My friend and former business partner Michael Hoffman of ClientXClient recently sent a copy of his new book Customer Worthy, which explores use of his customer experience management tool, the CxC Matrix. I’ve long been a big fan of the Matrix*, which visualizes all the ways a customer can interact with a business. The new book provides a detailed explanation of Matrix concepts and applications.

The core concept is to “Think Like a Customer” (a favorite Hoffman catch phrase), meaning to understand each contact from the customer’s point of view. The book explains how to use the Matrix to document contacts throughout the customer life cycle, allowing companies to systematically visualize, analyze, monetize, prioritize and ultimately optimize each interaction. It shows how to extend the Matrix to the departmental and system view of each contact, giving companies a roadmap of the steps they must take to execute on Matrix concepts.

Other sections address privacy concerns and highlight the cost of poor service. A final section explains how each department throughout the company can use the Matrix to organize its internal work and coordinate with the rest of the organization.

Customer Worthy provides a good mix of inspiration, theory and practical examples. I’m pleased he’s taken the time to work through Matrix concepts at length, since it’s a rich topic that repays detailed examination. Even if you don’t deploy the Matrix in the forms that Hoffman describes, it’s worth reading to reinforce the broader points that (a) the customer comes first and (b) there are systematic ways to make that thought a reality.

_________________

*This blog, which started when Hoffman and I were partners, was named for it.

This is the blog of David M. Raab, marketing technology consultant and analyst. Mr. Raab is founder and CEO of the Customer Data Platform Institute and Principal at Raab Associates Inc. All opinions here are his own. The blog is named for the Customer Experience Matrix, a tool to visualize marketing and operational interactions between a company and its customers.

Wednesday, May 26, 2010

Tuesday, May 25, 2010

Oracle Buys Market2Lead Intellectual Assets

Oracle tersely announced today that it had purchased the intellectual assets of demand generation vendor Market2Lead. This is an excellent fit for Oracle in that Market2Lead is a sophisticated product that is best suited to large, demanding marketing operations. Those are presumably the firms in Oracle's target market.

Market2Lead CEO Geoff Rego explained some of the mechanics of the deal to me in a private conversation, but the details were not for publication. However, a blog post by Eloqua's Joe Payne confirms that existing Market2Lead customers will remain clients of Market2Lead, while Oracle itself will be purchasing the technology itself. The effect is that those customers will have the option to stay with Market2Lead or migrate elsewhere over time. Payne's post says that Eloqua and Market2Lead have been discussing a path for Market2Lead clients who prefer Eloqua to an Oracle relationship.

The entry of Oracle into the demand generation space certainly reflects growing interest in the field. Note that Oracle's Seibel group already had a robust marketing automation solution for consumer marketers, so this does clarify that B2B marketing automation is different from B2C marketing automation. (This is why I prefer the term "demand generation" for B2B marketing automation, although it's been a losing battle.) If there's a single major distinction between the two types of systems, it's the heavy reliance of B2B marketing automation on sales automation data, which in practical terms means reliance on Salesforce.com. Part of the reason the deal was structured as a purchase of assets may be that Oracle is a major rival to Salesforce.com, and thus neither firm is all that interested in cooperating with the other.

I've been arguing for some time that we can expect an eventual merger of CRM and demand generation systems. The Oracle / Market2Lead deal seems a step in this direction: at the ownership level, those systems will now be integrated, even though they may remain fairly distinct technically. This would actually mirror the structure of Siebel's own merger of CRM and marketing automation components, which also used separate-though-synchronized databases the last time I looked.

A related question is whether this deal also heralds the start of consolidation among demand generation vendors. I do think the industry is overcrowded, but growth rates are still so high that I don't see that consolidation happening quite yet. Most of the activity has been among smaller businesses, who are not the primary clients for Oracle or Market2Lead. So I don't see other vendors as feeling much pressure as a result of this deal. Of course, this could change if Oracle pursues small business marketers directly, but I'd guess that it will take some time before they have a major impact.

Market2Lead CEO Geoff Rego explained some of the mechanics of the deal to me in a private conversation, but the details were not for publication. However, a blog post by Eloqua's Joe Payne confirms that existing Market2Lead customers will remain clients of Market2Lead, while Oracle itself will be purchasing the technology itself. The effect is that those customers will have the option to stay with Market2Lead or migrate elsewhere over time. Payne's post says that Eloqua and Market2Lead have been discussing a path for Market2Lead clients who prefer Eloqua to an Oracle relationship.

The entry of Oracle into the demand generation space certainly reflects growing interest in the field. Note that Oracle's Seibel group already had a robust marketing automation solution for consumer marketers, so this does clarify that B2B marketing automation is different from B2C marketing automation. (This is why I prefer the term "demand generation" for B2B marketing automation, although it's been a losing battle.) If there's a single major distinction between the two types of systems, it's the heavy reliance of B2B marketing automation on sales automation data, which in practical terms means reliance on Salesforce.com. Part of the reason the deal was structured as a purchase of assets may be that Oracle is a major rival to Salesforce.com, and thus neither firm is all that interested in cooperating with the other.

