer engagement solutions” rather than “campaign management” solutions. The general idea seems to be that customer engagement involves digital dialogs while traditional campaign management is mostly about outbound messages.

Happily, there’s more here than new labels. The main changes, set for release next March, are:

- an integrated framework to share customer information and marketing data (campaign plans, contents, etc.) across channels. This is supported by a new capability to read data in Microsoft SQL Server databases without first loading it into Alterian’s own database engine.

- a new user interface built using the Microsoft Silverlight platform. This is highly configurable and includes specific new tools for building queries, campaigns, and dashboards. The campaign builder in particular has been updated to support trigger-driven, multi-step processes in a branching flow chart.

The company also plans to expand integration with KXEN for predictive analytics, although it hasn’t set a release date.

Alchemy will also include revised and expanded versions of Alterian's social media, Web content management, Web analytics, and email solutions. These will be released throughout the first half of next year. A detailed roadmap is available in the Alchemy FAQ.

Pricing for Alchemy hasn’t been announced, but it will be somewhat higher than current Alterian products. The old products will remain available to serve what Alterian now refers to as “traditional” marketers.

Alchemy is a bit tough to assess. It doesn't add many new functions, but Alterian already had an extremely broad set of capabilities. I think what’s really happening is it knits together products that Alterian had previously acquired but not truly integrated. This is delivering on an old promise, not creating a revolution. Still, it should let marketers do a substantially better job at managing customer relationships across all channels. Revolutionary or not, that's an improvement well worth having.

Friday, November 19, 2010

More on Marketo Financials: Despite Past Losses, Prospects Are Bright

Summary: Public data gives some insights into Marketo's financial history and prospects. Despite past losses, the company is in a strong position to continue to compete aggressively. (Note: as Marketo has commented below, this article is based on my own analysis and was written without access to Marketo's actual financial information.)

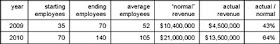

Here’s a bit more on this week's $25 million investment in Marketo: a piece in VentureWire quotes revenue for Markteo as $4.5 million for 2009 and "triple that" ($13.5 million) for 2010. This is the first time I've seen published revenue figures for the company. They allow for some interesting analysis.

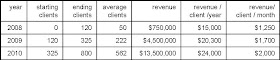

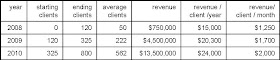

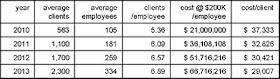

Data I've collected over the years shows that Marketo had about 120 clients at the start of 2009, 325 at the start of 2010, and should end 2010 with about 800. Doing a bit of math, this yields average counts of 222 for 2009 and 562 for 2010, which in turn shows average revenue per client of $20,000 per year or $1,700 per month in 2009 and $24,000 or $2,000 per month in 2010. The table below throws in a reasonable guess for 2008 as well.

Given that Marketo’s list prices start at $2,000 per month for the smallest implementation of its full-featured edition, this is pretty firm evidence that the company has indeed been aggressively discounting its system – as competitors have long stated.

Given that Marketo’s list prices start at $2,000 per month for the smallest implementation of its full-featured edition, this is pretty firm evidence that the company has indeed been aggressively discounting its system – as competitors have long stated.

(Some competitors have also said that Marketo's reported client counts are cumulative new clients, without reductions for attrition. If so, the revenue per active client would actually be a bit higher than I've calculated here. But Marketo itself says the reported figures are indeed active clients and I've no basis to doubt them. The following analysis wouldn't change much either way.)

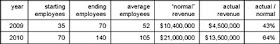

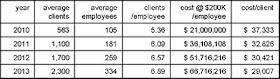

If you’ll accept a bit more speculation, we can even estimate the size of those discounts. That same VentureWire article quotes Marketo’s current headcount as 130 employees, compared with half that number at the start of the year. Assume there were 70 at the start of 2010 (which matches my own data) and will be 140 by year-end, for an average of 105. My records suggest that the headcount at the start of the 2009 was around 35, so the average headcount for that year was about 52.

Let’s assume a "normal" revenue of $200,000 per employee, which is about typical for software companies (and matches published figures for Marketo competitors Aprimo and Unica). That means Marketo revenues without discounting “should” have been about $10.4 million in 2009 and $21 million in 2010. Compared with actual revenues, this shows 2009 revenue was about 43% of the “normal” price ($4.5 million actual vs. $10.4 million expected) and 2010 revenue at about 64% ($13.5 million vs. $21 million).

So the good news for Marketo’s new investors is that Marketo has been discounting less (although there’s an alternative explanation that we’ll get to in a minute). The bad news is they have quite a way to go before they’re selling at full price.

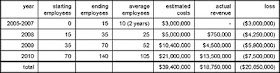

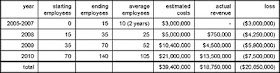

We can use the same data to estimate Marketo’s burn rate. Costs are likely to be very close to the same $200,000 per employee (this includes everything, not just salary). My records suggest the company had about 25 average employees in 2008, for $5 million in expenses. Marketo was founded in late 2005, so let’s figure it averaged 10 employees during the previous two years, and that they cost only $150,000 because the early stage doesn’t involve marketing costs. This adds another $3 million. That gives a cumulative investment of $39.4 million.

We can use the same data to estimate Marketo’s burn rate. Costs are likely to be very close to the same $200,000 per employee (this includes everything, not just salary). My records suggest the company had about 25 average employees in 2008, for $5 million in expenses. Marketo was founded in late 2005, so let’s figure it averaged 10 employees during the previous two years, and that they cost only $150,000 because the early stage doesn’t involve marketing costs. This adds another $3 million. That gives a cumulative investment of $39.4 million.

We already know revenue for 2009 and 2010 will be about $18 million. The company started selling in late February 2008 and my records show it ended that year with 120 clients. Assume the equivalent of 50 annual clients at $15,000 and you get 2008 revenue of $750,000, for $18.75 million total. That leaves a gap of $20.65 million between life-to-date costs vs. revenues.

We already know revenue for 2009 and 2010 will be about $18 million. The company started selling in late February 2008 and my records show it ended that year with 120 clients. Assume the equivalent of 50 annual clients at $15,000 and you get 2008 revenue of $750,000, for $18.75 million total. That leaves a gap of $20.65 million between life-to-date costs vs. revenues.

This nicely matches the “approximately $20 million” investment to date that Marketo CEO Phil Fernandez reportedin his own blog post on the new funding.

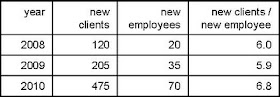

Now you can see why Marketo needed more money: its losses are actually growing despite having more customers and improved pricing. It lost nearly $16,000 for each new client last year ($7.5 million loss on 475 new clients). At that rate, even a modest increase in the number of new clients would have burned through nearly all of the company’s remaining $12 million within one year.