I've been arguing for some time that we can expect an eventual merger of CRM and demand generation systems. The Oracle / Market2Lead deal seems a step in this direction: at the ownership level, those systems will now be integrated, even though they may remain fairly distinct technically. This would actually mirror the structure of Siebel's own merger of CRM and marketing automation components, which also used separate-though-synchronized databases the last time I looked.

A related question is whether this deal also heralds the start of consolidation among demand generation vendors. I do think the industry is overcrowded, but growth rates are still so high that I don't see that consolidation happening quite yet. Most of the activity has been among smaller businesses, who are not the primary clients for Oracle or Market2Lead. So I don't see other vendors as feeling much pressure as a result of this deal. Of course, this could change if Oracle pursues small business marketers directly, but I'd guess that it will take some time before they have a major impact.

Thursday, May 20, 2010

Omniture Study Suggests Marketers Doubt Value of Analytics Investment

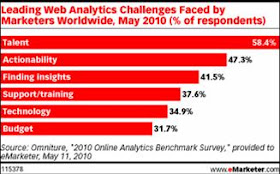

Not to beat a dead horse, but Wednesday’s eMarketer reported on yet another survey that touched on the question of why marketers don’t measure. Although the Omniture 2010 Online Analytics Survey is obviously limited to Web analytics, the answers probably apply to other types of measurement as well.

I wasn’t able to get a copy of the full survey results, despite two requests to Omniture and even filling it out myself, which was supposed to yield a copy that compared my answers with my peers'. Perhaps I’m peerless. But the snippets published in eMarketer are enough for now.

Specifically, eMarketer reported that the leading challenge in Web analytics was “talent”, cited by 58.4% of respondents. Assuming that “talent” is really a polite way of saying “skilled staff”, this suggests that lack of education, not lack of time, is the critical roadblock to better measurement. I’ve been betting the reason is time, but would reconsider in the face of new evidence.

But wait.

When I took the survey, the question about “talent” actually defined it as "lack of skill/time". So it’s perfectly possible that marketers picking "talent" really saw lack of time as the most important challenge.

My position is arguably strengthened by the relatively low ranking of "support/training" (37.6%) and "budget" (31.7%) in the answers. Those can certainly improve skills but they can’t expand the manager's available time. Even hiring more staff wouldn't do that.

On the other hand, the second- and third-ranked challenges were "actionability" (47.3%) and "finding insights" (41.5%) which both suggest doubts that Web analytics can deliver real value. This would show a need for education – but, as I wrote in my comment on the original Why Marketers Don't Measure post, it's a need for education in the fundamental utility of measurement, not education in specific techniques.

Bottom line: the Omniture survey confirms that marketers won’t invest in analytics until they’re convinced it’s the best use of their limited resources. Efforts to expand adoption of analytics should start with that.

I wasn’t able to get a copy of the full survey results, despite two requests to Omniture and even filling it out myself, which was supposed to yield a copy that compared my answers with my peers'. Perhaps I’m peerless. But the snippets published in eMarketer are enough for now.

Specifically, eMarketer reported that the leading challenge in Web analytics was “talent”, cited by 58.4% of respondents. Assuming that “talent” is really a polite way of saying “skilled staff”, this suggests that lack of education, not lack of time, is the critical roadblock to better measurement. I’ve been betting the reason is time, but would reconsider in the face of new evidence.

But wait.

When I took the survey, the question about “talent” actually defined it as "lack of skill/time". So it’s perfectly possible that marketers picking "talent" really saw lack of time as the most important challenge.

My position is arguably strengthened by the relatively low ranking of "support/training" (37.6%) and "budget" (31.7%) in the answers. Those can certainly improve skills but they can’t expand the manager's available time. Even hiring more staff wouldn't do that.

On the other hand, the second- and third-ranked challenges were "actionability" (47.3%) and "finding insights" (41.5%) which both suggest doubts that Web analytics can deliver real value. This would show a need for education – but, as I wrote in my comment on the original Why Marketers Don't Measure post, it's a need for education in the fundamental utility of measurement, not education in specific techniques.

Bottom line: the Omniture survey confirms that marketers won’t invest in analytics until they’re convinced it’s the best use of their limited resources. Efforts to expand adoption of analytics should start with that.

Wednesday, May 19, 2010

DemandBase Adds Real-Time Access to Web Visitor Identities

Summary: DemandBase has added real-time access to its data identifying Web site visitors, enabling Web sites to deliver customized pages. It's another step in the company's systematic expansion.

It’s more than a year since my original post about DemandBase. At the time, they had just extended their product beyond basic IP-address-based Web visitor identification to provide company details and contact names. Last week they announced their next leap forward, an API to return detailed company information quickly enough to use it to tailor visitor treatments.

Specifically, ABR returns data within 10 milliseconds of the initial page request, in time to customize even the first page served. According to DemandBase, this compares with one to two seconds for conventional IP address look-ups.

ABR gains its speed by querying DemandBase’s own database rather than querying external directories. This is one of those things that is harder than it sounds. DemandBase built its database by monitoring which IP addresses most often visit its 2,000-plus clients, parsing multiple external IP directories for the owners and geo-locations of the servers at those addresses, and adding attributes from business directories including D&B, Hoovers and JigSaw. The company says it can associate three times as many visitors with U.S. business addresses as a conventional IP lookup.

Once it finds a match, ABR will return 15-20 client-selected company attributes including size, industry and corporate parent. The system can also apply and return a client’s own data, such as the salesperson assigned to a company and custom classifications for size or industry. These features were already available from DemandBase: what's new with ABR is exposing the data to other applications through a real time API.

One use for the data is to feed rules that send different messages to different sets of customers and prospects. DemandBase is also working to use the data to route chat requests to appropriate agents. Another benefit is sending shorter registration forms to system-identified visitors, improving completion rates while still capturing complete profile data. The system also improves Web analytics by flagging responses from specific companies and market segments, even when visitors fail to identify themselves, delete cookies, or reach the site without clicking on email links.

ABR is still a bit rough around the edges. In particular, there are no prebuilt connectors for specific application systems (Web site engines, CRM systems or analytics tools), so clients are on their own when it comes to integrating the information they receive. The first connectors are due shortly. Similarly, client data such as customers and sales people must currently be loaded by DemandBase staff. This will also change, first with a self-service file upload and eventually with a direct API connection.

Pricing for ABR is set at $2,500 per month for unlimited use. This is beyond the reach of many small businesses, but affordable for companies with the technical savvy and visitor volume to benefit from the system.

Beyond its intrinsic merits, ABR is an interesting illustration of DemandBase’s continuing effort to separate itself from the commodity businesses of IP lookup and compiled data. The company started by giving away its basic service, identification of company visitors to Web sites, to quickly build a large base of clients and partners. It then added value by enhancing the data with business directory information and making it easy to buy the names of individual contacts. ABR further expands the company’s footprint by using its data to enhance other systems, moving it beyond the business of selling stand-alone software. Clever folks.

It’s more than a year since my original post about DemandBase. At the time, they had just extended their product beyond basic IP-address-based Web visitor identification to provide company details and contact names. Last week they announced their next leap forward, an API to return detailed company information quickly enough to use it to tailor visitor treatments.

Specifically, ABR returns data within 10 milliseconds of the initial page request, in time to customize even the first page served. According to DemandBase, this compares with one to two seconds for conventional IP address look-ups.

ABR gains its speed by querying DemandBase’s own database rather than querying external directories. This is one of those things that is harder than it sounds. DemandBase built its database by monitoring which IP addresses most often visit its 2,000-plus clients, parsing multiple external IP directories for the owners and geo-locations of the servers at those addresses, and adding attributes from business directories including D&B, Hoovers and JigSaw. The company says it can associate three times as many visitors with U.S. business addresses as a conventional IP lookup.

Once it finds a match, ABR will return 15-20 client-selected company attributes including size, industry and corporate parent. The system can also apply and return a client’s own data, such as the salesperson assigned to a company and custom classifications for size or industry. These features were already available from DemandBase: what's new with ABR is exposing the data to other applications through a real time API.

One use for the data is to feed rules that send different messages to different sets of customers and prospects. DemandBase is also working to use the data to route chat requests to appropriate agents. Another benefit is sending shorter registration forms to system-identified visitors, improving completion rates while still capturing complete profile data. The system also improves Web analytics by flagging responses from specific companies and market segments, even when visitors fail to identify themselves, delete cookies, or reach the site without clicking on email links.

ABR is still a bit rough around the edges. In particular, there are no prebuilt connectors for specific application systems (Web site engines, CRM systems or analytics tools), so clients are on their own when it comes to integrating the information they receive. The first connectors are due shortly. Similarly, client data such as customers and sales people must currently be loaded by DemandBase staff. This will also change, first with a self-service file upload and eventually with a direct API connection.

Pricing for ABR is set at $2,500 per month for unlimited use. This is beyond the reach of many small businesses, but affordable for companies with the technical savvy and visitor volume to benefit from the system.

Beyond its intrinsic merits, ABR is an interesting illustration of DemandBase’s continuing effort to separate itself from the commodity businesses of IP lookup and compiled data. The company started by giving away its basic service, identification of company visitors to Web sites, to quickly build a large base of clients and partners. It then added value by enhancing the data with business directory information and making it easy to buy the names of individual contacts. ABR further expands the company’s footprint by using its data to enhance other systems, moving it beyond the business of selling stand-alone software. Clever folks.

Tuesday, May 18, 2010

CMO Survey: Measurement Isn't Our Top Priority

I’ve spent a lot of time looking at surveys to understand marketers’ priorities. Another one crossed my desk today, taken by Aprimo at Argyle Executive Forum’s 2010 CMO Spotlight Forum: Retail and Consumer Goods & Services on April 29, 2010 in New York.

The results are the most puzzling yet. The survey seems nice and simple: three questions with five answers each, and the answers contain similar categories. But the most common answer to each question suggests a different priority:

Q: What is driving the highest degree of change to your marketing strategies?

A: Creating more compelling customer/prospect experiences (37%)

Q: What is the CMO’s biggest challenge today?