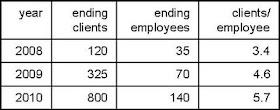

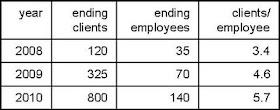

This isn’t just a matter of scale. It’s true that a start-up has to spread its fixed costs over a small number of clients, yielding a high cost per client during the early stages. Marketo shows this effect: the number of clients per employee has grown started at 3.4 at the end of 2008 and dropped to 5.7 at the end of 2010. This is the alternative to discounting as an explanation for those ratios of "normal" to actual revenue (remember: “normal” revenue based on number of employees).

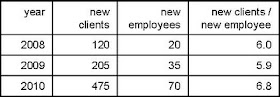

But the client/employee ratio can’t improve indefinitely. Many costs are not fixed: staffing for customer support, marketing, sales and administrative functions will all increase as clients are added. To get some idea of Marketo's variable costs, compare the change in employees with the change in clients. This is improving more slowly:

But the client/employee ratio can’t improve indefinitely. Many costs are not fixed: staffing for customer support, marketing, sales and administrative functions will all increase as clients are added. To get some idea of Marketo's variable costs, compare the change in employees with the change in clients. This is improving more slowly:

And here’s the problem: at 1 new employee for every 6.8 clients, Marketo is adding $200,000 in cost for just $163,000 in revenue (=6.8 x $24,000 / client). It truly does lose money on each new customer. You can’t grow your way out of that.

And here’s the problem: at 1 new employee for every 6.8 clients, Marketo is adding $200,000 in cost for just $163,000 in revenue (=6.8 x $24,000 / client). It truly does lose money on each new customer. You can’t grow your way out of that.

So what happens now? Let’s assume Marketo gets a bit more efficient and the new clients to new employee ratio eventually tops out at a relatively optimistic 8. At a cost of $200,000 per employee, those clients have to generate $25,000 in revenue for Marketo just to cover the increased expense. This is just a bit higher than the current $24,000 per client, so it seems pretty doable. But it leaves the existing $7.5 million annual loss in place forever.

In other words, Marketo must substantially increase revenue per client to become profitable. (In theory, Marketo could also cut costs. But the main controllable cost is sales and marketing, and incremental cost per sale is likely to rise as the company enters new markets and faces stiffer competition while pushing for continued growth. So higher revenue is the only real option.)

Revenue per client can be increased through higher prices, new products, and/or bigger clients. Pricing will be constrained by competition, although Marketo could probably discount a bit less. This leaves new products and bigger clients. Those are exactly the areas that Marketo is now pursuing through add-ons such as Revenue Cycle Analytics and Sales Insight, and enhancements for large companies in its Enterprise Edition. So, in my humble opinion, they're doing exactly the right things.

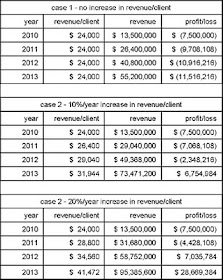

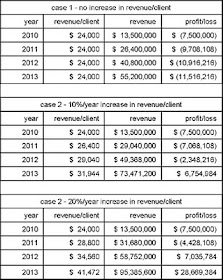

Some back-of-envelope calculations confirm that revenue per client is by far the most important variable in Marketo’s financial future. The following tables use some reasonable assumptions about growth in clients and clients per employee; take my word for it that the results don’t change much if you modify these. But results change hugely depending on what happens to revenue per client: losses continue indefinitely if it remains at the current $24,000 per year; they continue for two years and total $10 million if it increases at 10% per year; and they end after one year and $4.4 million if it grows at 20% per year. Bear in mind that revenue per customer did grow 20% from 2009 to 2010 ($20,000 to $24,000). So I’d expect it to continue rising sharply as Marketo firms up its pricing and starts acquiring larger clients.

Indeed, these figures raise the unexpected (to me) question of whether $25 million in funding is more than Marketo will need. I’d guess the company’s management and current investors were careful not to dilute their equity any more than necessary, so I think they’re planning some heavy investments that are not factored into my assumptions. In fact, the company has said as much: the VentureWire piece quotes Fernandez as stating the new funds will be used for additional sales and marketing staff, to open offices abroad, to integrate with other vendors and launch vertical services in sectors like health care and financial services.

Indeed, these figures raise the unexpected (to me) question of whether $25 million in funding is more than Marketo will need. I’d guess the company’s management and current investors were careful not to dilute their equity any more than necessary, so I think they’re planning some heavy investments that are not factored into my assumptions. In fact, the company has said as much: the VentureWire piece quotes Fernandez as stating the new funds will be used for additional sales and marketing staff, to open offices abroad, to integrate with other vendors and launch vertical services in sectors like health care and financial services.

I also expect continued aggressive pricing (perhaps more selectively than in the past) and maybe some acquisitions. It's possible that Marketo will also expand its own professional services staff, since clients definitely need help with adoption. But that would conflict with its existing channel partners so it would need to move carefully.

What does it all mean? Here are my conclusions:

- Marketo's losses reflect a conscious strategy to grow quickly through aggressive pricing. There is no fundamental problem with its cost structure: company could be profitable fairly quickly if it decided to slow down and raise prices.

- Marketo's future lies in the middle and upper tiers of the market. Its pressing financial need is to raise revenue per client, which will lead it away from the low-cost, bitterly competitive market serving very small businesses.

- The new funding will support an expanded marketing and product push. Competing with Marketo in its target segments is going to be a challenge indeed.

Here’s a bit more on this week's $25 million investment in Marketo: a piece in VentureWire quotes revenue for Markteo as $4.5 million for 2009 and "triple that" ($13.5 million) for 2010. This is the first time I've seen published revenue figures for the company. They allow for some interesting analysis.

Data I've collected over the years shows that Marketo had about 120 clients at the start of 2009, 325 at the start of 2010, and should end 2010 with about 800. Doing a bit of math, this yields average counts of 222 for 2009 and 562 for 2010, which in turn shows average revenue per client of $20,000 per year or $1,700 per month in 2009 and $24,000 or $2,000 per month in 2010. The table below throws in a reasonable guess for 2008 as well.

Given that Marketo’s list prices start at $2,000 per month for the smallest implementation of its full-featured edition, this is pretty firm evidence that the company has indeed been aggressively discounting its system – as competitors have long stated.

Given that Marketo’s list prices start at $2,000 per month for the smallest implementation of its full-featured edition, this is pretty firm evidence that the company has indeed been aggressively discounting its system – as competitors have long stated.(Some competitors have also said that Marketo's reported client counts are cumulative new clients, without reductions for attrition. If so, the revenue per active client would actually be a bit higher than I've calculated here. But Marketo itself says the reported figures are indeed active clients and I've no basis to doubt them. The following analysis wouldn't change much either way.)

If you’ll accept a bit more speculation, we can even estimate the size of those discounts. That same VentureWire article quotes Marketo’s current headcount as 130 employees, compared with half that number at the start of the year. Assume there were 70 at the start of 2010 (which matches my own data) and will be 140 by year-end, for an average of 105. My records suggest that the headcount at the start of the 2009 was around 35, so the average headcount for that year was about 52.

Let’s assume a "normal" revenue of $200,000 per employee, which is about typical for software companies (and matches published figures for Marketo competitors Aprimo and Unica). That means Marketo revenues without discounting “should” have been about $10.4 million in 2009 and $21 million in 2010. Compared with actual revenues, this shows 2009 revenue was about 43% of the “normal” price ($4.5 million actual vs. $10.4 million expected) and 2010 revenue at about 64% ($13.5 million vs. $21 million).

So the good news for Marketo’s new investors is that Marketo has been discounting less (although there’s an alternative explanation that we’ll get to in a minute). The bad news is they have quite a way to go before they’re selling at full price.

We can use the same data to estimate Marketo’s burn rate. Costs are likely to be very close to the same $200,000 per employee (this includes everything, not just salary). My records suggest the company had about 25 average employees in 2008, for $5 million in expenses. Marketo was founded in late 2005, so let’s figure it averaged 10 employees during the previous two years, and that they cost only $150,000 because the early stage doesn’t involve marketing costs. This adds another $3 million. That gives a cumulative investment of $39.4 million.

We can use the same data to estimate Marketo’s burn rate. Costs are likely to be very close to the same $200,000 per employee (this includes everything, not just salary). My records suggest the company had about 25 average employees in 2008, for $5 million in expenses. Marketo was founded in late 2005, so let’s figure it averaged 10 employees during the previous two years, and that they cost only $150,000 because the early stage doesn’t involve marketing costs. This adds another $3 million. That gives a cumulative investment of $39.4 million. We already know revenue for 2009 and 2010 will be about $18 million. The company started selling in late February 2008 and my records show it ended that year with 120 clients. Assume the equivalent of 50 annual clients at $15,000 and you get 2008 revenue of $750,000, for $18.75 million total. That leaves a gap of $20.65 million between life-to-date costs vs. revenues.

We already know revenue for 2009 and 2010 will be about $18 million. The company started selling in late February 2008 and my records show it ended that year with 120 clients. Assume the equivalent of 50 annual clients at $15,000 and you get 2008 revenue of $750,000, for $18.75 million total. That leaves a gap of $20.65 million between life-to-date costs vs. revenues.This nicely matches the “approximately $20 million” investment to date that Marketo CEO Phil Fernandez reportedin his own blog post on the new funding.

Now you can see why Marketo needed more money: its losses are actually growing despite having more customers and improved pricing. It lost nearly $16,000 for each new client last year ($7.5 million loss on 475 new clients). At that rate, even a modest increase in the number of new clients would have burned through nearly all of the company’s remaining $12 million within one year.

This isn’t just a matter of scale. It’s true that a start-up has to spread its fixed costs over a small number of clients, yielding a high cost per client during the early stages. Marketo shows this effect: the number of clients per employee has grown started at 3.4 at the end of 2008 and dropped to 5.7 at the end of 2010. This is the alternative to discounting as an explanation for those ratios of "normal" to actual revenue (remember: “normal” revenue based on number of employees).

But the client/employee ratio can’t improve indefinitely. Many costs are not fixed: staffing for customer support, marketing, sales and administrative functions will all increase as clients are added. To get some idea of Marketo's variable costs, compare the change in employees with the change in clients. This is improving more slowly:

But the client/employee ratio can’t improve indefinitely. Many costs are not fixed: staffing for customer support, marketing, sales and administrative functions will all increase as clients are added. To get some idea of Marketo's variable costs, compare the change in employees with the change in clients. This is improving more slowly: And here’s the problem: at 1 new employee for every 6.8 clients, Marketo is adding $200,000 in cost for just $163,000 in revenue (=6.8 x $24,000 / client). It truly does lose money on each new customer. You can’t grow your way out of that.

And here’s the problem: at 1 new employee for every 6.8 clients, Marketo is adding $200,000 in cost for just $163,000 in revenue (=6.8 x $24,000 / client). It truly does lose money on each new customer. You can’t grow your way out of that.So what happens now? Let’s assume Marketo gets a bit more efficient and the new clients to new employee ratio eventually tops out at a relatively optimistic 8. At a cost of $200,000 per employee, those clients have to generate $25,000 in revenue for Marketo just to cover the increased expense. This is just a bit higher than the current $24,000 per client, so it seems pretty doable. But it leaves the existing $7.5 million annual loss in place forever.

In other words, Marketo must substantially increase revenue per client to become profitable. (In theory, Marketo could also cut costs. But the main controllable cost is sales and marketing, and incremental cost per sale is likely to rise as the company enters new markets and faces stiffer competition while pushing for continued growth. So higher revenue is the only real option.)

Revenue per client can be increased through higher prices, new products, and/or bigger clients. Pricing will be constrained by competition, although Marketo could probably discount a bit less. This leaves new products and bigger clients. Those are exactly the areas that Marketo is now pursuing through add-ons such as Revenue Cycle Analytics and Sales Insight, and enhancements for large companies in its Enterprise Edition. So, in my humble opinion, they're doing exactly the right things.

Some back-of-envelope calculations confirm that revenue per client is by far the most important variable in Marketo’s financial future. The following tables use some reasonable assumptions about growth in clients and clients per employee; take my word for it that the results don’t change much if you modify these. But results change hugely depending on what happens to revenue per client: losses continue indefinitely if it remains at the current $24,000 per year; they continue for two years and total $10 million if it increases at 10% per year; and they end after one year and $4.4 million if it grows at 20% per year. Bear in mind that revenue per customer did grow 20% from 2009 to 2010 ($20,000 to $24,000). So I’d expect it to continue rising sharply as Marketo firms up its pricing and starts acquiring larger clients.

Indeed, these figures raise the unexpected (to me) question of whether $25 million in funding is more than Marketo will need. I’d guess the company’s management and current investors were careful not to dilute their equity any more than necessary, so I think they’re planning some heavy investments that are not factored into my assumptions. In fact, the company has said as much: the VentureWire piece quotes Fernandez as stating the new funds will be used for additional sales and marketing staff, to open offices abroad, to integrate with other vendors and launch vertical services in sectors like health care and financial services.

Indeed, these figures raise the unexpected (to me) question of whether $25 million in funding is more than Marketo will need. I’d guess the company’s management and current investors were careful not to dilute their equity any more than necessary, so I think they’re planning some heavy investments that are not factored into my assumptions. In fact, the company has said as much: the VentureWire piece quotes Fernandez as stating the new funds will be used for additional sales and marketing staff, to open offices abroad, to integrate with other vendors and launch vertical services in sectors like health care and financial services.I also expect continued aggressive pricing (perhaps more selectively than in the past) and maybe some acquisitions. It's possible that Marketo will also expand its own professional services staff, since clients definitely need help with adoption. But that would conflict with its existing channel partners so it would need to move carefully.