A: Integrating and tracking multiple channels (37%)

Q: What is most broken in marketing?

A: Correlating marketing activities to revenues (39%)

So which is it, folks? Customer experience, channel integration or marketing measurement? It's nice to know that I could cite whichever I like if I have a particular point to support. But mostly this suggests that CMOs are just plain confused.

I suppose a more subtle interpretation would be that marketers know that correlation of activities with revenues is their "most broken" process, but consider fixing it less important than integrating multiple channels. You could argue this supports the case I made in my last two posts that marketers haven't invested in measurement because they have other priorities.

The table below gives a more complete view of the results, with color-coding of related answers across categories. You might see a bit of a pattern if you look hard enough: integration and measurement show up in four of top six cells. And I suppose the #3 rank of measurement in the "biggest challenge" category reinforces my argument about its low priority.

You can download the survey results and take a more detailed CMO survey if you're so inclined. Aprimo seems to be setting up some sort of community as well, although I couldn't find any actual discussion to date.

The results are the most puzzling yet. The survey seems nice and simple: three questions with five answers each, and the answers contain similar categories. But the most common answer to each question suggests a different priority:

Q: What is driving the highest degree of change to your marketing strategies?

A: Creating more compelling customer/prospect experiences (37%)

Q: What is the CMO’s biggest challenge today?

A: Integrating and tracking multiple channels (37%)

Q: What is most broken in marketing?

A: Correlating marketing activities to revenues (39%)

So which is it, folks? Customer experience, channel integration or marketing measurement? It's nice to know that I could cite whichever I like if I have a particular point to support. But mostly this suggests that CMOs are just plain confused.

I suppose a more subtle interpretation would be that marketers know that correlation of activities with revenues is their "most broken" process, but consider fixing it less important than integrating multiple channels. You could argue this supports the case I made in my last two posts that marketers haven't invested in measurement because they have other priorities.

The table below gives a more complete view of the results, with color-coding of related answers across categories. You might see a bit of a pattern if you look hard enough: integration and measurement show up in four of top six cells. And I suppose the #3 rank of measurement in the "biggest challenge" category reinforces my argument about its low priority.

| Goals Driving Most Change | Biggest CMO Challenge Today | Most Broken in Marketing |

| create compelling experiences 37% | integrate & track multiple channels 37% | correlate activity w/revenue 39% |

| ROI / accountability 27% | do more with less 28% | lack of channel integration 27% |

| digital marketing 18% | accountability / measurement 18% | too many silos 15% |

| integrate channels 17% | control messages in social media 11% | perceived lack of marketing value 10% |

| streamline operations 1% | keep up with social media 6% | channel-consistent messaging 10% |

Why Marketers Don't Measure: A Test to Find Out

Last week's post Why Marketers Don't Measure generated some interesting debate on whether the problem is lack of time or lack of knowledge. It dawns on me that this should be a testable question -- something the assembled measurement gurus should find congenial.

My initial thought is an a/b test of email headlines, one offering "quick and easy ways to improve your marketing measurement" (i.e., time) and the other offering "learn how to do a better job measuring your marketing results" (i.e., knowledge). These could offer a book, Webinar, white paper or something else; what matters is which value proposition is more attractive, which would be measured simply through the open rate. Come to think of it, this could also be a split test in paid search or display ads.

I don't happen to have a suitable event upcoming to actually test this against, but perhaps someone out there could give it a try and share the results? Or can you think of a better test to answer the time vs. knowledge question?

My initial thought is an a/b test of email headlines, one offering "quick and easy ways to improve your marketing measurement" (i.e., time) and the other offering "learn how to do a better job measuring your marketing results" (i.e., knowledge). These could offer a book, Webinar, white paper or something else; what matters is which value proposition is more attractive, which would be measured simply through the open rate. Come to think of it, this could also be a split test in paid search or display ads.

I don't happen to have a suitable event upcoming to actually test this against, but perhaps someone out there could give it a try and share the results? Or can you think of a better test to answer the time vs. knowledge question?

Tuesday, May 11, 2010

Why Marketers Don't Measure

I had a small epiphany the other day when someone recommended that one of my clients needed a marketing measurement project. As author of The Marketing Performance Measurement Toolkit and a frequent speaker on the topic, I was surprised to find I didn’t like the idea. The problem was that this particular client had other marketing challenges that were more pressing. Even though their measurement could indeed be improved, a measurement project at this time would have been a distraction.

This got me to thinking. If I, a certified measurement guru, rejected a measurement project because we had other priorities, how much more likely are other marketers to make the same judgment? By coincidence – or was it? – I was speaking on the very topic a few days later, so I polled the audience. Sure enough, heads nodded vigorously: yes, they really understand the value of better measurement. But they just didn’t have time to set up a major effort.

It’s no news that marketers are busy. What makes this interesting (to me, at least) is that marketers have for years listed better measurement as a top priority but made little actual progress. When asked about obstacles, they generally come up with reasons like lack of data or measurement technology (For example, see the 2009 Marketing Performance Advantage study from CMG Partners and Chadwick Martin Bailey.) Since these are problems that can be solved with funding, they suggest that the root cause is that marketers doubt measurement is worth the investment or don’t know how to do it.