What does it all mean? Here are my conclusions:

- Marketo's losses reflect a conscious strategy to grow quickly through aggressive pricing. There is no fundamental problem with its cost structure: company could be profitable fairly quickly if it decided to slow down and raise prices.

- Marketo's future lies in the middle and upper tiers of the market. Its pressing financial need is to raise revenue per client, which will lead it away from the low-cost, bitterly competitive market serving very small businesses.

- The new funding will support an expanded marketing and product push. Competing with Marketo in its target segments is going to be a challenge indeed.

Wednesday, November 17, 2010

LoopFuse Captures More Web Traffic Data

Summary: LoopFuse has extended its system to capture more Web traffic data, which lays the foundation for future analytics.

LoopFuse recently released its latest enhancements, which it somewhat grandiosely labels as making it “the First and Only Marketing Automation Solution with Inbound Marketing”. In fact, as the subhead to their press release states, what they’ve really done is somewhat more modest: add “real-time Web traffic intelligence” by providing features to capture search terms, referring sites and page views, and link these to individual visitors.

The new release also adds real-time social media monitoring (directly for Twitter and Facebook, and through Collecta for blogs, YouTube and other sources).

These features are certainly useful. But my idea of "inbound marketing" is more along the lines of HubSpot, which provides search engine optimization, paid search campaign management, social media monitoring and posting, blogging, and Web content management. Although LoopFuse might eventually add those functions, it hasn't yet and isn’t necessarily moving in that direction.

Accepting their labels for the moment, let’s look at what LoopFuse has added:

- “content marketing” is a set of reports that tracks Web traffic related to different assets. Users get a list of the assets ranked by number of page views. They can then drill into each item to see a graph of traffic over time and to see details such as the number of visitors, views per visitor, and referring domains and pages. Because the views are tied to individual visitors, users can also click on the referring domain to see what other pages people from that domain visited. This is essentially the same information as provided by...

- “inbound marketing”, which shows visitor sources by category (direct links, paid search ads, organic search) and details within each category (specific messages, ads or keywords). As just noted, users can drill down to see which Web pages were viewed by visitors from each source.

- “social monitoring” provides real-time monitoring of user-selected terms on the various social Web sites. Unlike the other Web traffic data, this information isn’t stored within the LoopFuse database and isn't tied to specific individuals. LoopFuse plans to provide some trending reports in the future. Of course, the real trick would be linking social media comments to lead profiles.

All of these are valuable reports. Having them within a single system is particularly helpful for the small businesses targeted by LoopFuse, where all channels are likely to be handled by a small department and possibly the same individual. Otherwise, the users would need switch among several systems to do their job. In larger firms, where different people would be responsible for different channels, each channel can be managed by a separate system without requiring anyone to use multiple products.

Saving effort is nice, but the real value of a unified marketing database is being able to coordinate marketing messages and relate all marketing contacts to sales results. LoopFuse hasn’t publicly revealed its approach to marketing performance measurement but definitely has something in the works. I’m particularly hoping they'll use the detailed behavior information to relate outcomes to specific marketing messages, rather than just looking at movement through purchase stages. Although stage data by itself can project future revenues, it must be tied to specific marketing programs to measure those programs’ value.

In case you’re wondering, LoopFuse is storing the new Web traffic data in denormalized tables that are separate from the operational marketing database. This enables much quicker response to ad hoc queries and, should eventually support the time-based views needed for trends and stage analytics.

For those of you keeping score at home, LoopFuse’s Roy Russo also told me that the company stores each client’s data in a separate database instance. Russo said this has proven more scalable and cheaper than the textbook Software-as-a-Service approach of commingling several clients’ data in a single instance. So far as I know, most (but not all) marketing automation vendors use same approach as LoopFuse.

Russo also said that all data in the system is accessible via standard API calls, something that’s also not always possible with competitive products. In fact, Russo said LoopFuse’s entire interface is built on using the published API, which means that technically competent clients could build alternative interfaces to embed LoopFuse data and functions within other systems. If nothing else, this gets them Geek Style Points.

Of course, no discussion of LoopFuse is complete without mentioning its freemium offer, launched last June amid considerable controversy. The company says that nearly 1,000 accounts have now signed up for this, which is impressive by any standard. No news yet on how many have converted to paid.

One side effect that I hadn't anticipated – although LoopFuse apparently did – is that agencies and consultants use the freemium to service new clients, who convert to paid when their volumes grow. This gives LoopFuse an edge in the competition for channel partners. The value of that edge is a bit uncertain, though, since an increasing number of service firms – including Pedowitz Group, Annuitas and LeftBrain Marketing – are now working with multiple marketing automation vendors.

LoopFuse recently released its latest enhancements, which it somewhat grandiosely labels as making it “the First and Only Marketing Automation Solution with Inbound Marketing”. In fact, as the subhead to their press release states, what they’ve really done is somewhat more modest: add “real-time Web traffic intelligence” by providing features to capture search terms, referring sites and page views, and link these to individual visitors.

The new release also adds real-time social media monitoring (directly for Twitter and Facebook, and through Collecta for blogs, YouTube and other sources).

These features are certainly useful. But my idea of "inbound marketing" is more along the lines of HubSpot, which provides search engine optimization, paid search campaign management, social media monitoring and posting, blogging, and Web content management. Although LoopFuse might eventually add those functions, it hasn't yet and isn’t necessarily moving in that direction.

Accepting their labels for the moment, let’s look at what LoopFuse has added:

- “content marketing” is a set of reports that tracks Web traffic related to different assets. Users get a list of the assets ranked by number of page views. They can then drill into each item to see a graph of traffic over time and to see details such as the number of visitors, views per visitor, and referring domains and pages. Because the views are tied to individual visitors, users can also click on the referring domain to see what other pages people from that domain visited. This is essentially the same information as provided by...

- “inbound marketing”, which shows visitor sources by category (direct links, paid search ads, organic search) and details within each category (specific messages, ads or keywords). As just noted, users can drill down to see which Web pages were viewed by visitors from each source.

- “social monitoring” provides real-time monitoring of user-selected terms on the various social Web sites. Unlike the other Web traffic data, this information isn’t stored within the LoopFuse database and isn't tied to specific individuals. LoopFuse plans to provide some trending reports in the future. Of course, the real trick would be linking social media comments to lead profiles.

All of these are valuable reports. Having them within a single system is particularly helpful for the small businesses targeted by LoopFuse, where all channels are likely to be handled by a small department and possibly the same individual. Otherwise, the users would need switch among several systems to do their job. In larger firms, where different people would be responsible for different channels, each channel can be managed by a separate system without requiring anyone to use multiple products.

Saving effort is nice, but the real value of a unified marketing database is being able to coordinate marketing messages and relate all marketing contacts to sales results. LoopFuse hasn’t publicly revealed its approach to marketing performance measurement but definitely has something in the works. I’m particularly hoping they'll use the detailed behavior information to relate outcomes to specific marketing messages, rather than just looking at movement through purchase stages. Although stage data by itself can project future revenues, it must be tied to specific marketing programs to measure those programs’ value.

In case you’re wondering, LoopFuse is storing the new Web traffic data in denormalized tables that are separate from the operational marketing database. This enables much quicker response to ad hoc queries and, should eventually support the time-based views needed for trends and stage analytics.

For those of you keeping score at home, LoopFuse’s Roy Russo also told me that the company stores each client’s data in a separate database instance. Russo said this has proven more scalable and cheaper than the textbook Software-as-a-Service approach of commingling several clients’ data in a single instance. So far as I know, most (but not all) marketing automation vendors use same approach as LoopFuse.

Russo also said that all data in the system is accessible via standard API calls, something that’s also not always possible with competitive products. In fact, Russo said LoopFuse’s entire interface is built on using the published API, which means that technically competent clients could build alternative interfaces to embed LoopFuse data and functions within other systems. If nothing else, this gets them Geek Style Points.

Of course, no discussion of LoopFuse is complete without mentioning its freemium offer, launched last June amid considerable controversy. The company says that nearly 1,000 accounts have now signed up for this, which is impressive by any standard. No news yet on how many have converted to paid.

One side effect that I hadn't anticipated – although LoopFuse apparently did – is that agencies and consultants use the freemium to service new clients, who convert to paid when their volumes grow. This gives LoopFuse an edge in the competition for channel partners. The value of that edge is a bit uncertain, though, since an increasing number of service firms – including Pedowitz Group, Annuitas and LeftBrain Marketing – are now working with multiple marketing automation vendors.

Why Put Another $25 Million Into Marketo?

So...our friends at Marketo announced today that they've received another $25 million in venture funding. As one of their competitors snippily commented on Twitter, "Does that make the total $50M or $60M? I lost track."

I've lost track too, but it doesn't really matter. Marketo's strategy has been clear from the start: spend heavily to establish a strong position despite a relatively late start in the market. Of course, it wasn't just a matter of spending (Microsoft Zune, anyone?); they needed a solid product and good marketing as well. On all fronts, Mission Accomplished.

But the question is, what happens now? Obviously Marketo has a plan in mind and has convinced some pretty savvy investors that it makes sense. Presumably they've demonstrated a highly scalable business model that will allow them to take the latest funding and reliably transform it into growth and, eventually, into profits.

I find it a bit surprising that anyone can be $25-million-worth-of-certain about anything in such a young and volatile market, particularly because I still think B2B marketing automation will eventually be absorbed by larger CRM and/or Web content management suites. Certainly Marketo could be acquired by one of those companies but I don't think the price would be high enough to make the VCs happy. And surely they're still some time away from an IPO given what must be seriously money-losing financials to date.

I'm mostly writing this post in the hopes of seeing some helpful comments from others in the industry. Where does this all lead, both for Marketo and its competitors?

I've lost track too, but it doesn't really matter. Marketo's strategy has been clear from the start: spend heavily to establish a strong position despite a relatively late start in the market. Of course, it wasn't just a matter of spending (Microsoft Zune, anyone?); they needed a solid product and good marketing as well. On all fronts, Mission Accomplished.

But the question is, what happens now? Obviously Marketo has a plan in mind and has convinced some pretty savvy investors that it makes sense. Presumably they've demonstrated a highly scalable business model that will allow them to take the latest funding and reliably transform it into growth and, eventually, into profits.

I find it a bit surprising that anyone can be $25-million-worth-of-certain about anything in such a young and volatile market, particularly because I still think B2B marketing automation will eventually be absorbed by larger CRM and/or Web content management suites. Certainly Marketo could be acquired by one of those companies but I don't think the price would be high enough to make the VCs happy. And surely they're still some time away from an IPO given what must be seriously money-losing financials to date.

I'm mostly writing this post in the hopes of seeing some helpful comments from others in the industry. Where does this all lead, both for Marketo and its competitors?

Tuesday, November 16, 2010

Eloqua10 Offers a Much-Improved Interface and Revenue Reporting

Summary: Eloqua10 provides much-needed update to Eloqua's user interface and a new reporting infrastructure for “revenue performance management”. Neither change is revolutionary but both substantially improve the company’s competitive position within the crowded B2B marketing automation industry.

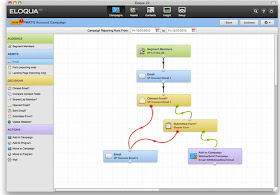

Eloqua is slated to officially release its long-promised Eloqua10 system on November 21. The main changes are an updated user interface and a new foundation for what the company calls "revenue performance management".

Let’s start with the interface. Previous versions of Eloqua were very powerful but notoriously difficult to learn and use. The company took this criticism to heart and began work more than two years ago on a new approach. The primary goal was to speed and simplify user navigation, which its research found was the root cause of 70% of user problems.

The new interface is a huge improvement. Users start on a customizable home page, which they populate from a pool of widgets for recently accessed items, favorite reports, upcoming campaigns and other information. System functions are access through tabs that align with typical user roles: campaigns for program designers, assets for content creators, contacts for segmentation managers, insight for managers and analysts, and setup for administrators.

Campaign design has been wholly revamped. The old system used a classic Visio-style diagram that only an engineer could love. Users now drag campaign components into a blank canvas, and then connect and configure them. The esthetics are carefully thought out, with components grouped and color-coded by type:

- audience (segment members)

- assets (email, e-form, landing page)

- decisions (a mix of lead behaviors [clicked email, opened email, submitted form, visited Web site] and attributes [compare contact fields, shared list member, sent email])

- actions (add to campaign, add to program, move to campaign, move to program, wait)

The components are connected with squiggly lines, which probably makes no actual difference but definitely seems more friendly.

More substantively, multiple users can work on the same design simultaneously and the designs can be saved as reusable templates. It’s worth noting that the “move to campaign” action can send leads to a specific step within another campaign – not a new feature but still rare within the industry.

Users can open up assets within the campaign flow and then create or edit them. Eloqua10 introduces a Powerpoint-style design interface that lets users drag objects into place and see the changes rendered immediately. These Powerpoint-style interfaces are increasingly common among marketing automation systems, replacing the older approach of editing blocks within predefined templates. The objects can be text, images, data fields, hyperlinks or dynamic content blocks.

Eloqua10 uses the new interface to create emails, forms and landing pages – an improvement over the older version, which had different design tools for different asset types. One downside of the change is that some assets built in previous Eloqua editions will need to be modified, as will some reports.

However, old campaigns and data should transfer to the new format automatically. This reflects the fact that, once you get beneath the interface, the functionality and data structures are largely unchanged from Eloqua9.