If ignorance is the problem, then education is the solution. This has long been my premise as a measurement evangelist: if only I could convince marketers that measurement is truly important and help them learn how to do it, they would take the plunge.

But if the real problem is lack of time, then education doesn't matter. My current thinking is that most marketers do sincerely want to improve their measurement programs and would even spend money to do it but just don’t have the time to set things up.

My analogy is a speedometer. We all recognize the benefits of a speedometer and use the speedometer built into our car, but few people would buy a speedometer by itself or attend seminars or buy books on speedometer design. We might glance at the speedometer when we buy a new car, but aren’t likely to give it much weight in our purchase decision. Similarly, I think marketers recognize that measurement is important and will use the measurement tools they have available, but few buy stand-alone measurement systems or make measurement a major factor in their product selection.

If I’m right about this, marketing system vendors are in an awkward position. They know that marketers are likely to use only the measurement tools their products provide, and thus that they should build in strong measurement capabilities to help their clients succeed. But they also know that marketers won’t buy their products because they have better measurement or pay extra for measurement features. So the software companies have no incentive to invest in better measurement capabilities.

Economists are familiar with this sort of market failure. It’s why seatbelts are required by law – because many buyers won’t pay extra for them despite their proven value. (Speedometers too, come to think of it.) Despite this, some marketing software includes extensive measurement features and some vendors have even attempted to differentiate their products with those features. I haven’t asked how that’s working out, but suspect it hasn’t been a major factor in many purchase decisions. (If any vendors care to comment on this point, I'd appreciate it.)

Consultants like myself have it easier. Although most marketers won’t spend either time or money on better measurement, there are enough others willing to pay consultants (basically trading time for money) for at least some of us to make a living.

The implications for me as a writer and speaker are a bit more pointed. Lectures aimed at inspiring or educating marketers about measurement are probably off target. Instead, marketers need concrete advice on how to do better measurement with their existing tools with a minimal investment in time. Such advice will lead to tactical and incremental projects rather than a grand unified measurement vision. But so long as it moves marketers in the right direction, it’s worthwhile.

This got me to thinking. If I, a certified measurement guru, rejected a measurement project because we had other priorities, how much more likely are other marketers to make the same judgment? By coincidence – or was it? – I was speaking on the very topic a few days later, so I polled the audience. Sure enough, heads nodded vigorously: yes, they really understand the value of better measurement. But they just didn’t have time to set up a major effort.

It’s no news that marketers are busy. What makes this interesting (to me, at least) is that marketers have for years listed better measurement as a top priority but made little actual progress. When asked about obstacles, they generally come up with reasons like lack of data or measurement technology (For example, see the 2009 Marketing Performance Advantage study from CMG Partners and Chadwick Martin Bailey.) Since these are problems that can be solved with funding, they suggest that the root cause is that marketers doubt measurement is worth the investment or don’t know how to do it.

If ignorance is the problem, then education is the solution. This has long been my premise as a measurement evangelist: if only I could convince marketers that measurement is truly important and help them learn how to do it, they would take the plunge.

But if the real problem is lack of time, then education doesn't matter. My current thinking is that most marketers do sincerely want to improve their measurement programs and would even spend money to do it but just don’t have the time to set things up.

My analogy is a speedometer. We all recognize the benefits of a speedometer and use the speedometer built into our car, but few people would buy a speedometer by itself or attend seminars or buy books on speedometer design. We might glance at the speedometer when we buy a new car, but aren’t likely to give it much weight in our purchase decision. Similarly, I think marketers recognize that measurement is important and will use the measurement tools they have available, but few buy stand-alone measurement systems or make measurement a major factor in their product selection.

If I’m right about this, marketing system vendors are in an awkward position. They know that marketers are likely to use only the measurement tools their products provide, and thus that they should build in strong measurement capabilities to help their clients succeed. But they also know that marketers won’t buy their products because they have better measurement or pay extra for measurement features. So the software companies have no incentive to invest in better measurement capabilities.

Economists are familiar with this sort of market failure. It’s why seatbelts are required by law – because many buyers won’t pay extra for them despite their proven value. (Speedometers too, come to think of it.) Despite this, some marketing software includes extensive measurement features and some vendors have even attempted to differentiate their products with those features. I haven’t asked how that’s working out, but suspect it hasn’t been a major factor in many purchase decisions. (If any vendors care to comment on this point, I'd appreciate it.)

Consultants like myself have it easier. Although most marketers won’t spend either time or money on better measurement, there are enough others willing to pay consultants (basically trading time for money) for at least some of us to make a living.

The implications for me as a writer and speaker are a bit more pointed. Lectures aimed at inspiring or educating marketers about measurement are probably off target. Instead, marketers need concrete advice on how to do better measurement with their existing tools with a minimal investment in time. Such advice will lead to tactical and incremental projects rather than a grand unified measurement vision. But so long as it moves marketers in the right direction, it’s worthwhile.

Thursday, May 06, 2010

Genoo Offers Web Marketing for Small Business

Summary: Genoo provides a simple Web site, demand generation and social marketing for $199 per month. It’s not the most sophisticated system or the prettiest, but some small businesses may find it's just what they need.

Genoo offers a small-business-oriented Web marketing system at a small-business-friendly price of $199 per month. I’m somewhat grandly labeling it a “Web marketing system” rather than “demand generation” because its microsite could replace a small company’s primary Web site. Demand generation features are adequate, if a bit rudimentary, and are supplemented by social marketing capabilities that do an above-average job of integrating social activities with traditional lead data. Over all, it’s an option worth considering for businesses with limited funding and limited needs. (For other small business systems, see my list of demand generation vendors from last November.)

Let’s start with the microsites. Each Genoo subscription includes a single site with unlimited pages using the client’s own domain name. Pages can be built with Genoo’s free standard design templates or clients can pay Genoo $500 for a custom template. Each page can incorporate CSS style sheets, tags for search engine optimization, social sharing widgets, data capture forms, and visitor comments. Commenters are automatically entered as leads into the Genoo database. The commenting system captures a URL, link text and Twitter name in addition to the usual first/last name and email address.

All pages are built and managed through a content library, which can also contain materials such as images, downloadable files and link lists. An RSS manager lets visitors subscribe to selected items, simplifying programs such as newsletters. RSS subscribers can also be automatically added as leads.

Data capture forms can be displayed within a Genoo page or linked to an externally-hosted page through Genoo-provided Javascript. Either configuration will post data directly to the Genoo database. One major limitation is that the system supports only a fixed set of data fields (29 if I counted correctly). Genoo plans to let users add custom fields but hasn’t set a date for this feature. User-defined surveys, which allow some expansion in data storage, are due this fall.

The current system lets users build forms with any of the existing fields, change formatting, labels and sequence, and designate fields as mandatory. Once a form is submitted, Genoo can add a lead type and lead source to the submitter’s record. Submission can also trigger a confirmation email, send the visitor to a confirmation Web page, and send an alert email to company staff.

Each lead can be tagged with multiple lead types. These can be set by page comments, content downloads and list criteria in addition to form submissions. List criteria can be based on combinations of existing lead types, other lead attributes (location, industry, company size, budget, etc.) and behaviors such as number of site visits, time since last visit, and number of emails.

The system can send emails through list selections or nurture programs. Leads enter nurture programs through triggers, which can be based on assignment of a new lead type or Web events such as email clicks, page views and downloads. Nurture programs contain one or more emails, each sent a specified number of days after the initial trigger event. Genoo’s nurture capabilities are barebones by today’s demand generation standards – email is the only type of message available, there’s no way to send different emails to different leads within the same step, and there's no way to skip a step. Genoo does plan to add direct mail and telemarketing options.

Let me modify that last statement just a bit: most of Genoo’s nurture capabilities are barebones. The scheme to coordinate movement of leads across sequences is quite elaborate – in fact, the term “Byzantine” comes to mind. For each sequence, users can a specify a trigger that will remove leads from the sequence and can decide whether entry to the sequence will remove a lead from all other sequences or a list of specific sequences. So far so good.

But if users really want to get fancy, they can also assign each sequence to a numeric level within track. They can then specify, separately for each sequence, whether entry to the sequence will suspend a lead from all other sequences within a track, from all sequences at lower levels within the same track, or all sequences at lower levels in all tracks. They can also block leads from entering a new sequence if the lead is already active at a sequence on a higher level. This is a very powerful and flexible approach, although users must be well organized to apploy it effectively. Of course, users can ignore these features if they wish.

Lead scoring in Genoo is more straightforward. Points can be assigned for attributes and activities, including the usual Web behaviors (page visits, form submissions, downloads) and social behaviors (sharing, commenting, RSS subscription). This is a closer integration of social into lead scoring than I recall seeing elsewhere. Users also specify how far back to look when assigning points and set a score threshold to submit a lead to CRM. Genoo maintains only one score per lead – a big problem for companies that want to score leads against different products, but a limit that Genoo shares with many other demand generation products.

Genoo offers bidirectional synchronization with Salesforce.com, although only a handful of the company's 32 current clients actually use it. Users have considerable control over which leads are shared, with options to create queues for leads to send to Salesforce and to specify which Salesforce.com campaigns will send leads back to Genoo.

Users can also create shared and personal follow-up queues within Genoo, complete with notes and scheduled activities for individual leads. This lets Genoo to provide basic contact management for clients without a separate CRM system.

Reporting in Genoo is reasonably complete, including source tracking, referrals, search keywords, email campaign results, links clicks, forms filled out, and forward-to-friend forms. The system doesn’t use IP addresses to report on the companies of anonymous Web site visitors, although the vendor is exploring an alliance with a third party to add this feature. As I mentioned in an earlier post on social marketing, Genoo is among the handful of systems that track social click-throughs to the original sharer, allowing marketers to see which leads are actively driving traffic through social media.

These features are all included in Genoo’s base price of $199 per month, regardless of file size or Web activity. Users pay another $8.50 per thousand for emails sent, which won't add much to most clients' bills. Clients wishing to use Genoo as a sales automation system pay another $9.95 per sales user per month. Set-up and support are free and there’s a 30 day free trial.