The big exception on the data front is what Eloqua calls “revenue performance management” (RPM), which uses a new analytical database that tracks the movement of leads through stages within the buying process. This database is updated in near-real-time with operational transactions and can also receive opportunity outcomes from sales automation or other external systems.

Unfortunately, Eloqua hasn’t released the actual reports that will be provided for RPM. It does say there’s a list of sixteen, of which some already exist. Reports they’ve mentioned include: the number and ages of leads at each stage in the funnel; relation of leads delivered to sales capacity at local levels; and revenue projections based on existing leads and stage-to-stage conversion rates. I don’t know which of these are already available.

There’s also a “two way revenue attribution” report that shows revenue allocated both by “first touch” and “all touch” methods. Although I’ve previously made clear my objections to revenue attribution in general, I think this approach is relatively sensible. “First touch” reporting is useful for acquisition programs, while “all touch” shows which programs are reaching buyers even if it doesn’t show the programs’ actual influence. With apologies for damning with faint praise, I’ll say Eloqua's approach is better than the illusion of precision created by fractional attribution.

Other enhancements planned for future releases include:

- benchmark reports that let marketers compare their company’s performance with averages for similar firms

- enterprise-level security enhancements such as global log-in across multiple Eloqua instances and item-level asset security

- user interface versions in languages other than English

- a new lead scoring interface and analytics to help build more accurate scoring rules

- Webinar management

- fax, SMS and print-on-demand outputs

Eloqua has a dozen or two customers already running Eloqua10. Other clients will be converted to the system over time to ensure users are ready for the new interface and have converted whatever assets and reports are needed. The company has a suite of new training materials in place and will not charge extra for the conversion.

Eloqua is slated to officially release its long-promised Eloqua10 system on November 21. The main changes are an updated user interface and a new foundation for what the company calls "revenue performance management".

Let’s start with the interface. Previous versions of Eloqua were very powerful but notoriously difficult to learn and use. The company took this criticism to heart and began work more than two years ago on a new approach. The primary goal was to speed and simplify user navigation, which its research found was the root cause of 70% of user problems.

The new interface is a huge improvement. Users start on a customizable home page, which they populate from a pool of widgets for recently accessed items, favorite reports, upcoming campaigns and other information. System functions are access through tabs that align with typical user roles: campaigns for program designers, assets for content creators, contacts for segmentation managers, insight for managers and analysts, and setup for administrators.

Campaign design has been wholly revamped. The old system used a classic Visio-style diagram that only an engineer could love. Users now drag campaign components into a blank canvas, and then connect and configure them. The esthetics are carefully thought out, with components grouped and color-coded by type:

- audience (segment members)

- assets (email, e-form, landing page)

- decisions (a mix of lead behaviors [clicked email, opened email, submitted form, visited Web site] and attributes [compare contact fields, shared list member, sent email])

- actions (add to campaign, add to program, move to campaign, move to program, wait)

The components are connected with squiggly lines, which probably makes no actual difference but definitely seems more friendly.

More substantively, multiple users can work on the same design simultaneously and the designs can be saved as reusable templates. It’s worth noting that the “move to campaign” action can send leads to a specific step within another campaign – not a new feature but still rare within the industry.

Users can open up assets within the campaign flow and then create or edit them. Eloqua10 introduces a Powerpoint-style design interface that lets users drag objects into place and see the changes rendered immediately. These Powerpoint-style interfaces are increasingly common among marketing automation systems, replacing the older approach of editing blocks within predefined templates. The objects can be text, images, data fields, hyperlinks or dynamic content blocks.

Eloqua10 uses the new interface to create emails, forms and landing pages – an improvement over the older version, which had different design tools for different asset types. One downside of the change is that some assets built in previous Eloqua editions will need to be modified, as will some reports.

However, old campaigns and data should transfer to the new format automatically. This reflects the fact that, once you get beneath the interface, the functionality and data structures are largely unchanged from Eloqua9.

The big exception on the data front is what Eloqua calls “revenue performance management” (RPM), which uses a new analytical database that tracks the movement of leads through stages within the buying process. This database is updated in near-real-time with operational transactions and can also receive opportunity outcomes from sales automation or other external systems.

Unfortunately, Eloqua hasn’t released the actual reports that will be provided for RPM. It does say there’s a list of sixteen, of which some already exist. Reports they’ve mentioned include: the number and ages of leads at each stage in the funnel; relation of leads delivered to sales capacity at local levels; and revenue projections based on existing leads and stage-to-stage conversion rates. I don’t know which of these are already available.

There’s also a “two way revenue attribution” report that shows revenue allocated both by “first touch” and “all touch” methods. Although I’ve previously made clear my objections to revenue attribution in general, I think this approach is relatively sensible. “First touch” reporting is useful for acquisition programs, while “all touch” shows which programs are reaching buyers even if it doesn’t show the programs’ actual influence. With apologies for damning with faint praise, I’ll say Eloqua's approach is better than the illusion of precision created by fractional attribution.

Other enhancements planned for future releases include:

- benchmark reports that let marketers compare their company’s performance with averages for similar firms

- enterprise-level security enhancements such as global log-in across multiple Eloqua instances and item-level asset security

- user interface versions in languages other than English

- a new lead scoring interface and analytics to help build more accurate scoring rules

- Webinar management

- fax, SMS and print-on-demand outputs

Eloqua has a dozen or two customers already running Eloqua10. Other clients will be converted to the system over time to ensure users are ready for the new interface and have converted whatever assets and reports are needed. The company has a suite of new training materials in place and will not charge extra for the conversion.

Saturday, November 13, 2010

Rapid Insight Provides Low-Cost Options for Desktop Data Transformation and Predictive Modeling

Summary: Rapid Insight offers low-cost desktop tools for data transformation and automated regression modeling. They're a good choice for companies that need something simple yet powerful.

Predictive modeling is widely used by consumer marketers to select names for mailing lists and to decide which products to offer existing customers. These models are typically built by statisticians with tools like SAS and SPSS. In other cases, marketers can build them for themselves with automated tools like KXEN that are tightly integrated with the marketing automation system.

But most marketers still don’t have a marketing automation system or even an integrated marketing database. Nor do they have the skills to use a product like SAS. This group needs stand-alone tools to do two key things: assemble data from multiple sources, and build and execute the models themselves. (Okay, three things.)

Rapid Insight offers exactly those two (or three) capabilities in a reasonably priced package.

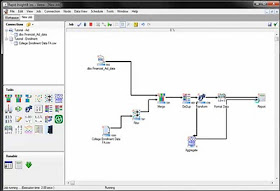

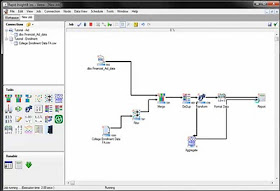

Veera is the data assembly tool. It lets users connect to most standard data sources and then define a processing flow to filter, merge, aggregate, transform and otherwise manhandle data into a form that makes it useful. Veera also provides some basic analytics including descriptive statistics (mean, median, value frequencies, etc.), cross tabs and graphing. The flow is set up as a sequence of icons with a drag-and-drop interface, which means users don’t have to learn a scripting language. Rather than go into more details, I'll just point you to the vendor's on-demand demo.

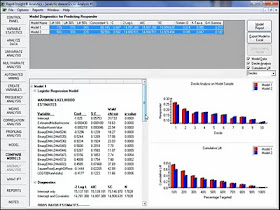

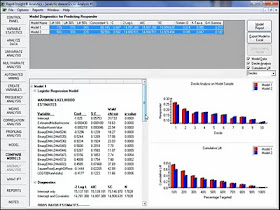

The predictive modeling tool, prosaically named Analytics, builds logistic and least squares regression models. (Logistic models predict yes/no outcomes such as whether someone will respond to a promotion; least squares models predict continuous numeric outcomes such as lifetime value.) The Analytics interface is more sequential than Veera: users get a set of tabs that lead them through the steps of loading data, selecting variables, building the model itself, assessing the results, and scoring an audience. At each step along the way, users can make their own decisions or allow the system to choose for them.

I’ve seen quite a few automated modeling systems over the years, and was impressed at how well Analytics provides users with information to understand what's happening and take control when desired. This should let the system satisfy knowledgeable statisticians looking for a productivity enhancer, as well as novices who want to rely on the system's choices. Analytics also has a good online demo.

Veera and Analytics both run in client/server or desktop configurations. They load data into system memory (RAM), which means very large projects could be problematic. The vendor says a half-million rows with a couple hundred variables is a reasonable universe to model.

The two products are sold separately. This makes sense: many companies could use a generic data assembly tool like Veera for purposes other than modeling. For example, marketers might use it to construct a multi-source marketing database for promotions or analytics.

Pricing is $3,000 for the first Veera user and $5,000 for Analytics, with discounts for additional licenses. This is quite reasonable compared with other automated modeling systems, although other products often provide more than just regression models. Annual maintenance for each product is $1,750 per license. Rapid Insights has been selling its products since 2005 and has more than 150 clients with over 200 licenses.

Predictive modeling is widely used by consumer marketers to select names for mailing lists and to decide which products to offer existing customers. These models are typically built by statisticians with tools like SAS and SPSS. In other cases, marketers can build them for themselves with automated tools like KXEN that are tightly integrated with the marketing automation system.

But most marketers still don’t have a marketing automation system or even an integrated marketing database. Nor do they have the skills to use a product like SAS. This group needs stand-alone tools to do two key things: assemble data from multiple sources, and build and execute the models themselves. (Okay, three things.)

Rapid Insight offers exactly those two (or three) capabilities in a reasonably priced package.

Veera is the data assembly tool. It lets users connect to most standard data sources and then define a processing flow to filter, merge, aggregate, transform and otherwise manhandle data into a form that makes it useful. Veera also provides some basic analytics including descriptive statistics (mean, median, value frequencies, etc.), cross tabs and graphing. The flow is set up as a sequence of icons with a drag-and-drop interface, which means users don’t have to learn a scripting language. Rather than go into more details, I'll just point you to the vendor's on-demand demo.

The predictive modeling tool, prosaically named Analytics, builds logistic and least squares regression models. (Logistic models predict yes/no outcomes such as whether someone will respond to a promotion; least squares models predict continuous numeric outcomes such as lifetime value.) The Analytics interface is more sequential than Veera: users get a set of tabs that lead them through the steps of loading data, selecting variables, building the model itself, assessing the results, and scoring an audience. At each step along the way, users can make their own decisions or allow the system to choose for them.

I’ve seen quite a few automated modeling systems over the years, and was impressed at how well Analytics provides users with information to understand what's happening and take control when desired. This should let the system satisfy knowledgeable statisticians looking for a productivity enhancer, as well as novices who want to rely on the system's choices. Analytics also has a good online demo.

Veera and Analytics both run in client/server or desktop configurations. They load data into system memory (RAM), which means very large projects could be problematic. The vendor says a half-million rows with a couple hundred variables is a reasonable universe to model.

The two products are sold separately. This makes sense: many companies could use a generic data assembly tool like Veera for purposes other than modeling. For example, marketers might use it to construct a multi-source marketing database for promotions or analytics.

Pricing is $3,000 for the first Veera user and $5,000 for Analytics, with discounts for additional licenses. This is quite reasonable compared with other automated modeling systems, although other products often provide more than just regression models. Annual maintenance for each product is $1,750 per license. Rapid Insights has been selling its products since 2005 and has more than 150 clients with over 200 licenses.

Thursday, November 04, 2010

Right On Interactive Offers Lifecycle Reporting

Summary: Right On Interactive has added great life stage reporting to the data integration and output generation features of its earlier 5Buckets product. It could supplement a traditional marketing automation system or perhaps replace one. Either way, it’s worth a look to see what you’re missing.

When I reviewed Right On Interactive in a July 2009 post, the company was selling its 5Buckets marketing software as a multi-channel output generation tool that complemented conventional marketing automation systems. Since then, Right On has expanded its functions, dropped the 5Buckets name, and repositioned itself as a marketing automation alternative focused on “customer lifecycle marketing”. It’s tempting to discuss the business strategy behind this, but I assume that you Dear Reader are a marketer and therefore it's not your problem So let’s look at what the system actually does.

We'll start with the standard marketing automation functions. These are what you need if Right On is really to substitute for one of the better-known products:

What that means in practice is users can assign contacts to lifecycle stages. This lets the system track contacts as they move through the buying, on-boarding and retention processes. Specifically, it generates reports on the number of contacts in each stage, stage-to-stage conversion rates, and average time spent in each stage. It stores each contact’s stage and score histories so it can report on trends in these metrics as well.

Digging a bit deeper: users define the stages by creating segmentation rules similar to standard queries. The system checks each contact against the rules, assigning the contact to the latest stage for which they qualify. The actual stages can be whatever the user wants. Right On's default set holds two lead stages (investigate and evaluate) and two customer stages (value and advocate).

But there's more. Right On creates scatter plots of contacts in each stage, using customer fit and activity scores as dimensions. The resulting “lifecycle map” is a graphic representation of the shape and quality of the company's contact inventories. The plots are interactive: users can select a group on the plot to create a new segment and can drill down to see the details of the individual contacts. They can view reports and maps for all contacts or selected segments.

Right On recognizes that its data could be used to project future business and to correlate stage changes with marketing campaigns, although it hasn’t yet built these features. Once it does, the system will go a long way to providing the stage-based marketing measurement that I’ve been arguing marketers really need. (You can also view my Marketo-sponsored Webinar on the topic.)

So where does this leave us?

I’m lukewarm about Right On as a primary marketing automation system but see great value in its lifecycle reporting. Pricing is relatively modest – starting at just under $1,700 per month for up to 50,000 contacts – so larger firms may be able to use both Right On and a conventional marketing automation product. Smaller companies will probably have to choose one or the other.