Genoo offers a small-business-oriented Web marketing system at a small-business-friendly price of $199 per month. I’m somewhat grandly labeling it a “Web marketing system” rather than “demand generation” because its microsite could replace a small company’s primary Web site. Demand generation features are adequate, if a bit rudimentary, and are supplemented by social marketing capabilities that do an above-average job of integrating social activities with traditional lead data. Over all, it’s an option worth considering for businesses with limited funding and limited needs. (For other small business systems, see my list of demand generation vendors from last November.)

Let’s start with the microsites. Each Genoo subscription includes a single site with unlimited pages using the client’s own domain name. Pages can be built with Genoo’s free standard design templates or clients can pay Genoo $500 for a custom template. Each page can incorporate CSS style sheets, tags for search engine optimization, social sharing widgets, data capture forms, and visitor comments. Commenters are automatically entered as leads into the Genoo database. The commenting system captures a URL, link text and Twitter name in addition to the usual first/last name and email address.

All pages are built and managed through a content library, which can also contain materials such as images, downloadable files and link lists. An RSS manager lets visitors subscribe to selected items, simplifying programs such as newsletters. RSS subscribers can also be automatically added as leads.

Data capture forms can be displayed within a Genoo page or linked to an externally-hosted page through Genoo-provided Javascript. Either configuration will post data directly to the Genoo database. One major limitation is that the system supports only a fixed set of data fields (29 if I counted correctly). Genoo plans to let users add custom fields but hasn’t set a date for this feature. User-defined surveys, which allow some expansion in data storage, are due this fall.

The current system lets users build forms with any of the existing fields, change formatting, labels and sequence, and designate fields as mandatory. Once a form is submitted, Genoo can add a lead type and lead source to the submitter’s record. Submission can also trigger a confirmation email, send the visitor to a confirmation Web page, and send an alert email to company staff.

Each lead can be tagged with multiple lead types. These can be set by page comments, content downloads and list criteria in addition to form submissions. List criteria can be based on combinations of existing lead types, other lead attributes (location, industry, company size, budget, etc.) and behaviors such as number of site visits, time since last visit, and number of emails.

The system can send emails through list selections or nurture programs. Leads enter nurture programs through triggers, which can be based on assignment of a new lead type or Web events such as email clicks, page views and downloads. Nurture programs contain one or more emails, each sent a specified number of days after the initial trigger event. Genoo’s nurture capabilities are barebones by today’s demand generation standards – email is the only type of message available, there’s no way to send different emails to different leads within the same step, and there's no way to skip a step. Genoo does plan to add direct mail and telemarketing options.

Let me modify that last statement just a bit: most of Genoo’s nurture capabilities are barebones. The scheme to coordinate movement of leads across sequences is quite elaborate – in fact, the term “Byzantine” comes to mind. For each sequence, users can a specify a trigger that will remove leads from the sequence and can decide whether entry to the sequence will remove a lead from all other sequences or a list of specific sequences. So far so good.

But if users really want to get fancy, they can also assign each sequence to a numeric level within track. They can then specify, separately for each sequence, whether entry to the sequence will suspend a lead from all other sequences within a track, from all sequences at lower levels within the same track, or all sequences at lower levels in all tracks. They can also block leads from entering a new sequence if the lead is already active at a sequence on a higher level. This is a very powerful and flexible approach, although users must be well organized to apploy it effectively. Of course, users can ignore these features if they wish.

Lead scoring in Genoo is more straightforward. Points can be assigned for attributes and activities, including the usual Web behaviors (page visits, form submissions, downloads) and social behaviors (sharing, commenting, RSS subscription). This is a closer integration of social into lead scoring than I recall seeing elsewhere. Users also specify how far back to look when assigning points and set a score threshold to submit a lead to CRM. Genoo maintains only one score per lead – a big problem for companies that want to score leads against different products, but a limit that Genoo shares with many other demand generation products.

Genoo offers bidirectional synchronization with Salesforce.com, although only a handful of the company's 32 current clients actually use it. Users have considerable control over which leads are shared, with options to create queues for leads to send to Salesforce and to specify which Salesforce.com campaigns will send leads back to Genoo.

Users can also create shared and personal follow-up queues within Genoo, complete with notes and scheduled activities for individual leads. This lets Genoo to provide basic contact management for clients without a separate CRM system.

Reporting in Genoo is reasonably complete, including source tracking, referrals, search keywords, email campaign results, links clicks, forms filled out, and forward-to-friend forms. The system doesn’t use IP addresses to report on the companies of anonymous Web site visitors, although the vendor is exploring an alliance with a third party to add this feature. As I mentioned in an earlier post on social marketing, Genoo is among the handful of systems that track social click-throughs to the original sharer, allowing marketers to see which leads are actively driving traffic through social media.

These features are all included in Genoo’s base price of $199 per month, regardless of file size or Web activity. Users pay another $8.50 per thousand for emails sent, which won't add much to most clients' bills. Clients wishing to use Genoo as a sales automation system pay another $9.95 per sales user per month. Set-up and support are free and there’s a 30 day free trial.