When I reviewed Right On Interactive in a July 2009 post, the company was selling its 5Buckets marketing software as a multi-channel output generation tool that complemented conventional marketing automation systems. Since then, Right On has expanded its functions, dropped the 5Buckets name, and repositioned itself as a marketing automation alternative focused on “customer lifecycle marketing”. It’s tempting to discuss the business strategy behind this, but I assume that you Dear Reader are a marketer and therefore it's not your problem So let’s look at what the system actually does.

We'll start with the standard marketing automation functions. These are what you need if Right On is really to substitute for one of the better-known products:

- data management: Right On can import files from any source, placing the data into standard structures or custom tables. Users can link the imported data to any other table, allowing complex data structures. They can also load data to the system API. This is more powerful than many marketing automation products, which are largely limited to a company, contact and activity history files.

- segmentation: users can define segments using a step-by-step query builder or by writing SQL. The query builder supports complex relationships. This is competitive with or better than standard marketing automation systems.

- campaign design: users can define campaigns with multiple “tactics” . Each tactic has its own action, schedule, metrics, documents, and start and end dates. Contacts can enter a tactic from an assigned segment or flow from a previous tactic based on their response and a user-specified waiting period. These features let Right On support multi-step campaigns although complex designs would be a challenge.

- create emails and forms: Right On uses ExactTarget for email and form creation. The integration is fairly smooth since the editing features are accessed within the Right On interface. A native solution is under development but the current approach should work for unless you have a particular aversion to ExactTarget.

- campaign actions: each tactic can execute one action. These include sending an email via Salesforce.com or ExactTarget, creating a Salesforce.com task, generating an output file, and sending emails to Foursquare friends. This covers the basic needs, although most other products also offer options such as changing data and adding a contact to a list or campaign.

- CRM integration: Right On can synchronize data with Salesforce.com and Microsoft CRM on a regular basis. It can also pull file segments and Salesforce.com campaign members as lists. This makes it roughly equivalent to other products. Right On also has a connector with location-based social network Foursquare.

- campaign reporting: users can manually enter campaign costs, target revenue, and actual revenue. The system will capture responses and use the results for response reporting, cost per response and return on investment. This is pretty standard stuff, although many other systems can also import opportunity revenue automatically from Salesforce.com – a feature still in Right On’s future.

- lead scoring: users can define separate scores for customer fit and activities. Customer fit is based on static attributes such as title while activity score is based on events such as email opens or Twitter posts. There’s also an engagement index that compares the actual activity score with the maximum possible score had the contact responded to every promotion. The scoring rules are built in the usual fashion, by assigning to points to different attribute values or different events, although the interface is nicer than most. Contacts are rescored nightly. The scores are stored on the customer record and can trigger an action to send the contact to Salesforce.com. This is on par with other products.

What that means in practice is users can assign contacts to lifecycle stages. This lets the system track contacts as they move through the buying, on-boarding and retention processes. Specifically, it generates reports on the number of contacts in each stage, stage-to-stage conversion rates, and average time spent in each stage. It stores each contact’s stage and score histories so it can report on trends in these metrics as well.

Digging a bit deeper: users define the stages by creating segmentation rules similar to standard queries. The system checks each contact against the rules, assigning the contact to the latest stage for which they qualify. The actual stages can be whatever the user wants. Right On's default set holds two lead stages (investigate and evaluate) and two customer stages (value and advocate).

But there's more. Right On creates scatter plots of contacts in each stage, using customer fit and activity scores as dimensions. The resulting “lifecycle map” is a graphic representation of the shape and quality of the company's contact inventories. The plots are interactive: users can select a group on the plot to create a new segment and can drill down to see the details of the individual contacts. They can view reports and maps for all contacts or selected segments.

Right On recognizes that its data could be used to project future business and to correlate stage changes with marketing campaigns, although it hasn’t yet built these features. Once it does, the system will go a long way to providing the stage-based marketing measurement that I’ve been arguing marketers really need. (You can also view my Marketo-sponsored Webinar on the topic.)

So where does this leave us?

I’m lukewarm about Right On as a primary marketing automation system but see great value in its lifecycle reporting. Pricing is relatively modest – starting at just under $1,700 per month for up to 50,000 contacts – so larger firms may be able to use both Right On and a conventional marketing automation product. Smaller companies will probably have to choose one or the other.

Tuesday, November 02, 2010

Oracle Buys ATG: Bad News for Marketing Automation?

So…Oracle bought ATG today for $6.00 per share or, as the press release puts it with charming nonchalance, “approximately $1.0 billion”. I can’t exactly say I told you so, since this particular pairing never crossed my mind. But if you look back at my “doughnuts and pizza slices” post on software acquisitions, it does make perfect sense. ATG is a specialist in e-commerce (the ERM doughnut in the online operations pizza slice), an area where Oracle’s traditional ERM products are weak. As my model suggests it should, ATG also encompasses online CRM and online marketing, where Oracle’s Siebel line is also a little thin.

Since Oracle is already strong in offline ERM and offline analytics, ATG leaves Oracle just one slice short of a pie. In other words, Oracle needs a Web analytics product. With Omniture, CoreMetrics and Unica already gone, only Webtrends is an option…unless Oracle gobbles up Adobe. ‘nuff said.

So much for the obvious. What I really care about is the implications for marketing systems. I’d say the ATG purchase lessens the odds of Oracle buying a marketing automation vendor. The logic is this: buying ATG suggests that Oracle, like IBM (which put Unica in its WebSphere organization), is focusing on online marketing rather than marketing automation in general. Since ATG itself provides substantial online marketing functionality, there’s a smaller gap for Oracle to fill with a separate marketing automation purchase. Nor have I forgotten that Oracle already bought marketing automation vendor Market2Lead, plugging a different set of holes.

If anything, Oracle (and IBM) need to strengthen their position in online advertising. I'd look for them to buy tools to manage banner ads, search ads, and search engine optimization. This in turn could point towards investments in content management and digital asset management systems. That also leads further away from standard marketing automation.

The day-to-day impact of all this on marketers is slight. They still need marketing automation tools to do their jobs. If anything, they’re better served by having some marketing automation vendors remain independent, since this keeps prices down and encourages competitive innovation. A less-helpful result may be to further isolate digital marketing from other channels, when what we need is to integrate them more closely. Perhaps digital marketing systems will grow to the point that they take over offline marketing as well. I hadn't expected such a role reversal, but it’s certainly possible. Just ask Oedipus. Not that that turned out so well.

Since Oracle is already strong in offline ERM and offline analytics, ATG leaves Oracle just one slice short of a pie. In other words, Oracle needs a Web analytics product. With Omniture, CoreMetrics and Unica already gone, only Webtrends is an option…unless Oracle gobbles up Adobe. ‘nuff said.