Tuesday, May 04, 2010

Genoo and Act-On Software Add Social Marketing Features

Summary: Two low-cost demand generation systems, Genoo and Act-On Software, have added unusually advanced social marketing features.

A few weeks back, I wrote about social marketing features from consumer marketing automation vendors. Naturally our friends in the business marketing space have been adding such features as well. I got details from two of them last week.

- Genoo, which offers a solid demand generation system for a rock-bottom $199/month, has placed a particular focus on capturing contact information from social interactions. People who comment on a Genoo-hosted Web page or subscribe to a Genoo-originated RSS feed can be loaded into the system as contacts and these activities can factor into their lead score. I don’t recall seeing either feature in any other demand generation system, although I haven't checked carefully.

Genoo also offers “share to social” badges for messages delivered by its system. These embed a unique ID to link any resulting Web visits back to the original sharer. This feature is not unique – Genius.com and smartFocus do something similar – but it’s still pretty unusual. However, the value is so obvious that I expect many other vendors will soon follow. Genoo can also assign lead score points for social media sharing.

I expect to post a more comprehensive review of Genoo in the next week or two.

- Act-On Software is another low-cost system, starting at $500 per month. It has made several important enhancements since my review in March 2009, notably multi-step campaign sequences and bi-directional integration with Salesforce.com.

To the current topic, it has also added a “Twitter Prospector” to reduce the labor required to mine Twitter for leads. This lets users define multiple search queries and see each result in separate columns. To screen out marketing pitches, the system can exclude tweets with embedded links. Users can reply to selected tweets through corporate accounts, drawing on a library of standard messages. This reduces the risk of inappropriate replies. Users can also forward a tweet to someone else for review or comment.

Act-On will also string together related tweets to give a sense of the on-going dialog. Web site visits driven from Twitter are flagged in the activity history of individual leads and in general Web analytics reports, although Act-On does not tie them to the originator like Genoo. It does add the Twitter ID of known visitors to their lead profile when possible.

Providing a library of standard replies to Twitter messages is not unique (see my December 2009 review of Spredfast for something similar). But it’s an unusual feature for a demand generation system, which typically defers to CRM for managing interactions with individuals. Act-On originally developed the feature for its own use, so perhaps there's no deep significance to its choice. It's also worth considering that the next logical step -- fully automated replies to social messages -- would almost surely fall within the normal scope of marketing and demand generation. (I'm not sure automated responses are such a great idea, but they will ultimately be the only way to manage the volume of messages presented in social media. So it's more a question of how to do them effectively than whether to do them at all.) What we see here is still more blurring of the boundaries between the demand generation and CRM systems, a trend I fully expect to continue.

A few weeks back, I wrote about social marketing features from consumer marketing automation vendors. Naturally our friends in the business marketing space have been adding such features as well. I got details from two of them last week.

- Genoo, which offers a solid demand generation system for a rock-bottom $199/month, has placed a particular focus on capturing contact information from social interactions. People who comment on a Genoo-hosted Web page or subscribe to a Genoo-originated RSS feed can be loaded into the system as contacts and these activities can factor into their lead score. I don’t recall seeing either feature in any other demand generation system, although I haven't checked carefully.

Genoo also offers “share to social” badges for messages delivered by its system. These embed a unique ID to link any resulting Web visits back to the original sharer. This feature is not unique – Genius.com and smartFocus do something similar – but it’s still pretty unusual. However, the value is so obvious that I expect many other vendors will soon follow. Genoo can also assign lead score points for social media sharing.

I expect to post a more comprehensive review of Genoo in the next week or two.

- Act-On Software is another low-cost system, starting at $500 per month. It has made several important enhancements since my review in March 2009, notably multi-step campaign sequences and bi-directional integration with Salesforce.com.

To the current topic, it has also added a “Twitter Prospector” to reduce the labor required to mine Twitter for leads. This lets users define multiple search queries and see each result in separate columns. To screen out marketing pitches, the system can exclude tweets with embedded links. Users can reply to selected tweets through corporate accounts, drawing on a library of standard messages. This reduces the risk of inappropriate replies. Users can also forward a tweet to someone else for review or comment.

Act-On will also string together related tweets to give a sense of the on-going dialog. Web site visits driven from Twitter are flagged in the activity history of individual leads and in general Web analytics reports, although Act-On does not tie them to the originator like Genoo. It does add the Twitter ID of known visitors to their lead profile when possible.

Providing a library of standard replies to Twitter messages is not unique (see my December 2009 review of Spredfast for something similar). But it’s an unusual feature for a demand generation system, which typically defers to CRM for managing interactions with individuals. Act-On originally developed the feature for its own use, so perhaps there's no deep significance to its choice. It's also worth considering that the next logical step -- fully automated replies to social messages -- would almost surely fall within the normal scope of marketing and demand generation. (I'm not sure automated responses are such a great idea, but they will ultimately be the only way to manage the volume of messages presented in social media. So it's more a question of how to do them effectively than whether to do them at all.) What we see here is still more blurring of the boundaries between the demand generation and CRM systems, a trend I fully expect to continue.